A change in booking behaviour resulted in a loss of revenues last month, while an unpredictable Brexit affects decision making, writes Natasha Fielding

Looming and as-yet unquantified changes to UK gas transmission capacity charges expected early next year have reduced the visibility of the cost of moving gas in and out of the UK.

UK system operator National Grid on 10 November announced a 36pc shortfall in revenues collected in October, the first month in which the new gas charging regime was in place. National Grid will make up for the under-collection in revenues by hiking capacity charges for early next year. But it has not yet specified the size of the increase or when it will take effect.

National Grid can adjust capacity fees within the gas year by adjusting the revenue recovery charge (RRC), which is designed to compensate for under or over-recovery in revenue and was set at zero ahead of this gas year. It can be revised at a month's notice. National Grid should finalise adjustments to charges by 1 December. It initially planned to introduce the changes as early as possible and "up to and including March". But the system operator suggested on 19 November that it may introduce RRCs from 1 February for a longer duration.

National Grid also plans to ask the regulator to urgently consider two uniform network code (UNC) modifications. The first will look to change how the firm's allowed revenue is calculated, while the second will seek to adjust the payment collection process as of the start of October with a view to recovering some or all of the payments already made.

October's substantial shortfall stemmed from a change in booking behaviour, resulting in more revenues coming from overrun charges, within-day and interruptible bookings — none of which count towards National Grid's maximum allowed revenue under the existing system. The exclusion of these types of fees — categorised as "capacity neutrality" — needs reviewing, National Grid says.

If National Grid makes up the lost revenues through entry and exit RRCs, then capacity-based charges could rise substantially. But if the system operator assumes that the revenue collection system will be adapted and backdated to the start of October, the increase in RRCs could be smaller.

Layers of risk

The impending increase in capacity-based charges adds another layer of unpredictability for early 2021, on top of uncertainty arising from other potential charging changes and the UK's exit from the EU.

UK gas and electricity market regulator Ofgem is yet to make a final decision on various proposals seeking to modify aspects of the UNC.

UK storage operator Storengy has submitted a proposal to increase the discount applied to capacity charges at storage connection points to 80pc from 50pc. It expects Ofgem to make a decision shortly before the deadline on 3 January, despite having fast-tracked the modification proposal.

Storengy has also proposed the introduction of a discount to the RRCs at storage connection points, arguing that double charging puts storage at a disadvantage. The deadline for Ofgem to make a final decision is mid-March next year.

Storengy has cancelled storage auctions for the 2021-22 and 2022-23 storage years, citing an unpredictable regulatory environment, which means shippers have to factor significant risk into any gas storage capacity valuation.

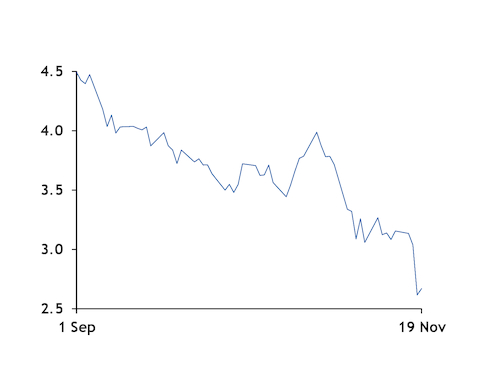

Transmission cost uncertainty could discourage firms from booking capacity on pipelines connecting the UK to the Netherlands and Belgium until there is more clarity. The lack of a trade deal ahead of the UK's exit from the EU has increased the risk associated with committing to cross-border transmission capacity. But cross-Channel price differentials have not favoured such bookings in recent weeks.