Mounting production costs in the Democratic Republic of Congo (DRC) could halt or even reverse the cobalt market's downward trajectory in the coming weeks, particularly if combined with a potential rebound in Chinese demand.

Prices for copper — the main revenue source for DRC cobalt producers — have fallen sharply since March as global macroeconomic headwinds built, with the LME three-month contract now down by 26.6pc since 7 March at $7,870.50/t. For now, copper prices are still above pre-Covid averages but further declines could lead to the suspension of some converters and mines in DRC, according to market participants.

Furthermore, prices for sulphur — the precursor to sulphuric acid, which is used heavily by copper/cobalt miners in the copper belt region of central and southern Africa — in the copper belt are much higher than elsewhere in the world. Chinese sulphur stood at $50-100/t cfr on 4 August. One deal in Lubambashi was done at $790/t dap on 4 August.

Meanwhile, high energy costs and inflationary pressures are squeezing mining firms' margins. And the ramp-up of Ivanhoe Mines' Kamoa Kakkula copper mine near Kolwezi is boosting regional demand for trucking, tightening access to transport facilities for other operations. The mine is the second-largest copper complex in the world, straining resources for miners in the region.

"Mines are likely to underperform. There are struggles finding acid-soluble ore and sulphuric acid prices have skyrocketed in recent months. The sulphuric acid market for the copper belt is completely detached and a producer had an outage so the acid supply has dried up," said an analyst for a DRC cobalt supplier, adding that "labour, diesel and trucking costs are also much higher. If prices continue to decline we may get a September surprise."

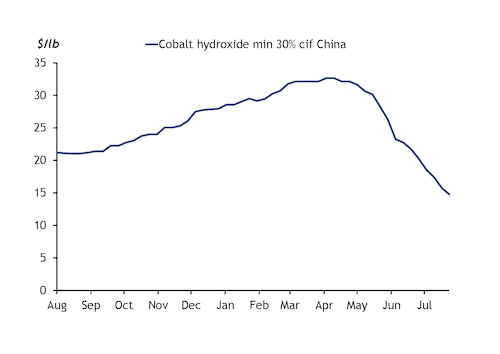

Meanwhile, a slight turnaround in Chinese cobalt demand in the coming weeks could also lend support to the cobalt complex, potentially lifting cobalt hydroxide prices and pushing up the value of cobalt metal and chemicals.

"I think the Chinese consumers are looking at the different end-users and seeing some green shoots, especially in EVs, but there is still a lot of material in the system," one European cobalt trader said.