A number of Ukrainian storage users are concerned that proposed amendments to the law that would transition Ukrainian gas reporting to energy units from volumetric space would underestimate their stocks.

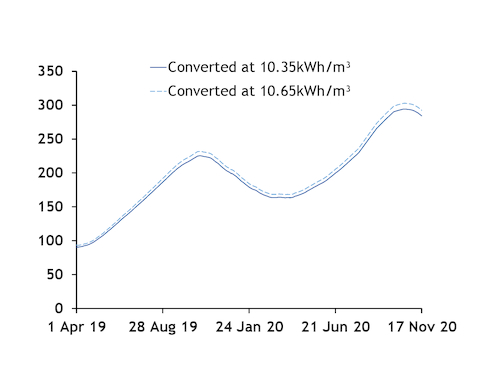

The gross calorific value (GCV) of 10.35kWh/m³ for stored gas proposed for the second reading of the law is significantly lower than the actual value of 10.58-10.65kWh/m³ that was injected, market participants said. Applying this uniform GCV to their stored volumes would be "unacceptable" as it would undervalue their stocks, they said.

Ukraine's parliament is moving towards adopting a bill that would compel the switch to energy units with effect from 1 April 2021.

One international trader said that the firm had placed more than 500mn m³ in storage with a GCV of 10.65kWh/m³. If this were to be converted using the proposed GCV, the company would lose about 150GWh of stored gas.

Ukrainian stocks were 27.5bn m³ yesterday morning, well up from 21.5bn m³ a year earlier. This would be equivalent to 284TWh using the proposed GCV versus 292TWh using a GCV of 10.65kWh/m³ (see converted stocks graph).

A number of storage users plan to propose changes to the parliamentary energy committee overseeing the bill in order to modify the GCV calculation. One possible alternative would be a conversion using the average calorific value for the previous year, which could also be used to recalculate the cost of gas storage, the firms said.

Withdrawals accelerate

Ukraine's stockdraw accelerated this week, but could slow with mild weather expected later this month.

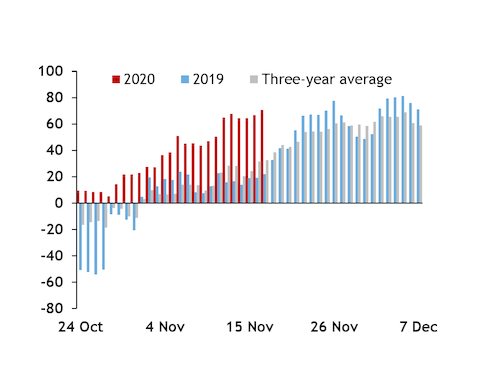

Net withdrawals rose to 64.1mn m³/d on 11-17 November from 43.8mn m³/d on 4-10 November, reversed from net injections of 33.9mn m³/d in the whole of November 2019 (see stock movement graph).

Non-resident firms — which held over 9bn m³ in Ukrainian storage — withdrew 1.29mn m³/d on 1-15 November, storage operator Ukrtransgaz said. And this could continue in December. Firms booked an additional 500,000m³/d of Ukrainian exit capacity to Hungary for December, lifting subscriptions to 33.5mn m³/d. And 3.8mn m³/d was booked on the Hungarian entry side. At least some of the bookings may have been made by firms planning to re-export gas held in Ukrainian storage next month. This was similar to the 500,000mn m³/d that transmission system operator GTSOU said has been returned to EU markets so far this month.

A turn to colder weather may have boosted heating demand in recent days relative to earlier this month and late October. Overnight lows in Kyiv dropped to 1.21°C on 11-17 November from 5.87°C in the previous week and below 2.32°C a year earlier.

Recent forecasts pointed to significantly milder weather over the rest of November, which could pare heating demand and discourage a quick continued stockdraw.

But this could be partly offset by a rise in heating demand driven by government measures intended to combat the Covid-19 outbreak, which could lift consumption of communal enterprises. A weekend quarantine was introduced, shutting all catering establishments, salons, gyms and stores, except for grocery stores. But offices and other communal buildings will likely continue to be heated, even with more people working from home, which could result in stronger weather-adjusted heating demand during the week.