A scheduled halt to the 55bn m³/yr Nord Stream gas pipeline on the 14-25 July gas days could result in a drawdown of Russian state-controlled Gazprom's stocks and reconfigure flows across central Europe.

Pipeline and upstream maintenance elsewhere in Europe this year has been delayed or postponed as a result of the Covid-19 pandemic, but the timing of Nord Stream maintenance has remained unchanged. And there have been no changes to planned maintenance on Nord Stream's onshore continuations, Opal and Nel. Both pipelines are scheduled to be unavailable on 14-22 July.

The Nord Stream maintenance could also result in a halt or reduction in flows along the 30.9bn m³/yr Eugal pipeline — which runs adjacent to Opal through Germany to the Czech border and can receive gas from Nord Stream through Nel. Works at the Lubmin II compressor station also scheduled for 14-22 July could reduce Eugal flows as well. Eugal is intended to mostly receive gas from the unfinished 55bn m³/yr Nord Stream 2 pipeline, but the Nel tie-in has provided Nord Stream with additional flexibility to feed gas into Eugal this year while Nord Stream 2 remains unfinished.

Both Opal and Eugal can also take flows delivered at the "network exchange point" of Gross Koris in Germany, part-way along each pipeline's route between Greifswald at the German beach and the Brandov virtual interconnection point (VIP) at the Czech border. Eugal's 21bn m³/yr exit capacity there will be reduced by 42pc on the 20-21 July gas days in works separate to those at Lubmin II.

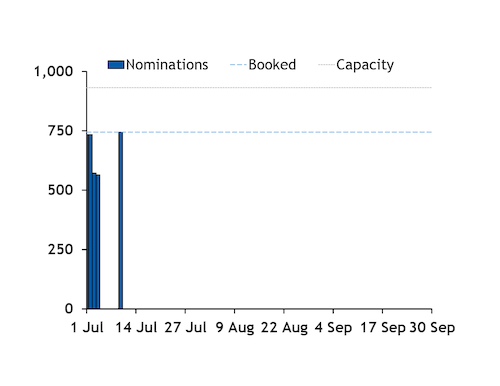

The shorter planned works on Nel, Opal and Eugal could allow Gazprom or other firms to at least partly offset the lack of gas entering the pipelines from Nord Stream by sourcing gas elsewhere. Gazprom likely booked 744.5 GWh/d of third-quarter capacity at the Mallnow exit point to Germany of the Yamal-Europe pipeline, which delivers gas from the same Russian fields that supply Nord Stream, some of which could be delivered into Opal or Eugal from Gaspool at Gross Koris.

Mallnow maintenance previews Nord Stream

A switch to withdrawals at a large number of storage sites across northwest and central and eastern Europe over Mallnow maintenance in recent days could indicate how Gazprom plans to meet customer nominations during Nord Stream maintenance.

The pipeline's maintenance has often resulted in a reconfiguration of flows across the region, with Gazprom relying on slower deliveries to its own subsidiaries and storage, as well as withdrawing from some of its own capacity in northwest and central Europe.

The firm has likely switched to withdrawals at some of the storage sites where it holds capacity during Mallnow maintenance.

Scheduled works at Mallnow halted flows at the German-Polish border point on 6-10 July. Nominations were 624 GWh/d on 1-5 July — well below capacity of 931.5 GWh/d — but rose again to 744.5 GWh for 11 July (see Mallnow graph).

Withdrawals were registered at a number of sites where Gazprom holds capacity in recent days. The Netherlands' Bergermeer facility — where Gazprom holds 1.9bn m³ of the site's total 4.1bn m³ of capacity — registered net withdrawals of 180 GWh/d on 6-8 July, reversed from injections of 39.2 GWh/d earlier in the month. There were also net withdrawals from Gazprom's capacity at Haidach on the Austrian-German border and Rehden — where Gazprom holds capacity — over the same period.

Gazprom may have also withdrawn from capacity booked ahead of last winter at facilities where it does not hold long-term capacity.

The firm booked a further 3.5bn m³ of space in Europe prior to last winter, in addition to the just over 5bn m³ to which it has long-term access, and which it could have rolled over.

The firm also earlier said it had concluded contracts for 3bn m³ of stored gas in Austria, Hungary and Slovakia "until 31 March 2021", but did not provide a more detailed breakdown.

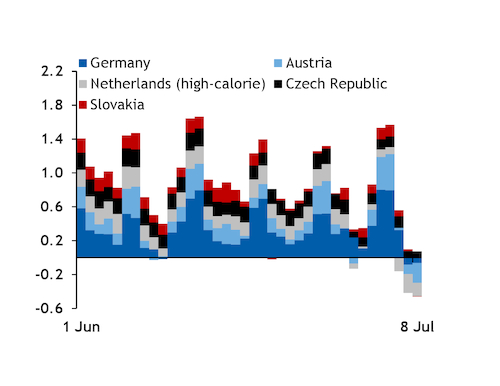

The switch to withdrawals has significantly slowed or reversed the stockbuild in a number of countries. Combined German, Austrian, Czech, Slovak, and high-calorie Dutch sites switched to withdrawals of 101 GWh/d on 6-8 July from injections of 904 GWh/d earlier in the month (see stock movements graph).

Gazprom having higher stocks in Europe this summer could have left it with ample supply to withdraw from storage during the works without increasing its reliance on other supply routes. Deliveries transiting Ukraine and arriving at Velke Kapusany remained broadly unchanged over the Mallnow maintenance.

Annual Nord Stream maintenance has also often ended earlier than planned, with flows ramping up at least partly before the end of scheduled maintenance.

Nord Stream maintenance scheduled to halt deliveries on 16-30 July 2019 ended early, with deliveries restarting on 26 July, albeit below capacity.