The South Korean coal market firmed slightly this week, with coal still ahead of gas in the merit order for power generation as seasonal cooling demand ramps up.

Argus assessed NAR 5,800 kcal/kg coal $0.86/t higher on the week at $55.29/t cfr South Korea. But supply-side fundamentals in Asia-Pacific remain weak and key fob prices softened at the start of July. Argus assessed NAR 5,800 kcal/kg Australian coal $0.64/t lower on the week at $43.01/t fob Newcastle.

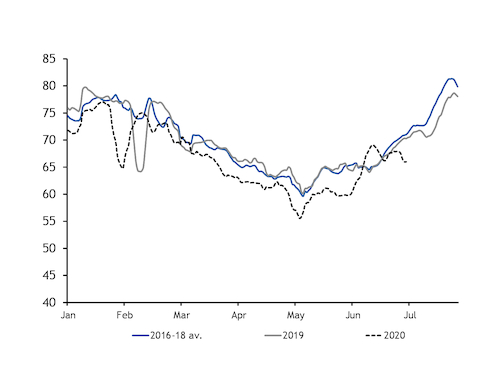

South Korean daily peak power demand has slipped back below seasonal norms in recent days, but consumption typically climbs steeply in July in tandem with hotter weather. The country's meteorological administration said there is a 40pc chance of above-average temperature this month and a 50pc chance in August and September.

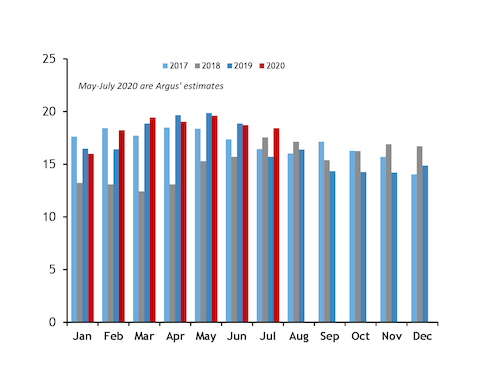

A slight drop in nuclear availability this month compared with June may also compound the need for greater fossil fuel generation. Around 18.4GW of nuclear capacity is scheduled to be available this month, from 18.7GW in June, although this would still be up from actual output of 15.7GW in July 2019.

Around 850MW less state-owned coal capacity is currently expected to be available this month compared with July 2019, which, in conjunction with firmer nuclear output, will likely curb coal burn relative to last year. But the solid fuel retains a cost advantage over natural gas for power generation, meaning coal-fired plants will likely be first to ramp up at times of peak demand or low renewable output.

Gas incumbent Kogas has set its July tariff for the power sector at $10.10/mn Btu, which implies a generation cost for a 60pc-efficient gas-fired plant of $58.51/MWh. The equivalent cost for a 38pc-efficient coal-fired plant is around $36.22/MWh according to Argus analysis, based on the June-average cfr South Korea price assessment of $55.76/t.

But oil-linked contractual LNG prices will weaken through the third and fourth quarters as a result of the slump in crude prices earlier in 2020. This will potentially make Kogas' domestic tariff for the power sector more competitive with coal as the year progresses, creating downside risk for coal prices.