South Korea-delivered coal prices rose sharply this week amid tighter fundamentals driven by a firmer demand outlook in Asia-Pacific and high-calorific value (CV) supply disruption.

Argus assessed NAR 5,800 kcal/kg coal $2.36/t and $1.08/t higher on the week at $118.45/t cfr South Korea and $98.33/t fob Newcastle, respectively. These prices equate to $124.17/t and $103.08/t on a NAR 6,080 kcal/kg basis.

Argus' latest South Korea-delivered price assessment is close to a string of recent cif Taiwan tender awards from earlier in the week. Taiwan's state-owned power company Taipower reportedly purchased two Panamax vessels of NAR 5,700 kcal/kg Australian coal at around $125/t cif Taiwan and at least six Panamax vessels of GAR 6,322 kcal/kg — or NAR 6,000 kcal/kg — Australian coal at around $130/t cif Taiwan, all for delivery in June-July.

South Korean tender activity cooled slightly this week after a combined total of 1.32mn t was awarded last week, all for loading in 2021.

State-owned Korea Western Power (Kowepo) on 2 June secured two Capesize vessels of NAR 5,800 kcal/kg South African coal from Geneva-based trading company Mercuria at $97/t fob on a NAR 6,080 kcal/kg basis, as part of a five-year term tender. The two cargoes are to be loaded in August and September.

Argus estimates that the Kowepo tender award would net-forward to South Korea at $114.33/t on a NAR 6,080 kcal/kg basis, assuming a Capesize freight rate of $17.33/t. This would suggest a narrow cost advantage over Australian NAR 5,800 kcal/kg coal, which would net-forward to around $122-116/t depending on the vessel size, according to Argus coal and freight assessments this week.

And high-CV Russian coal was reportedly offered at around $123-126/t cfr South Korea this week, market participants said.

South Korean prices were supported by a firmer coal demand outlook this week following an unplanned outage at the 1.4GW Shin Kori 4 nuclear reactor. The downtime is expected to last for around a month, a source at operator Korea Hydro and Nuclear Power said.

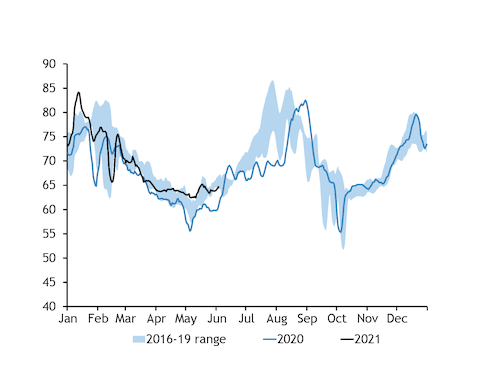

A month-long outage would cut South Korea's nuclear availability by 3.2GW compared with actual generation of 19.5GW in June last year, Argus estimates. This would compound the impact of recovering overall power demand, and is likely to boost generation from coal and gas this month compared with June 2020.

The nuclear issue may also be the reason behind state-owned utility Korea South-East Power (Koen) reportedly suspending its voluntary restriction on coal-fired plants, amid growing concerns of a potential power shortage. The voluntary suspension at the 560MW Samcheonpo unit 4 was cut to 2-8 June from 2-30 June in last week's schedule, potentially because of the recent nuclear outage.

State-owned Kepco utilities' voluntary suspensions are scheduled to average just 1.2GW during 5-13 June, compared with 2.5GW a week earlier, according to the latest weekly coal plant maintenance schedule published by the Korea Power Exchange. Planned outages for other reasons are scheduled to average 8.6GW during the same period, down from 11GW last week.

Temperatures in Seoul are forecast to be unseasonably warm during 6-17 June, deviating above the norm by as much as 3.05°C, Speedwell Weather data show.

Japan

Japanese net-forward prices extended their recent gains on the back of ongoing strength in the global coal market.

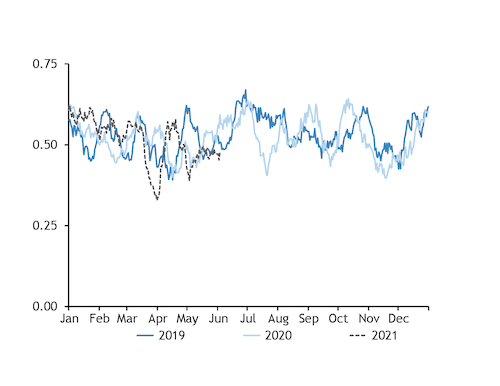

Railing disruption in Colombia and Russia and upcoming railway maintenance in South Africa have tightened the global high-CV fundamental outlook, while loadings at Newcastle remain short of last year's pace at the same stage. Loadings have averaged around 480,000 t/day recently, down from 590,00 t/day this time last year and 510,000 t/day in early June 2019.

Rising northeast Asian oil-linked LNG prices may also be supporting demand for seaborne coal, as the solid fuel is set to become increasingly competitive for power generation as the year progresses.

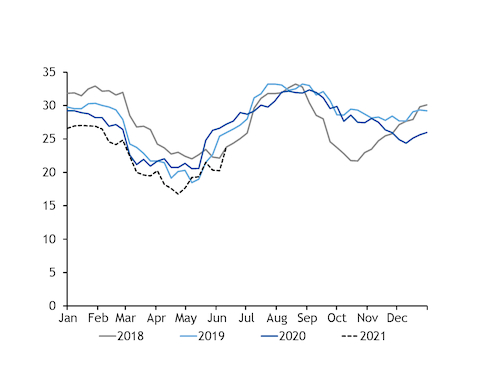

Japanese coal-fired plant restrictions are also gradually easing, which could support greater coal use in the weeks and months ahead. Implied availability for June is around 35.6GW according to Argus analysis, up from 30.9GW in May and 33.6GW in April.

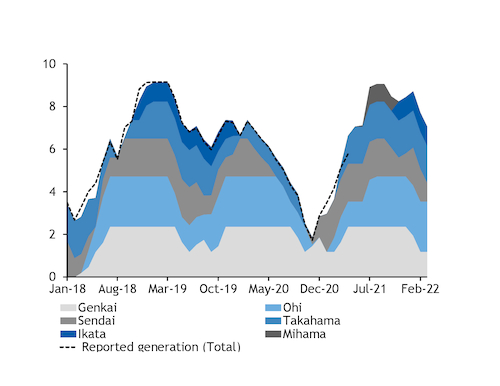

But firmer nuclear availability could weigh on the need for thermal generation unless there is a strong recovery in power demand this summer. Japanese nuclear availability is scheduled to average 9.02GW during the third quarter, which would be more than double the output recorded in July-September last year.

Switzerland-based trading company Glencore has reportedly settled its annual benchmark price with Japanese utility Tohoku Electric Power at $109.97/t basis GAR 6,322 kcal/kg for Australian supplies from July and onwards, market participants said. This price is up by around 60pc compared with $68.75/t a year earlier, underscoring the strength of high-CV prices in Asia.