China in the 2020-21 marketing year stepped up its grain imports, while diversifying away from its traditional suppliers to meet strong animal feed demand and amid rapidly rising commodity prices in the global markets and trade tensions.

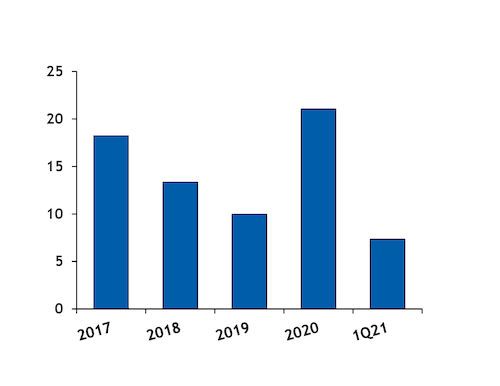

China — the world's largest grain buyer — imported a combined 21.04mn t of barley, sorghum and wheat last year, the highest level since 2015. Receipts of all three crops totalled 7.34mn t in January-March of this year, nearly matching levels for the whole of 2019 (see chart). At the same time, corn imports rose to a record high of 11.29mn t last year and reached 6.73mn t in the first quarter of 2021, already above levels seen before 2020.

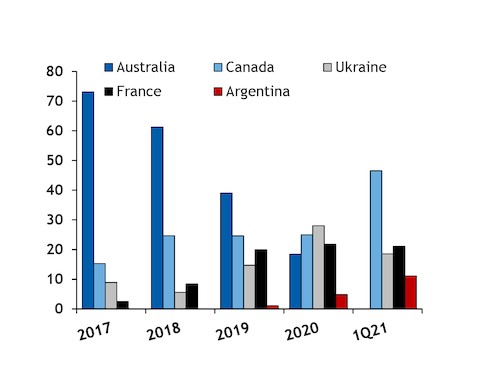

On the barley side, China imported 8.52mn t of the product between the start of the 2020-21 marketing year in June and March 2021 — its second-highest level after 8.78mn t imported in 2017-18 and up by 70pc on the year. The largest exporters were Canada, Ukraine and France, with more than 86pc of crops being shipped from these countries (see chart).

Chinese barley imports rose even though Australia — traditionally its largest barley supplier — was completely excluded from the Chinese market in the first quarter of this year, with zero exports reported during the period. This was a result of trade tensions between the two countries, prompting China to introduce customs duty on Australian barley.

Argentine barley suppliers also benefited from Australia's absence, providing 11pc of China's national imports in January-March, up from 4.8pc last year and just 1pc in 2019.

Meanwhile, China has stepped up its wheat imports from Australia — exempt from the latest series of high tariffs. The latter exported 0.82mn t of wheat in January-March, nearly half of total Chinese receipts during the period.

But imports from France, Lithuania and Kazakhstan have remained robust this year, confirming trends seen since 2018 and contrasting with imports before that date, dominated by Australia, Canada and the US.

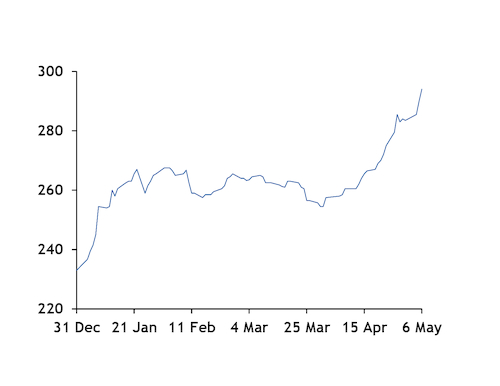

Imports of non-corn crops are rising rapidly as many Chinese animal feed producers have adjusted their feed rations, replacing some corn with other grains, amid a price rally in the global corn market. Argus last assessed the spot fob Ukrainian corn at $294/t, up from $233/t at the end of last year (see chart).

Still, as corn imports also continue to rise, China has turned to the US, which overtook Ukraine as its largest supplier of corn this year. US corn exports saw a boost from the implementation of the US-China phase one trade agreement in late 2019, accounting for 52pc of Chinese corn receipts in January-March, against 47pc for the Ukrainian equivalent.