South Korean delivered coal prices edged lower this week despite continued strength in the Australian fob market, with competitive gas prices and recovering nuclear availability expected to trim coal use in August.

Argus assessed NAR 5,800 kcal/kg coal delivered to South Korea at $137.47/t ($144.11/t on an NAR 6,080 kcal/kg basis) which was broadly flat on the week. The equivalent specification of coal was assessed at $121.08/t fob Newcastle ($126.92/t on an NAR 6,080 kcal/kg basis), which was up by more than $4/t on the week.

Tender activity in South Korea was subdued this week, although one utility was heard to have awarded a September-loading Capesize cargo of Australian NAR 5,800 kcal/kg coal on a NAR 6,080 kcal/kg basis at around $127/t fob Newcastle, but this could not be confirmed.

Tight Australian supply kept Newcastle prices supported, but buying interest in South Korea may begin to wane, with coal burn expected to ease beyond July.

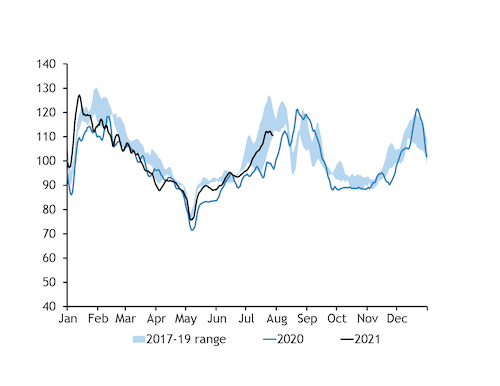

South Korean power exchange KPX today forecast August power demand to rise by only 0.9pc from last year, which suggests a slight month-on-month decrease from July. Daily peak power demand in July has jumped by 18pc from a year earlier, with Argus estimating that overall power generation has climbed by around 15pc to a seasonal record of close to 72GW.

This increase has probably triggered a first year-on-year rise in South Korean coal-fired generation since April 2020, but forecast weaker power demand and an expected recovery in nuclear availability next month could weigh on coal consumption again.

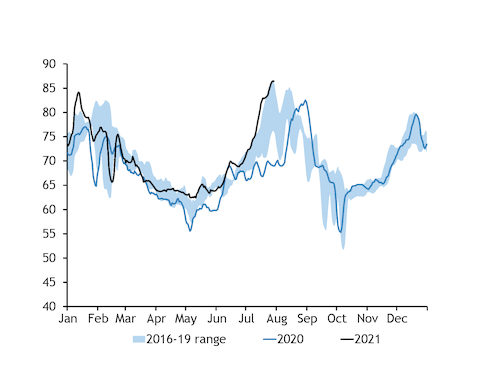

Nuclear availability is scheduled to recover to nearly 18GW in August, from 16.7GW in July and output of 16.8GW in August 2020, which would more than offset KPX's forecast year-on-year increase in power demand.

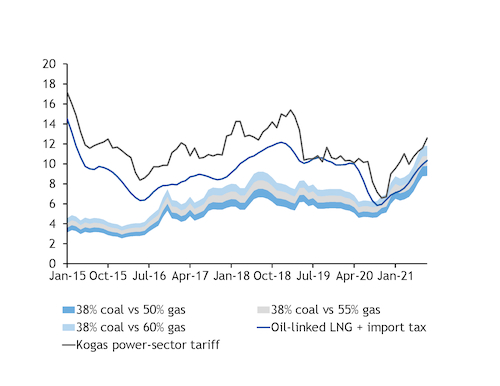

And gas-fired generation remains more competitive with coal than a year earlier, which could focus any fossil fuel displacement on the solid fuel next month. State-run gas supplier Kogas set its August gas tariff for the power sector at 13,597.61 won/GJ, equivalent to around $12.58/mn Btu. This is a 28-month high and up from $8.20/mn Btu a year earlier, but even stronger gains in coal prices this year have cut coal's relative advantage for power generation.

The August Kogas tariff is around $0.78/mn Btu higher than the fuel-switching price at which a 60pc efficient gas-fired unit could compete with a 38pc coal-fired unit, according to Argus analysis based on NAR 5,800 kcal/kg coal prices. But this is in from a $2/mn Btu premium to the fuel-switching price last August.

If gas-fired generation holds steady on the year, nuclear generation rises in accordance with availability and power demand only increase by 1pc, coal-fired generation would be displaced compared with August 2020, according to Argus analysis.

Japan braced for unseasonably warm August

In Japan, an upward revision to the temperature forecast for August could boost overall power demand and generation from fossil fuels compared with previous expectations next month.

Large parts of northern Japan face a 60-70pc probability of above-average temperatures next month, the Japan meteorological agency says. But Tokyo is still under a state of emergency because of Covid-19, which could slow growth in overall power demand, while much higher nuclear availability compared with a year earlier should weigh on thermal import requirements in the second half of this year.

Japan's nuclear availability is expected to average 8.8 GW/month in July-December, up from 3.4 GW/month a year earlier. Availability in August is expected to be 4.7GW higher on the year at 9.1GW.

Stronger gains in high-calorific value coal prices also mean that oil-linked LNG — the primary source of gas supply in Japan — is becoming increasingly competitive with coal for power generation in the country, which could encourage buyers to withdraw from the spot coal market. Japanese coal imports fell in June, while LNG receipts rose.

Temperatures in Tokyo have been a few degrees above the long-term average in recent weeks, with national power demand up by around 11pc on the year at an average of nearly 107GW.