Thermal coal prices for the South Korea market dipped this week ahead of restrictions across the country's coal-fired power plants from next month, which are expected to limit peak winter burn at last year's four-year low.

Argus assessed NAR 5,800 kcal/kg coal with maximum 1pc sulphur at $50.05/t fob Newcastle and $59.41/t cfr South Korea this week, which were up by 20¢/t and down by 32¢/t on the week, respectively.

No new tender awards were reported, but South Korean GS Donghae Electric Power issued a fresh tender today to buy four shipments of 58,000t for December-February loading.

The South Korean government is expected to give further details about the extent of restrictions on the use of coal-fired plants over December-February by the end of this month.

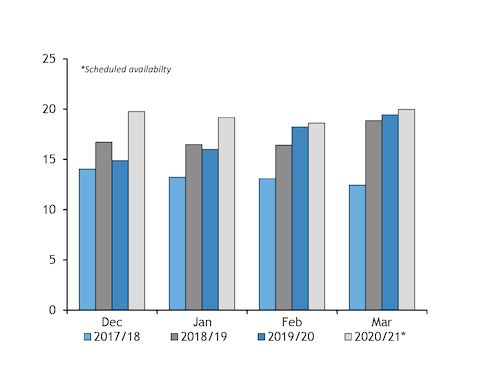

An average of 10 coal-fired units, or 5.5GW of state-controlled Kepco's coal-fired fleet, was unavailable each day during last December-February, with a 20pc restriction on the use of most of the remaining 46 units, or 28.2GW.

This implied an average daily availability of around 22.6GW and actual Kepco coal-fired generation averaged 22.1GW in December-February, suggesting nearly all available capacity was dispatched in the base load.

A similar dynamic is likely to unfold this winter, with coal burn set to be determined by the level of physical capacity that is available for use. But with nuclear availability scheduled to be 4.9GW and 3.2GW higher than actual output last year in December and January, respectively, and flat in February, the power system may have enough flexibility to accommodate even more stringent restrictions this winter.

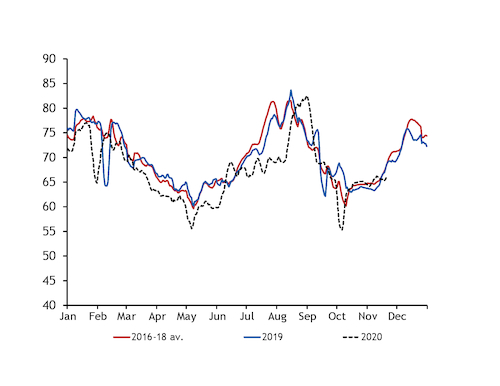

An unseasonably mild outlook for December could also compound any negative impact from the Covid-19 pandemic on overall power demand, further weighing on South Korea's reliance on coal burn.

Daily mean temperatures in Seoul are forecast to exceed the 2009-18 average by more than 4°C next month, which would be up from a 1.5°C deviation above the norm last year, according to Speedwell data.

The temperature in Seoul so far this month has been nearly 2°C above the long-term average, up from a 0.2°C deviation last year. But daily peak power demand during 1-26 November is 65.5GW, up slightly from 64.9GW in the same period last year.