Australian coal mining firms are turning to Asia to fund growth options, but it is unclear how successful they will be despite record-breaking coal prices allowing them to reset balance sheets savaged by two financial years of losses to 30 June 2021.

Australian thermal and metallurgical coal producer Whitehaven Coal is confident that it will be able to raise up to A$1bn in Asian bonds to support its growth plans, yet fellow producer TerraCom has been forced to accept backup financing for its operations after it failed to secure new sources of debt to sustain its existing operations.

This difference in experience could reflect the status of the two firms, with Whitehaven having built a reputation as a good operator over several years and TerraCom being a relatively new entrant operating lower-grade, higher-cost mines. Or it could reflect the reality of the finance market for thermal coal against the optimism that continues to drive Whitehaven's growth ambitions in the face of increased global action on carbon emissions.

Both firms are making exceptional margins, with TerraCom making an operating cash margin of A$101/t in September on sales of 170,000t from its Australian 2.5mn t/yr Blair Athol mine in Queensland and expecting to make more than A$140/t in the October-December quarter on 575,000t based on current projections.

Despite these record-breaking margins, TerraCom was unable to secure up to $215mn in new debt at a lower interest rate of around 9pc/yr, and instead has had to roll over its previous finance at 12.5pc interest plus 0.75pc of revenues from Blair Athol. This compares to the standard business debt interest rate of less than 5pc in Australia, reflecting in part the limited borrowing options that coal mining operations face as financial institutions progressively withdraw their services from the high-carbon sector.

Yet Whitehaven was upbeat in its assessment of its capacity to secure up to A$1bn in debt financing in the Asian bond market to build new mines at Vickery in New South Wales (NSW) and Winchester South in Queensland over the next decade. The firm, which has an existing A$1bn revolving debt facility that expires in mid-2023, had net debt of A$808.5mn as of 30 June, but expects strong coal prices to allow it to be in a net cash position before the end of March.

Coal mining firms' strong cash generation, reputation as good employers offering high paying jobs and payment of royalties have led federal resources minister and National Party MP Keith Pitt to suggest that the government provide an A$250bn lending facility to firms wishing to invest in coal mining in Australia. This may be the price that the National Party, which is the minor party in the ruling coalition with the Liberals and represents rural constituencies including coal mining regions, will seek in return for supporting more ambitious carbon targets to the UN Cop 26 climate conference in the UK's Glasgow later this month. This would be a game changer for coal investment in Australia, allowing mining firms access to cheaper debt to pursue expansion plans across NSW and Queensland.

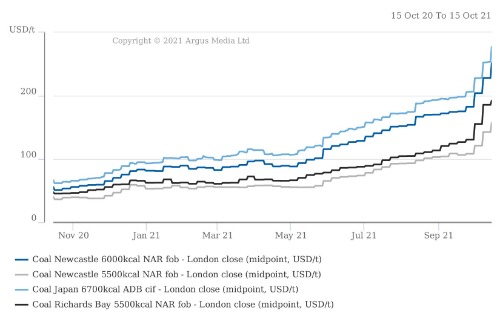

Argus last assessed the high-grade 6,000 kcal/kg NAR thermal coal price at $251.43/t fob Newcastle on 15 October, up from $174.46/t on 10 September, $151.90/t on 30 July and $47.56/t a year earlier. It assessed lower-grade coal at $157.52/t fob Newcastle for NAR 5,500 kcal/kg on 15 October, up from $108.67/t on 10 September and $42.08/t the previous year.

The heat-adjusted premium on a NAR 6,000 basis for higher-grade thermal coal was at $79.57/t on 15 October, up from $55.91/t on 10 September and $1.65/t a year earlier before Beijing's ban on Australian coal took full effect.

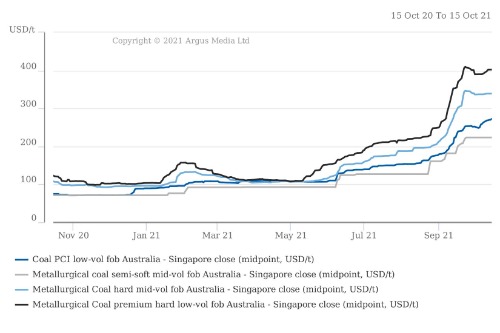

Premium hard coking coal prices more than tripled from early May to $409.75/t fob Australia in mid-September, before easing slightly. Argus last assessed the premium hard low-vol coking coal price at $402/t fob Australia on 19 October, up from $110.95/t on 11 May. Lower-grade metallurgical coal prices have also increased, at a slightly lower rate.