The European ferrous scrap industry is in uncharted territory in which existing monthly pricing mechanisms may lead to increased risk exposure and difficult renegotiations for buyers and sellers.

Scrap contracts between European recycling firms and industry accounts are typically settled against indices that publish just once a month or on a fixed-price basis.

This mechanism has worked satisfactorily when prices were relatively stable over the contracted period.

But global scrap prices in both seaborne and domestic markets have become increasingly volatile since 2018 because of various protectionist trade measures and rising political risk in major scrap supplying and consuming regions.

And the onset of the global coronavirus pandemic has intensified this volatility, with large monthly decreases expected to occur in the domestic markets of Europe, the UK and US over the next two weeks.

The standard deviation for the Argus E1 ferrous scrap delivered to mill assessment was just over 2 in August-December 2018, before rising to close to 15 in the first three-quarters of last year and just below 20 in the past two quarters.

The standard deviation measures the dispersion of a set of values. A high standard deviation indicates a wider spread of the data.

And a monthly index is more likely to be skewed or biased as it typically has fewer inputs. Those inputs are also likely gathered in a comparatively narrow window, usually towards the end of a monthly assessment period, that reflect the market sentiment and condition only in that given window.

Buyers and sellers could therefore end up suffering huge losses if prices register large fluctuations, as was the case in European scrap markets in March and which looks increasingly likely to be the case in April and May. And the higher volatility can lead to increased instances of price renegotiation.

Settling contracts against the monthly average of a daily index would allow the buy- and sell-side to limit exposure to adverse price movement and reduce its associated impact on cash flows.

A suitable daily index can also provide greater indication of future price movement.

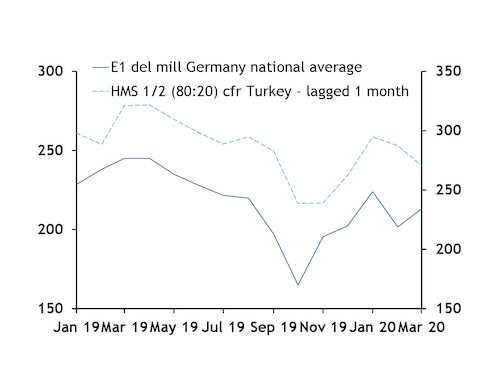

For example, the Argus monthly national average assessment for E1 ferrous scrap delivered to mill in Germany has a 90pc correlation with the monthly average of the Argus daily cfr Turkey premium HMS 1/2 80:20 assessment in the past 15 months. The latter is adjusted for a four-week lag to reflect the difference in delivery time.