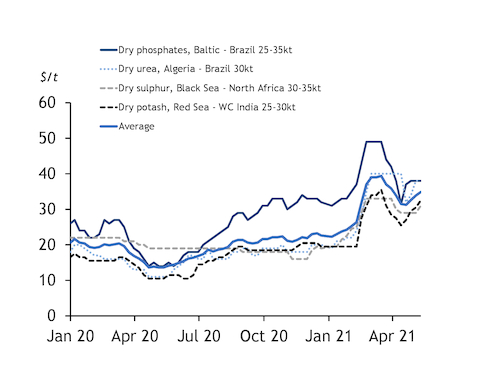

Dry bulk fertilizer freight rates have continued to rebound this week, with the average rising across a select basket for three weeks in a row since 22 April.

Argus' selected basket of fertilizer freight rates — including urea from Algeria to Brazil, Russian MAP to Brazil, potash from the Red Sea to India, and sulphur from the Black Sea to north Africa — rose to $34.88/t yesterday, up by $1/t on a week earlier.

This marks the third consecutive rise of the average from $31.25/t as of 22 April.

The average basket rate has rebounded to levels at the start of April. The average had posted five weeks of successive drops to 22 April, falling from the recent peak of $39.38/t on 18 March (see chart).

But a combination of factors has supported freight rates in recent weeks, particularly the improving macroeconomic climate and global trade, and a surge in iron ore demand in China.

Vessel owners are also asking for premiums above market rates for shipment to India, following port force majeure declarations and the possibility of vessel quarantines at following destinations, contributing to rising dry bulk rates.

The China-India route is one of the most important in the dry bulk fertilizer market, with Argus' average assessments for shipments of 60,000t of urea and 45,000-55,000t of DAP on the route hitting $28.50/t this week, up from $24.10/t at the start of April.

Latest quotes remain firm, with indications today for Middle East-Brazil urea hitting $58-60/t, up from the mid-$40s/t at the start of April.