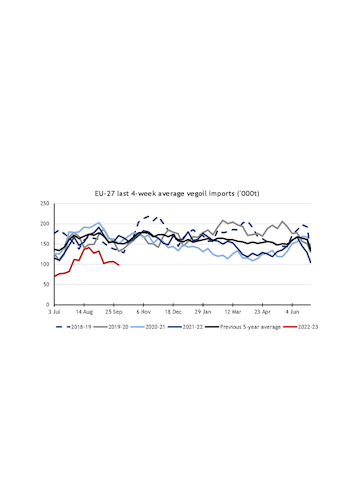

The EU's vegetable oil imports slowed across the complex in the week to 2 October, as buyers received more soybeans and rapeseed, while sunflower arrivals slid.

The EU imported 1.50mn t of vegetable oils — palm (CPO), sunflower (SFO), rapeseed (RSO) and soybean (SBO) oil — in the first three months of the 2022-23 marketing year (July-June), provisional data from the European Commission show.

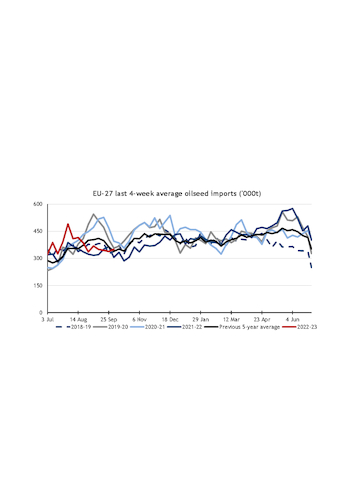

Imports of oilseeds — soybeans, rapeseed and sunflower seeds (SFS) — reached 5.29mn t as of 2 October, compared with 4.47mn t a year earlier.

Average weekly SFO imports slowed in the past four weeks, although cumulative volumes so far this marketing year remain 4pc above the five-year average. But SFS imports fell further in the past week, reaching their lowest weekly level since the second week of the marketing year.

CPO imports recorded their second-lowest weekly volume so far this marketing year, bringing cumulative imports in 2022-23 down by 45pc on the year, as consumers drive a shift to other vegetable oils.

SBO and RSO receipts drop

Imports of SBO dropped to an 11-week low in the week to 2 October, bringing cumulative imports since the beginning of the marketing year in July down by more than a third in the past two years. In contrast, soybean imports almost doubled on the week, indicating stronger margins for European crush plants despite medium-term concerns over energy costs.

RSO receipts also slid, hitting their lowest in six weeks. Cumulative volumes were down by almost a quarter on the year but well above the five-year average, as industry slowly switches back to sunflower after rapeseed oil earlier this year replaced lower sunflower supply from Ukraine.

But rapeseed imports jumped to 181,000t on greater deliveries from Ukraine, representing by far the highest weekly volume so far this marketing year. Ukrainian rapeseed cargoes over the past four weeks were destined mainly for the Netherlands, with the country scheduled to receive 106,000t of product shipped last month.

Ukraine's deliveries could slow though, as the country's oilseed harvest slows. SFS and soybean threshing was significantly down on the year in the past week, with delays in SFS harvest potentially leading to heavy crop losses.

Strong rapeseed supply to the EU is set to continue though, following a bumper crop in Australia, which has reversed the usual Australian canola premium over Canadian supply in recent weeks and caused Canada's market share to drop to just 2pc.