Turkish ferrous scrap importers increased their purchases of deep-sea bulk cargoes in April in response to rumours surrounding China's elimination of a tax rebate on steel exports, and because of a lower available price range than in March.

Turkish importers also had to buy increased volume to compensate for when they withdrew from the market for eight days in the middle of March, during which time steel demand stayed strong.

The average price on a premium HMS 1/2 80:20 equivalent level for deep-sea deals recorded in April was $428.80/t cfr, down by $9.10/t from $437.90/t cfr in March, giving buyers impetus to increase purchasing rates in April at a time when overseas steel markets showed no signs of losing strength.

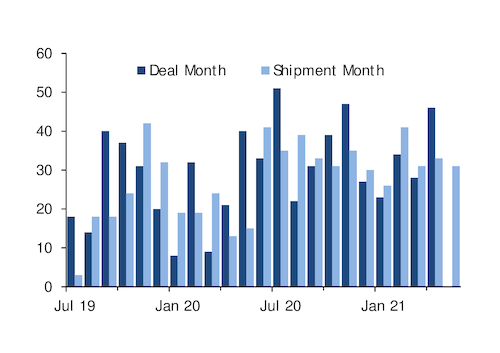

Turkish mills were recorded buying 50 deep-sea cargoes in April, totalling around 1.58mn t. They are estimated to have purchased close to 60 deep-sea cargoes totalling around 1.9mn t. A further 700,000-800,000t of cargoes of less than 10,000t are estimated to have been bought by Turkish mills in April, bringing the total ferrous scrap volume purchased for the month to more than 2.6mn t.

The 50 cargoes purchased represent a sharp increase from the 34 deals recorded in March and 21 in April 2020. The estimate of 60 deep-sea purchases for April is 33pc up on an estimated 45 cargo purchases in March 2021.

Turkish mills accelerated their deep-sea purchasing rate in the second half of April, in line with the move by Chinese steel producers to sharply increase export rebar offers by $100/t because of their expectation that the elimination of the tax rebate on steel exports would be confirmed. A total of 28 deep-sea scrap cargoes were bought by Turkish steelmakers in the last 14 days of April. Deep-sea scrap suppliers also showed less sales appetite in the final week of April when the Chinese decision was eventually confirmed, which combined with emerging Turkish domestic rebar demand to place sharp upward pressure on prices.

Argus' cfr Turkey steel scrap assessment increased by $21.80/t from $427.20/t cfr on 1 April to $449/t cfr on 30 April, but the assessment was still at $427.50/t cfr on 27 April and rose by $21.50/t in the last four days of the month.

Of the 50 cargoes recorded traded in April, 16 were of Baltic/Scandinavian origin. At least three were for lower than 18,000t, as quantities for one full-sized cargo were fixed on two separate occasions in those cases. A total of 14 cargoes were of continental European origin, 12 were US origin, five were Russian origin and three were UK origin.

A total of 29 of the 50 cargoes were sold for May shipment. Another 19 cargoes were sold for June shipment, and two were for prompt April shipment.

To date, 22 cargoes are now recorded traded for June shipment. Because the Turkish domestic longs steel markets has showed a significant improvement in demand this week, complementing extremely strong export activity, mills are expected to need at least another 25 cargoes for June shipment.