India may have run down its LNG stocks in May to meet stronger industrial demand as domestic production fell further.

Indian gas consumption largely outstripped supply for the second consecutive month in May, suggesting the country ran down its LNG inventories accumulated in the first quarter of this year. Overall demand was 4.87bn m³ in May, well above total supply — including net domestic production and LNG imports — of 4.13bn m³.

Demand had already outstripped supply by 364mn m³ in April, suggesting India may have almost completely cleared the LNG stocks it had accumulated in January-March. Combined supply in the first quarter of this year totalled 15.2bn m³, exceeding consumption over the same period by 1.58bn m³.

This would be equivalent to Indian terminals accumulating stocks of 1.23mn t of LNG, assuming all the excess supply was from LNG deliveries.

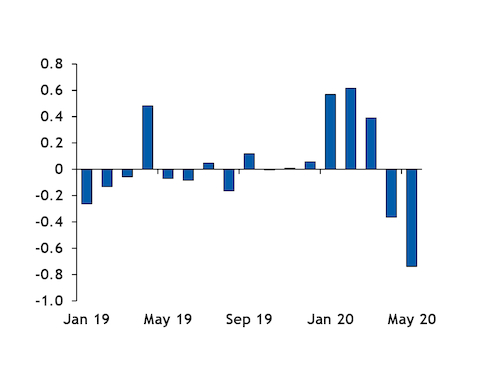

Market conditions may have provided an incentive for more use of LNG storage capacity than in 2019, as the wider gaps between supply and demand suggest (see graph).

India sought to take advantage of low spot LNG prices in the first quarter of this year, when the first Covid-19 outbreak in northeast Asia led buyers in the region to seek cargo deferrals, possibly leading to a large number of distressed cargoes being offered in the Asia-Pacific basin. In February, Indian LNG deliveries soared by 68pc on the year. Once India's first lockdown was announced in late March, Petronet sought to defer Qatari term cargoes until later this year, but the outcome of the negotiations remained unclear.

Indian domestic gas demand rebounded in May after plunging in April because of the nationwide lockdown. Total consumption in May rose to 4.87bn m³ from 4.57bn m³ a year earlier, driven mainly by stronger demand from fertiliser producers and refineries.

Higher industrial demand more than offset the drop in power-sector gas burn and city gas demand, which remained lower than a year earlier as the lockdown was extended to cover most of May. But the drop in upstream production meant that even city gas distributors used more LNG than a year earlier in May.