Declines in available injection capacity as European gas storage facilities become increasingly full this summer will vary widely by region.

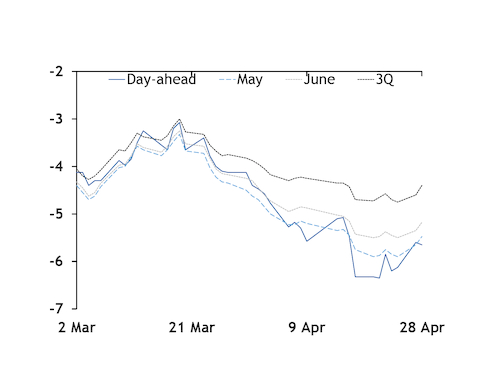

Storage inventories could close in on capacity across much of Europe in mid- to late summer. And declining injection capacity as reservoir pressure rises could force the stockbuild to step lower in some facilities, even if there is an incentive to continue to maximise injections with European near-curve prices in steep backwardation (see TTF prices graph).

Aggregate European stocks entered April at a record high, following a mild winter in which an influx of LNG arrived in Europe and with some firms having built up particularly high stocks to prepare for potential disruption to Russian pipeline flows to Europe through Ukraine, which did not materialise.

And the stockbuild has got off to a fast start, pushing inventories further above average. Weak weather-adjusted consumption — with several countries in lockdown to contain the spread of the Covid-19 pandemic — has freed up even more supply for injections.

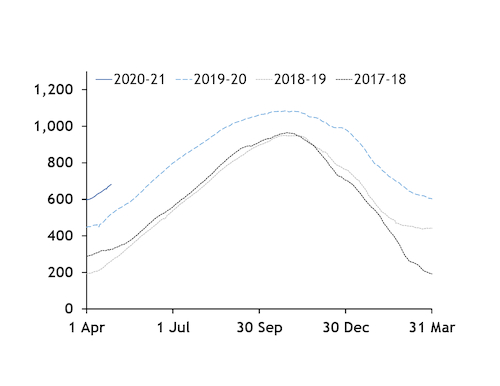

Aggregate European stocks were at around 62pc of capacity yesterday morning, data from storage operators' group Gas Storage Europe (GSE) show (see stocks graph). Inventories only reached that high on 4 June last year, and on 3 August 2018 when inventories had been drawn down heavily late in the preceding winter.

Aggregate inventory data includes the Netherlands' Norg, which is being filled for the first time this summer with low-calorie supply created through quality conversion rather than directly with Groningen field offtake.

The prospect of storage facilities filling sooner than in previous years raises the possibility of injection capacity constraints curbing the stockbuild in some regions in mid- to late summer, although the split may be uneven.

Overall available European injection capacity falls to 63pc once inventories reach 90pc of capacity, Entso-G said in its summer outlook. And it slips to 51pc with only 1pc of capacity — or around 11TWh — unfilled (see table).

Entso-G bases its average injection curve on the storage profiles provided by GSE members. "Default values" are used in cases where specific profiles are not available, calculated using a weighted average based on working gas capacity of the provided ones. Even with nameplate injection capacity cut by half, this would still allow for a considerable overall stockbuild.

But the picture varies widely from country to country. Considerably more injection capacity is preserved in Hungary relative to elsewhere in Europe, with as much as 89pc of its technical injection capacity available, even when sites are 90pc full. Injection capacity also declines more slowly than average in northern France, the Netherlands and Poland.

The rate of decline is slightly above average in Germany, which has the largest working gas capacity at 226TWh. Only three-quarters of nameplate injection capacity would be available already using Entso-G's profile, with sites around 77pc full yesterday morning. But this was unlikely to have restricted injections, given ample technical injection capacity.

The injection curve declines most steeply in the Czech Republic, with only 40pc of nameplate injection capacity still available once sites are over 90pc full. And restrictions on available injection capacity are second-highest in Italy, which has a regulated storage system.

Stogit's storage code was revised at the start of this storage year. Under the new system, each firm must bring stocks within a defined range at the end of each month and is allocated injection capacity, partly based on the ratio between its inventories on 15 April and booked capacity over the full storage year. Stogit used to set overall stock requirements at its facilities.

Enough grid flexibility for 100pc refill: Entso-G

There is enough flexibility in the transmission system to allow storage facilities to be completely refilled across Europe, with the exception of Latvia, Entso-G said.

The country's physical congestion or dependence on an import source would limit injections and prevent sites from being completely replenished, Entso-G said.

Latvian storage facilities only reach 55pc of capacity — or 14TWh — by 30 September in Entso-G's outlook, up from 34pc at the start of April. This is because of limited entry capacity to Latvia from Lithuania, with Entso-G assuming no gas arriving from Russia is injected into storage. This resulted from Gazprom's decision not to use the Incukalns facility for its customers in Russia, the association said.

That said, the site's working gas capacity is in any case already restricted to 18.54TWh, well below its 24.2TWh maximum, because of technical issues.

Under Entso-G's base-case scenario, European storage inventories reach 90pc of capacity on 30 September, while the association also models scenarios with 80pc and 100pc fill levels.

Entso-G does not account for the effect of the Covid-19 pandemic in its outlook, given that it collected data for its supply and demand assumptions in January. The pandemic may have influenced demand assumptions, gas supply potentials and planned maintenance, it said.

| Entso-G's average European injection curve | pc |

| Working gas volume | Available injection capacity |

| 100 | 0.0 |

| 99 | 51.4 |

| 90 | 63.0 |

| 80 | 72.2 |

| 70 | 78.5 |

| 60 | 85.1 |

| 50 | 90.8 |

| 40 | 94.3 |

| 30 | 97.2 |

| 20 | 98.5 |

| 10 | 99.4 |

| 0 | 99.9 |

| — Entso-G | |