Thermal coal prices for South Korea fell this week, with milder weather expected next month.

In the utility tender market, state-owned Korea Midland Power and Korea Western Power awarded Australian coal this week. The former bought two Capesize NAR 5,800 kcal/kg shipments for March and April loading in the mid-$78s/t on a NAR 6,080 kcal/kg fob Newcastle price basis and the latter awarded an 80,000t cargo of similar specification material at $79.50/t on a NAR 6,080 kcal/kg fob Newcastle price basis.

Independent power producer (IPP) GS Donghae Electric Power this week tendered for three 60,000t NAR 5,300-6,000 kcal/kg shipments from Australia or Russia for February-March loading, with offers due by 28 January.

Argus' NAR 5,800 kcal/kg cfr South Korea and fob Newcastle assessments gained 5pc and 9pc, respectively, this month during a cold snap across northeast Asia, but an outlook for milder weather could erode support in the short term.

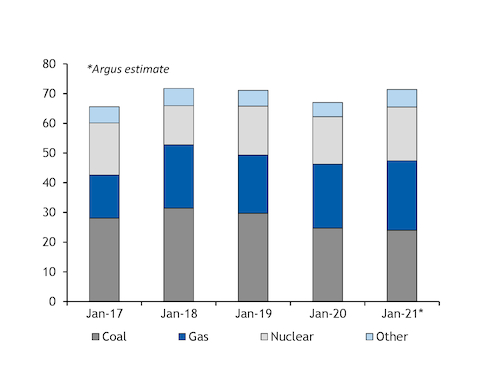

Overall South Korean power generation has averaged 71.4GW this month, according to Argus analysis of peak power demand, up sharply from 67GW in January last year.

Coal and gas would need to make up 47.4GW of this total, assuming all 18.1GW of scheduled available nuclear capacity is dispatched and that other sources provide 5.9GW. This would be up from 46.2GW of coal and gas-fired generation in January 2020.

Coal would comprise 24GW of the total, assuming available state-owned capacity is capped at an 80pc load and that private-sector coal-fired generation is unchanged on the year, leaving a record 23.4GW requirement for gas.

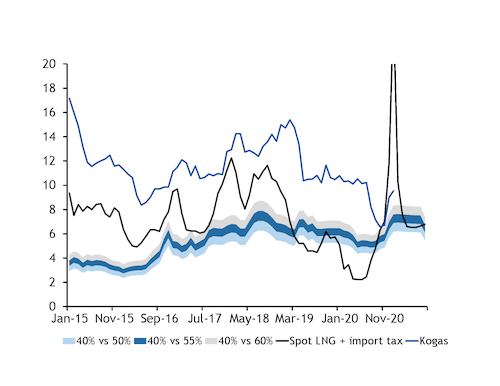

Record power-sector gas demand and strong consumption for heating has squeezed LNG availability, probably preventing the government from enforcing stronger restrictions on the coal fleet. In addition, Kogas' domestic gas tariff is now above 40pc-efficient coal-switching prices, so the capacity restrictions are keeping cost-competitive plants idle and creating a financial cost for state-run utilities.

Data show that 11-12 coal-fired units have been idle each day in January, against the government's target of 9-16. And 6-11 units are scheduled to be offline next month, but this will increase as new outages are added to the schedule, which only covers stoppages due to start in the week ahead.

A milder outlook and the Korean new year holiday, which typically drives a slump in power demand, around 12 February should also ease pressure on the power system and enable the government to enforce more restrictions. Between 10 and 15 units were suspended each day in February 2020.

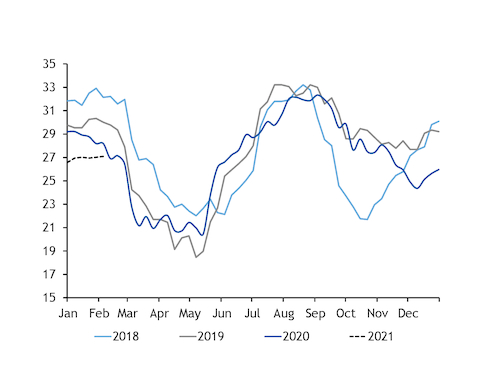

The country's weather office said today there was only a 20pc chance of below-average temperatures next month, although it could still be colder than February 2020, which was particularly mild. Speedwell data suggest Seoul will record 471 heating degree days next month, compared with 436 in February 2020. January 2021 degree days are on course to be up by around 30pc on the year, at a three-year high of 644.