The global platinum supply deficit is expected to narrow considerably in 2021, after Covid-related production cuts hit output earlier this year, according to the World Platinum Investment Council (WPIC).

Platinum production took a hit as Covid-19 lockdowns hampered operations in key regions including southern Africa. As a result, the WPIC estimates that supply has fallen by 18pc this year, but with demand down by only 5pc, resulting in a deficit of 1,202 koz, compared with an 89 koz deficit in 2019.

Production and demand rebounded in the third quarter as lockdown measures eased globally. Supply rose by 48pc in July-September with output nearing pre-Covid levels, while demand rose by 75pc largely owing to automotive demand, the WPIC said. It expects this recovery to continue this quarter and in 2021, resulting in the global platinum deficit narrowing to 224 koz next year.

Tentative recovery

Global automobile demand has risen significantly since the first half of 2020, when new vehicle sales plummeted amid the pandemic. The automotive sector enjoyed a 70pc quarter-on-quarter rise in demand in July-September, bolstering the need for platinum used in catalytic converters, the WPIC noted. The recovery was so strong that platinum demand for automotive applications was just 3pc shy of the same period a year earlier. This strength is expected to continue, with platinum demand forecast to rise by 24pc, or 575 koz, in 2021, the WPIC said.

Global jewellery demand also rose sharply in the third quarter, underpinned by Chinese consumption. Global jewellery demand increased by 27pc quarter on quarter, which factors in a 14pc (29 koz) rise from China. Next year, China is expected to record an annual rise in jewellery demand for the first time in seven years, rising by 13pc, with global consumption also forecast to rise at the same rate.

But global platinum supply still lagged the third quarter of 2019 by 5pc.

Investment rising

The platinum sector has registered a significant rise in investment, largely with investors pushing into precious metals over equities. Investment demand increased by 291pc (730 koz) year on year in the third quarter, with a large portion of this coming from electronically traded funds. Investment demand is expected to grow by nearly a third in 2020, with this trend expected to continue next year.

Particular attention is being paid to platinum's use in hydrogen fuel cells — an eco-friendly fuel option that is attracting increasing attention. Earlier today, the UK announced a 10-point plan for a green industrial revolution, part of which includes a £500mn ($665mn) investment in hydrogen for use in homes.

Prices recover

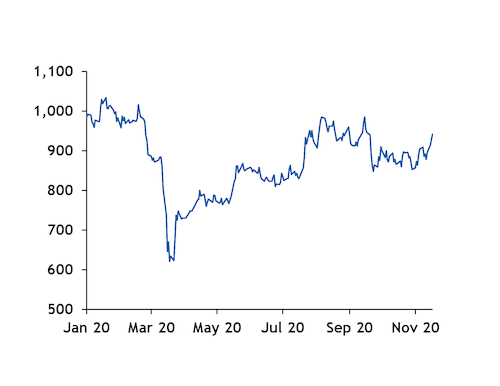

Platinum prices have recovered since their 2020 low of $621/troy ounce (toz) on 21 March, according to UK speciality chemical producer Johnson Matthey. Prices stood at $942/toz on 18 November, reflecting limited availability and increased demand.

Depressed prices earlier this year did benefit platinum jewellery consumption in China, the WPIC said, with jewellery makers in the region boosting stocks of the metal when prices slumped in March. A similar trend occurred in 2009, with WPIC chief executive Paul Wilson commenting that "with platinum jewellery demand falling every year for the past seven years, the fact it is forecast to increase in 2021 is good news indeed".