South Korean utilities secured Australian and Russian coal in tenders this week, as buyers sought to capitalise on favourable prices amid a weak demand outlook.

Argus assessed the NAR 5,800 kcal/kg (minimum NAR 5,700 kcal/kg) cfr South Korea market for the first time at $63.93/t. This is equivalent to $67.02/t on a NAR 6,080 kcal/kg basis.

The assessment covers thermal coal with a maximum of 1pc sulphur and 17pc ash for delivery in three months — currently May-July.

One index-relevant deal was reported to Argus this week. State-owned utility Korea Southern Power (Kospo) awarded 165,000t of NAR 5,800 kcal/kg Russian coal to a trader at $65/t cfr, one market participant said. The coal will be delivered in three Supramax shipments of 55,000t in June, July and August.

Kospo tendered for 160,000t of minimum NAR 5,600 kcal/kg coal with a maximum sulphur content of 0.8pc and a maximum ash content of 15pc in a tender that closed on 2 April. The utility operates two coal-fired power plants — the 2GW Samcheok Green on the east coast and the 4GW Hadong facility in the south.

Two Australian producers were also awarded cargoes in a tender organised by state-owned utility Korea Midland Power. Argus assessed fob Newcastle NAR 5,800 kcal/kg coal $1.43/t higher on the week at $59.77/t.

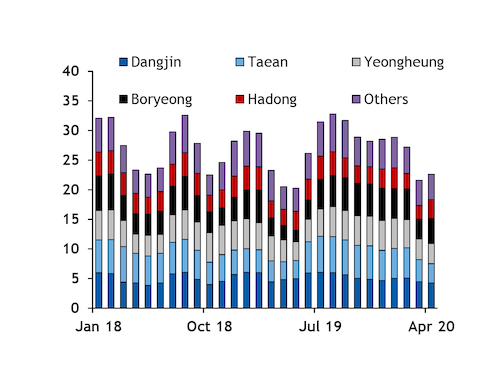

Around 28pc of Kospo's coal capacity was suspended during December-March as part of government efforts to improve air quality, with generation further capped by limits on the use of operational capacity during the winter. Samcheok Green and Hadong ran at around 75pc and 62pc of their respective technical capacities in December-January, the most recent Kepco data show.

But restrictions have eased since the end of March. Only two of the eight Hadong units are facing downtime in April, with unit 4 scheduled to be off line over 7 April-3 July and unit 7 slated to return on 25 April after operations were suspended on 2 March. The 1GW Samcheok Green 2 unit has been off line since 7 March and is due to return at the end of May.

Around 22.1GW of state-owned Kepco coal capacity is scheduled to be available next week and up to 21.6GW across April as a whole, although further maintenance suspensions may be published at short notice. State coal generation averaged 18.3GW in April 2019, meaning there is a possibility that coal output could record a first year-on-year increase since November this month.

An expected year-on-year drop in nuclear output may also increase the need for coal-fired generation this spring, although the power demand outlook remains weak during what is normally a low-demand period ahead of the cooling season.

The Korean power exchange forecast peak power demand to inch up to an average 65.1GW on working days next week, from 64.6GW this week, although this would be short of the 69.1GW average in the same fortnight last year.

The 1.4GW Shin Kori 3 nuclear plant is expected to return on 5 April, but the 1GW Hanbit 5 reactor is scheduled to begin maintenance on 4 April. Nuclear availability is expected to be around 19GW this month, compared with actual output of 19.65GW a year earlier.