The evergreen expansion in US LPG and ethane production may be sheltered from weak oil prices in the coming years, write Amy Strahan and Matt Scotland

The growth in US natural gas liquids (NGL) production and exports is likely to be affected by the degree of the crude oil price recovery in the coming years. But the domestic oil industry's favouring of associated gas-rich wells, falling upstream costs and lower Middle Eastern output can support further growth, delegates at the world LPG Association's e-LPG Week heard.

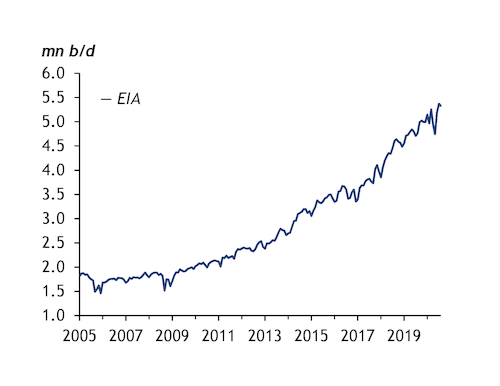

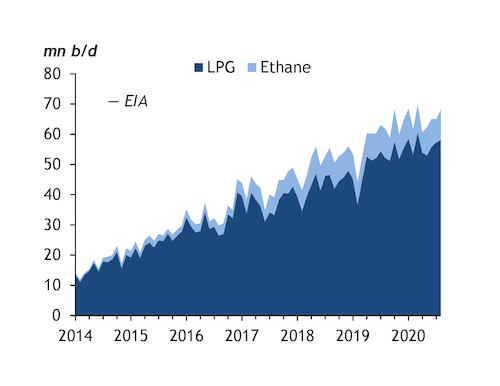

US NGL production from natural gas processing is likely to grow to around 5.7mn b/d (208mn t/yr) by 2025 if Nymex WTI crude recovers to near $45/bl over the next few years, although much of the gain may be made by ethane, consultancy RBN Energy chief executive Rusty Braziel told the conference. Output stood at 5.32mn b/d in August compared with 4.83mn b/d last year and 4.37mn b/d in 2018, the latest EIA data show. It dropped to a yearly low of 4.75mn b/d in May as a result of the Covid-19 pandemic and shut-in upstream oil and gas production.

"There is not much growth in LPG production in that $45/bl scenario… we expect propane supply to increase by just 1pc," Braziel said. US crude production is expected to slow to around 10mn-11.2mn b/d next year, he said. Output stood at around 12.2mn b/d in 2019, EIA data show. The resulting decline in the production of associated gas at crude wells in the Permian basin in Texas and New Mexico could slow US Gulf coast LPG exports to 1.1mn b/d (35mn t/yr), he said.

Yet such declines have not been borne out this year despite the pandemic slashing global oil demand, leading to widespread US production shut-ins. "Crude oil took a large hit earlier this year, but [US] producers tend to give deference to wells with more associated gas and gas liquids," US midstream firm Targa Resources NGL vice-president Rob Donaldson told delegates. Upstream producers' swift cuts to production as demand and prices slumped caught many in the market by surprise, yet the focus on capturing more of the by-products such as NGLs and bringing them to market supported LPG, he said. "As oil producers continue to develop fields and reduce their costs, while $37-41/bl WTI might not have been profitable 3-5 years ago, output is holding up quite well for oil and for NGLs."

US LPG exports hit record highs in October, partly as a result of lower Middle Eastern output, Donaldson said. Flat LPG production in the Middle East will continue to drive demand for US exports, not only from new propane dehydrogenation (PDH) plants in China but also for residential use in India, Donaldson said. India usually sources its supply from the nearby Mideast Gulf but its growing need for imports has led to it increasingly turn to the US — it is also the largest importer of the country's ethane. The continuing investment in newbuild very large gas carriers (VLGCs) also signifies the expectation that US exports will keep growing, he said.

Keystone props

Gains in US NGL production are likely to come mainly from the Marcellus and Utica shales in the northeast of the country, Braziel said. This will be supported by a fall in imports from Canada as the country exports more LPG from its Ridley Island export terminal and a new terminal in Prince Rupert is due to start-up in first-quarter 2021, he said. US LPG export growth may be increasingly driven from the east coast from the Marcus Hook terminal in Pennsylvania and the Newington terminal in New Hampshire, according to RBN.

The only significant growth in domestic propane demand will come from midstream firm Enterprise Products Partners' second PDH unit in Mont Belvieu, due to open in second-quarter 2023. The strong increase in US LPG exports this year has left market participants wondering whether domestic supplies could be constrained if heating demand spikes over winter. But the market has already taken action, Braziel said. "They have shored up term contracts and increased volumes and storage capacity to be able to handle spikes and diversify supply sources."