South Korean delivered coal prices continued to rise on the back of strength in the global market, but the pace of the increase has slowed amid the Chuseok holidays or Korean thanksgiving.

Argus assessed NAR 5,800 kcal/kg coal prices at $148.14/t fob Newcastle and $175.31/t cfr South Korea this week, up by $4.21/t and $3.31/t on the week, respectively. By comparison, prices rose by $4.34/t and $7.52/t on 17 September.

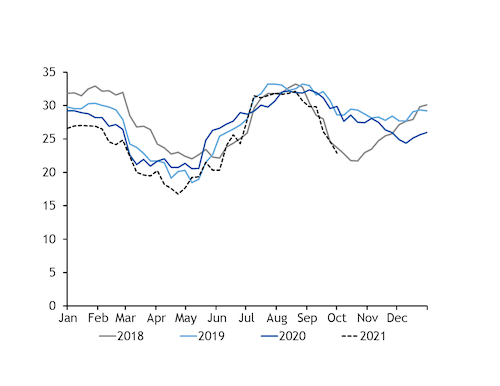

Freight rates across the Asia-Pacific region also firmed this week, with the Capesize rate between Australia's Newcastle port and Zhoushan, China, gaining by another $3.70/t on the week to a $27.15/t average during 20-23 September. The equivalent rate between east Australia and South Korea remained above $22/t during 20-23 September at a $22.64/t average, compared with a $22.04/t average during the same days last week and $11.20/t a year earlier.

South Korean state-owned utility Korea Western Power (Kowepo) closed a five-year term tender today, seeking a combined total of around 2.8mn t of NAR 4,200-6,000 kcal/kg coal during January 2022-December 2026.

The tender requests two cargoes in a lot of 155,000t to be shipped during the first quarter of next year. The full result of this tender was not heard by the time of writing, but a Switzerland-based trading company was reportedly awarded a Capesize cargo of NAR 5,000 kcal/kg Australian coal at $125/t fob Gladstone on a NAR 6,080 kcal/kg basis for January-March 2022. Kowepo reserves the right to change the cargo size to two Panamax shipments, two months prior to the loading date.

On the coal demand side, firmer nuclear availability combined with unseasonably warm weather across the peninsula has encouraged state-owned Kepco utilities to increase their voluntary restrictions across the coal fleet this week.

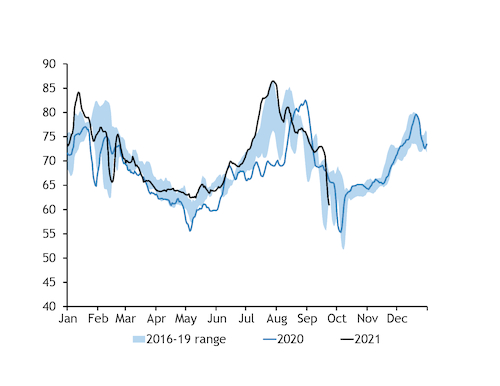

Temperatures in South Korea's capital city Seoul are forecast to soar above the seasonal norm during the next fortnight, by as much as 2.66°C, according to Speedwell Weather data. Warmer weather has hampered South Korean power demand since mid-September, with average peak power demand decreasing by more than 3GW on the year to 63.9GW during 20-23 September (see chart).

But South Korea's nuclear availability is scheduled to average 17GW during this month, compared with an actual output of 12.9GW in September last year, which will further weigh on fuels demand.

The latest maintenance schedule published by the Korea Power Exchange (KPX) shows that voluntary restrictions are scheduled to average 3.56GW this month, up from a 3.18GW average based on last week's schedule. Kepco also plans to voluntarily idle 4.92GW of coal-fired capacity in October, with 6.1GW due to be unavailable in total next month based on the latest schedule.

Kepco's overall coal availability is currently scheduled to average 25.71GW and 22.61GW in September and October, respectively, down by more than 5.3GW on the year each month.

Warm forecast weighs on Japanese demand outlook

Japan-landed coal costs rose this week, as the tight domestic supply situation in China and a firm winter outlook in Europe continued to bolster regional fob prices.

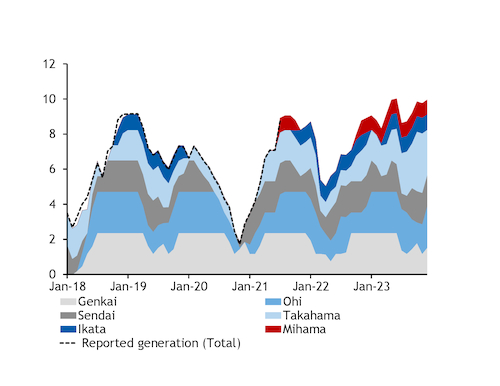

But the outlook for fossil fuel-fired power generation this autumn and early winter is still soft, as nearly all of Japan's restarted nuclear reactors are currently available and with unseasonably mild conditions forecast for the month ahead.

Japanese nuclear generation is likely to have peaked at around 9GW in both August and September, up from 4.2GW a year earlier, thanks to the restart of the Mihama 3 reactor and lighter maintenance across the rest of the fleet.

Availability will ease slightly for October-January, but is still expected to be nearly 6GW higher, on average, compared with the same period last winter.

The additional nuclear availability could be compounded by softer power demand in the short term, with the Japan Meteorological Agency saying there is a 60-70pc chance of above-average temperatures across most of the country in the month to 24 October.

Japan is still fighting rising Covid-19 infections, although new daily cases have been gradually falling in line with increased vaccination rates. New daily cases averaged 4,878 in the past week compared with more than 20,000 earlier this month. This may result in the end of the country's extended state of emergency on 30 September.

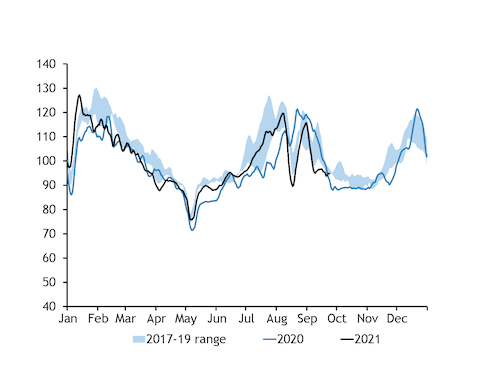

Any lull in power sector consumption of fossil fuels could be particularly weak for coal demand, as rising spot prices continue to erode the fuel's competitive advantage over utilities' oil-linked LNG term supply. Japanese LNG imports have grown more strongly than coal this year and stocks are now well ahead of 2020, creating additional flexibility to ramp up gas-fired generation ahead of coal this winter.

Japan's LNG stocks were around 2.5mn t as of 15 September, slightly up from the end of August, according to the latest survey by the country's trade and industry ministry. Stocks at the end of August stood at around 2.43mn t, up by 25pc from a low of 1.94mn t at the end of May. August inventories were 52pc higher than the 1.6mn t held a year earlier and 42pc higher compared with the four-year seasonal average of 1.71mn t for the end of August.