US products exports recovered in June as Gulf coast refiners boosted their runs, reopening a key outlet with the help of rising Latin American demand.

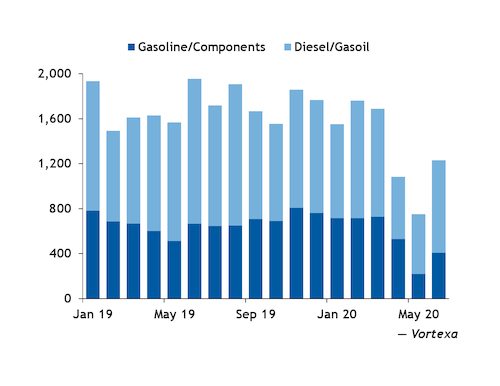

US Gulf coast waterborne refined products exports rose to about 1.23mn b/d in June after bottoming out in May at 750,000 b/d. However, flows are still a far cry from levels near 2mn b/d set in June 2019, according to estimates from oil analytic firm Vortexa.

June waterborne exports rebounded thanks to revived demand in Brazil and Mexico, where efforts to reopen boosted fuel demand. Drastically lower imports in May also prepared these countries to take in more US products in June.

About 820,000 b/d of waterborne diesel loaded out of the US Gulf coast in June, up by more than 50pc from April but still lagging the 1.3mn b/d that loaded in June 2019, according to Vortexa estimates. Waterborne Gulf coast gasoline loadings in June also rose to 410,000 b/d, up by 78pc from May levels.

These figures do not include overland exports to Mexico by rail, pipeline and truck, which in April accounted for more than 70pc of diesel exports to Mexico and more than 30pc of gasoline flows, according to waterborne data from Vortexa and exports data from the US Energy Information Administration (EIA).

The stronger export market, along with the continued recovery in US domestic demand, helped lift Gulf coast refining margins to an average of $7.96/bl in the second half of June, up from $5.43 in the first half of June and $4.23/bl in May. These margins are measured against WTI Houston crude and based on a 3-2-1 yield.

Improving margins have encouraged US refiners to slowly raise crude runs from steep cuts that were put in place beginning in March and throughout April and May.

Rising US Gulf coast refinery utilization has helped to spur exports. US Gulf coast refinery utilization for the week ending 3 July was is 80.7pc in the EIA data, up from the early May level of 71.8pc, the lowest level since 2017 when Hurricane Harvey knocked out a fifth of US refining capacity. Estimated weekly exports of gasoline increased by 8.5pc to 524,000 b/d, the highest volume since the end of April.

Gulf coast refiners can operate at a minimum of 70-75pc, and further cuts could mean technical and safety complications in addition to poor economics.

Whether Gulf coast refiners can sustain production returns will depend on how effectively they can move inventory out of the region.

Higher exports did little to reign in the growing stockpiles on the Gulf coast. Distillates inventories rose to 58.4mn bl during the week ended 3 July, EIA data show, the highest level in 30 years of the agency's official record keeping.

The glut continues to force product into offshore storage vessels. As of 9 July, five vessels carried a combined 780,000bl of gasoline and diesel in the US Gulf coast as floating storage, Vortexa data show.

Similarly, diesel inventories continued to grow across the Atlantic coast, even as the region saw a rare surge in exports in June.

About 100,000 b/d of diesel loaded out of the Atlantic coast in June to destinations in Morocco, Brazil and Europe, according to Vortexa estimates. This was up from just 10,000 b/d that loaded in April and 41,000 b/d that loaded in June 2019.

Diesel suppliers in New York Harbor boosted exports while cutting production and reducing imports from the Gulf coast region. Distillates stocks still grew to 39.2mn bl during the week ended 26 June, the highest level since February 2017.

The uplift in US exports also face hurdles from the demand side. Mexico's gasoline inventories held well above five-year averages as of mid-June, data from the Mexico energy ministry (Sener) show. This is in part because state-owned Pemex raised production by 10pc year-on-year to 220,000 b/d in April. Production levels took a dip in early June but rose again by mid-June, all the while maintaining above year-ago levels, Sener data show.

In addition, independent fuel importers to Mexico face bureaucratic delays and problems with renewing permits, which could limit the country's overall imports.

On the other hand, an earthquake in late June shut the country's largest 330,000 b/d Salina Cruz refinery, which has boosted the country's gasoline imports in late June and early July, and could continue to do so.

Brazil's appetite for US imports is limited by inexpensive and ample ethanol supplies as well as rising domestic production from state-owned Petrobras. But Brazil is switching to higher density and octane gasoline specifications beginning 3 August, which could raise domestic prices and attract more imports from the US. Current market estimates value the new specification to be worth 5¢/USG more than the current specification.

US refiners must calibrate their output to balance domestic and export demand with disruptions from Covid 19-related demand reductions.

In the US, rising virus counts in three of the top five gasoline-consuming states have tempered demand recovery heading into the third quarter. Some states have halted or even backtracked efforts to reopen the economy.

The pandemic is also accelerating in Mexico, where lifting of Covid-19 prevention measures has not been enough to fully spark industrial and transportation activities that use more diesel. Brazil has also become the new hotspot for the pandemic.