Months of low US imports have made the European diesel market sensitive to small increases in demand.

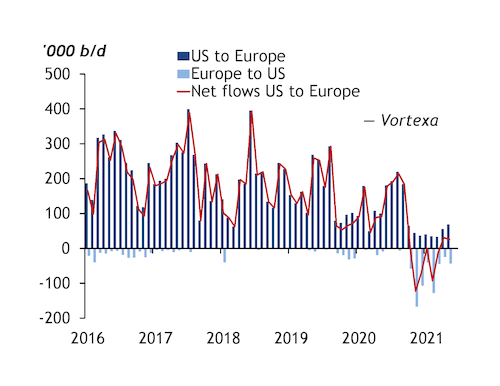

More European diesel has been moving to the US, reversing the long-standing direction of transatlantic trade. Net flows of diesel and heating oil from the US to Europe have been exceptionally low for the past eight months, according to market participants and data from oil analytics firm Vortexa (see graph).

European demand has been so low throughout most of the pandemic that diesel margins have lingered at $3-6/bl, roughly half the lowest level recorded in 2019. But a hint of returning demand in the past few weeks has combined with a dearth of transatlantic imports to restore margins to an 11-month high. French-grade diesel cargoes reached an $8.37/bl premium to North Sea Dated crude on 2 June, the highest since July 2020.

The US was the third-largest supplier of diesel and gasoil to Europe in 2019 after Russia and Saudi Arabia, with 125,000-400,000 b/d moving across the Atlantic before late 2020. Imports have fallen below 50,000 b/d on average since October. The drop in the flow of diesel shipments east and a rise in exports on the reverse westbound route helped push net flows of diesel from the US to Europe below 10,000 b/d in October, from an average 140,000 b/d during the preceding nine months. European supplies moving west far outstripped those moving east a month later, Vortexa data show. The net flow remained largely westward until it flipped eastward again in April and May this year.

The reason for the low and inverted flows has been US diesel pricing at a rare, large and sustained premium to the same product in northwest Europe. Low-sulphur diesel loading in the US Gulf coast averaged close to a $37.85/t premium to French-grade diesel delivered to northern France from October 2020-May 2021. The premium steadily increased over the period, with US prices of about $60/t, or 10pc, higher than those in Europe in May. The US product was priced at an average discount of $3.95/t to European diesel in 2019.

Demand recovery

Support for US prices has come from the gradual recovery of demand as Covid-19 vaccination cover has expanded and lockdown measures have been lifted. Almost half of adults in the country were fully vaccinated by late May, far higher than the 20-25pc rate typical in Europe, according to the European Centre for Disease Prevention and Control.

Another supportive factor in the US has been culls to refining capacity, which have been even harsher than in Europe. Capacity had been culled by 840,000 b/d by late May, compared with around 500,000 b/d in Europe.

Along the way, there was a temporary collapse in US production in February, as a cold spell caused Texas' power grid to fail. Only around 2.9mn b/dof low-sulphur diesel was produced in the US in the week to 26 February, according to the EIA, the lowest weekly output recorded in at least a decade and well below typical levels of 4mn-5mn b/d.

With US prices so far above those in Europe and European refining run rates still less than 75pc on average, domestic producers seem much better placed to meet returning demand than transatlantic suppliers. This may mean that Europe's diesel and gasoil imports from the US remain subdued for months to come.

But some market share could be freed up by low amounts arriving from east of Suez. China recently introduced a tax on imports of light-cycle oil, a gasoil blendstock, which is indirectly reducing the country's gasoil exports. Asia is now taking a larger share of Mideast Gulf product away from Europe as a result.

| Transatlantic diesel and gasoil loadings | '000t | ||

| Month | US to Europe | Europe to US | Net |

| May 2021 | 232 | 153 | 79 |

| April 2021 | 185 | 99 | 86 |

| March 2021 | 82 | 181 | -99 |

| February 2021 | 104 | 481 | -377 |

| January 2021 | 141 | 171 | -30 |

| December 2020 | 133 | 445 | -312 |

| November 2020 | 127 | 672 | -545 |

| October 2020 | 257 | 240 | 17 |

| September 2020 | 718 | 0 | 718 |