Croatia's 2.05mn t/yr Krk LNG terminal today received its fourth US LNG cargo of six overall since it was commissioned at the start of this year.

The 173,400m³ BP-chartered Kinisis arrived today, having cast off from the 15mn t/yr Freeport facility on 28 April. Two other cargoes have arrived from the same facility, one in March and the other in April. Krk's first delivery on 1 January was made from the US' 5.75mn t/yr Cove Point.

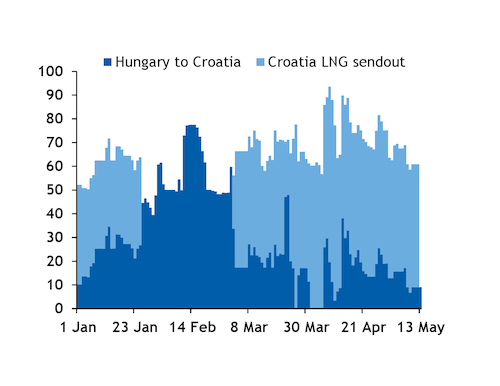

Deliveries to the terminal have coincided with lower pipeline flows to Croatia from Hungary. Market participants said this may be the result of a swap arrangement involving a large Croatian supplier that holds a Russian supply contract (see graph).

Hungary's state-owned gas supplier MFGK — which brought in Krk's first US cargo — said that its LNG would be "exclusively" sourced from western European firms.

MFGK signed a supply agreement with Shell for 194,000 t/yr of LNG, although this did not cover all of the Hungarian firm's Krk booking. Each of the vessels that have so far delivered to Krk from the US are chartered to BP, which has 4.4mn t/yr of offtake from Freeport.

The terminal has begun to receive regular deliveries after a slow start. It expects one delivery this month — with a second initially expected on 31 May removed from the schedule — but it received two as originally planned in April. One cargo in March and two in each of January-February listed on earlier schedules failed to arrive.

Trading firm MET Croatia, one of the terminal's users, said in April that it has been a "rather turbulent beginning of operations, with pricing anomalies". Its receipt on 26 April — a transshipped Russian cargo picked up at Belgium's 7.2mn t/yr Zeebrugge terminal — was its first at Krk. It had expected to receive its first cargo in February.

CEE receives less US LNG

Central and eastern European markets long seeking to diversify supply have been unable to repeat the second quarter of 2020, when weak global demand had allowed for higher US receipts, including spot deliveries.

Just one US cargo has been delivered to Greece's 3.6mn t/yr Revithoussa LNG terminal since 1 April, lower than the three a year earlier. None have been delivered to Turkish terminals this quarter, whereas five had been delivered by this time last year.

Aggregate LNG deliveries to Turkey have slowed considerably, while state-owned Botas has relied more on Algerian and Nigerian LNG. It holds a long-term supply contract with Sonatrach for 4.4bn m³/yr of LNG until 2024 and a 1.3bn m³/yr deal with Nigeria's NLNG that expires in October.

Relatively stronger deliveries to Croatia, as well as Poland — where the two US-loaded cargoes to arrive so far this quarter match the previous year, counting one that arrived on 31 March — underline the importance of contractual arrangements to support steady LNG deliveries.

Most Greek LNG supply is made on a spot basis, while Poland's state-owned PGNiG and Botas have at times also bought additional US volumes on the spot market (see data & downloads).

While Russia's state-controlled Gazprom reported quick year-to-date sales to each of Turkey, Poland and Greece in most or all of its four monthly sales updates so far this year, sales to Hungary were higher on the year in January-February only. Gazprom remains the region's dominant supplier.