Updates lead and adds detail about European reaction

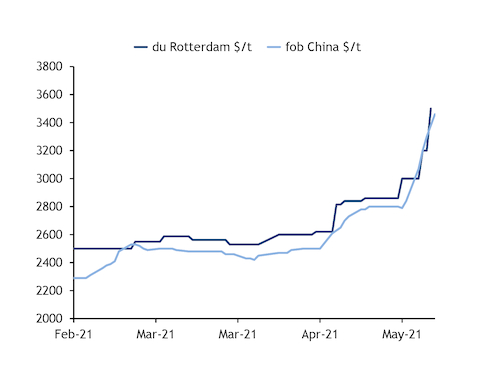

Global magnesium prices have climbed sharply this week on rising feedstock costs, with steep hikes in the Chinese market quickly filtering across to Europe where a year of sluggish demand has led to traders maintaining low inventories, leaving them more exposed to potential supply tightness and in need of top-ups (see chart).

Chinese domestic prices for 99.9pc grade magnesium metal hit a 12-year high of 21,500-21,900 yuan/t ($3,359-3,422/t) ex-works today, up by Yn4,200/t from 6 May. Chinese export prices were assessed at $3,430-3490/t fob today, a new 12-year high, up by $670/t since 6 May when prices were $2,760-2,820/t. Prices in Europe also rose sharply to $3,400-3,600/t, their highest level since November 2008, in the middle of the global financial crisis.

Coal prices have been steadily rising for the past two months, but surged this week after the Chinese administration said it had ceased economic dialogue with Australia because of diplomatic tensions. Safety inspections at mines in Shanxi and tight supply from Inner Mongolia also added to the problem. Argus assessed prices for 62 CSR metallurgical coke at $442.50/t fob China on 12 May, up by $58.75/t from a week earlier. Prices for premium hard low-volatile coking coal are at Yn1,720/t del north China, having risen steadily from Yn1,480/t on 20 April.

Thermal coal futures dipped today after Chinese premier Li Keqiang said at a state council meeting on 12 May that Beijing will work to cap excessive rises in bulk commodity prices to maintain stable economic development. But overall, China's physical coal complex remains supported by tight fundamentals.

Meanwhile, offers for ferro-silicon — another key feedstock for magnesium metal — also moved down by Yn100-200/t today. Prices had risen in previous weeks because Inner Mongolia and Ningxia introduced energy control measures and there were environmental inspections in Qinghai province.

Price hikes filter through to Europe

European traders lifted their offers sharply this week as the steep China hikes filtered through. One European trader received an offer at $3,400/t fob Tianjin on 12 May, having bought 500t last week at the significantly lower price of $2,675/t fob Tianjin. Meanwhile, a southern European trader received two offers this week for material coming from north China ports, one at $3,450/t fob and another at $3,510/t fob.

A third trader offered material at $2,800/t in warehouse Rotterdam on 4 May, but when the customer responded this week to finalise a booking they had to raise their bid to €3,100/t ($3,750/t), although the deal had been done by the time Argus went to press.

Some market participants have criticised the scale of this week's price hikes, saying the increases are too sharp given underlying supply-demand fundamentals. But most expect European prices to keep rising next week as offers of material coming from China continue to climb.

For the past few months, most of the magnesium spot trade in Europe has been on a back-to-back basis, with traders keeping warehouse inventories fairly low because regional demand has been fairly low over the past year and it is difficult to store magnesium metal for long periods of time. Given stocks are so low, supply tightness is likely to become more acute in Europe if demand from the aluminium industry continues to ramp up as Europe emerges from its latest lockdown restrictions.

Strong Chinese demand lifting commodity prices

The Chinese bulk commodity market sustained its growth in April. The China Bulk Merchandise Index, a gauge of growth in the domestic bulk commodity market, stood above the boom-or-bust line of 100pc at 103.3pc last month, according to data from the China federation of logistics and purchasing. The index has risen for four consecutive months, indicating a stable and growing domestic bulk commodity market.

China's main economic planning agency the NDRC, the State Administration for Market Regulation and the Tangshan municipal government launched inspections at local steelmakers to urge them to maintain market discipline after Li's remarks. Spot steel prices fell in response by around Yn400/t today.

Tangshan city in the northern Hebei province is China's key steel production hub. The steel industry is one of the main consumption sectors for magnesium.

Prices for aluminium, another downstream product, have also declined. May contracts on the Shanghai Futures Exchange (SHFE) closed at Yn19,350/t today, down by Yn390/t from yesterday.

Producers in Shaanxi province, the largest magnesium production hub in China, use waste gas from their semi-coking coal production to heat magnesium metal furnaces. About 5-6 equivalent tonnes of coal and 1.1t of ferro-silicon are consumed to produce one tonne of magnesium metal.

Sentiment in the spot market, previously shored up by futures prices in the past week, has weakened. Magnesium producers have not raised their offers today, keeping them unchanged from yesterday at Yn22,000/t following the fall in coal prices. Market activity has also slowed today, with only a few deals concluded at Yn21,500/t and most buyers monitoring the direction of prices.