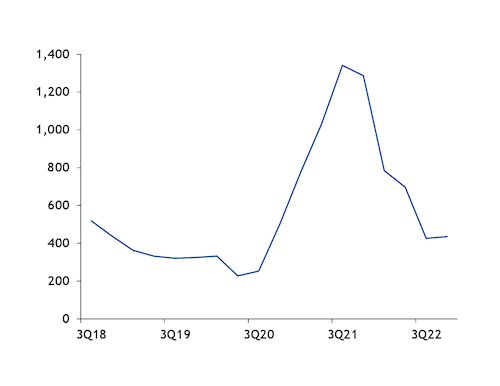

The spread between US hot-rolled coil (HRC) and #1 bushelling scrap prices has been resetting at levels higher than its pre-Covid-19 pandemic average.

The spread between the Argus US Midwest HRC ex-works assessment and #1 busheling ferrous scrap, a key feedstock into US electric arc furnace (EAF) steelmakers, was up by 36pc to $426/short ton (st) in the third quarter compared with $321/st in the same period of 2019, the last full quarter before the pandemic started sweeping across the world.

HRC prices have mostly flattened in the last two months, with low demand and oversupply keeping the market from appreciable price increasesand in a range of $776-822/st.Prices have remained relatively steady as service centers have stopped most speculative buying to work down inventories, slowing a downward trend that before August saw prices dropping by double digits every week. A previous spike in pricing in March and April was driven by steel feedstock raw material concerns out of Europe, and quickly dissipated.

Prime grade scrap prices reached multi-year highs earlier this year of $758/gross ton (gt)after the conflict in Ukraine sent pig iron and iron metallics prices soaring. As prices surged, mills aggressively scaled back buying programs of prime grades with persistent erosion in flat-rolled finished steel prices, weaker order books, and a sharp drop in pig iron import prices further weighing on the scrap grade.

Over the last five months, some major US steelmakers have shifted melt mixes to favor more obsolete grades in an effort to reduce reliability on monthly spot traded volumes of prime as spreads between #1 busheling and shredded scrap ballooned with numerous investments in developing alternatives like low-copper shred or iron metallic sources. Busheling has fallen to $382/gt during the most recent trade in September.

If the wider spread holds, it would afford US steel mills lower costs as they pump billions of dollars into new and more efficient mills and downstream assets to diversify their businesses.