India's diesel demand is poised to increase this quarter during the festive season, but higher domestic prices are likely to weigh on consumption, analysts told Argus.

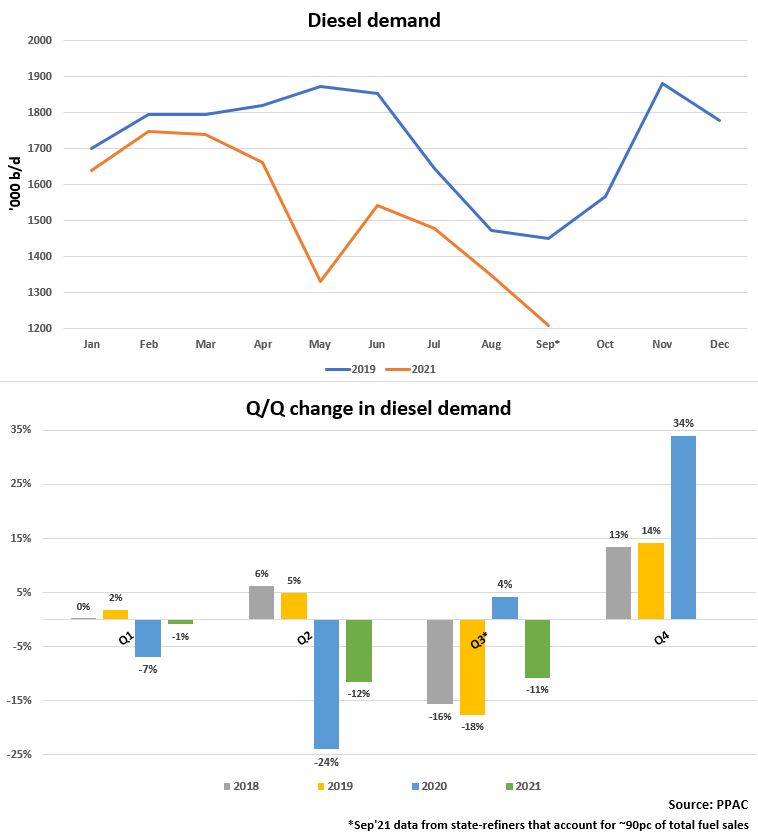

Domestic diesel use was at 1.21mn b/d in September, down by 7pc compared with the same time in pre-pandemic 2019, according to demand figures from state-controlled refiners that account for around 90pc of the country's fuel sales. This was because of higher domestic prices and a monsoon-induced fall in trucking activity.

"We believe [the] harvesting and festive season would lend some support to diesel here on, driven by increase in goods transportation mobility," said Mumbai-based Crisil Research director Hetal Gandhi, echoing expectations of Indian refiners.

Consumption of the motor fuel usually falls by about 15pc on the quarter in July-September because of the monsoon season but rises by around 14pc on the quarter in October-December on the back of a surge in demand for goods during religious festivals in India. The latter would, in turn, increase use of trucks and heavy motor vehicles, which are predominantly fuelled by gasoil, while small diesel generators are typically used to light up public places and power festive booths.

But higher domestic diesel prices could put a dampener on demand, said Kavita Chacko, senior economist at Mumbai-based ratings agency Care Ratings.

Diesel was being sold at 101.03 rupees/litre ($1.34/l) in Mumbai yesterday after rising past the triple-digit mark for the first time ever last week, while gasoline retailed at Rs110.41/l.

The operational cost of trucks has increased following the hike in motor fuel prices, said the All India Motor Transport Congress (AIMTC), which represents truckers and private-sector bus operators across India.

"About 43pc of diesel consumption is by transport vehicles. Truck and small fleet owners' operations have now become more unviable due to daily fuel price hikes," the AIMTC said, adding that it is considering whether "to stop unviable operations across the country, very shortly".

Meanwhile, fears of coal shortage-induced power outages could also nudge up consumption of diesel as it is used in small off-grid generators to supply electricity to homes, offices and emergency generators in the manufacturing industry. But analysts expect that outages will not be widespread as supplies are likely to increase on the back of new government measures to address the coal shortage.

"In case there are power outages, the use of diesel generators by certain industrial consumers is likely … As a stop-gap arrangement, certain industrial consumers may depend on diesel, especially to meet the higher demand," said Prashant Vasisht, vice-president of Indian ratings agency Icra.

Market participants close to Indian refiners said grid operators may have to purchase gas to fire their generators in the absence of coal, while fuel oil and naphtha are also preferred by power plants for electricity generation.