Developed countries continue to fall far short of their pledge to provide and mobilise $100bn/yr in climate finance to developing nations over 2020-25. With finance having been declared a priority of this year's UN Cop 27 climate conference in Egypt, several factors could still hamper reaching a figure the adequacy of which is already in question.

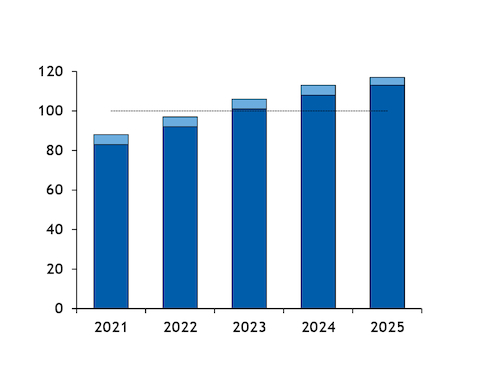

Developed countries agreed to provide and mobilise $100bn/yr in climate finance jointly for developing countries by 2020 at 2009's Cop 15 in Copenhagen. Parties at 2015's Cop 21 in Paris agreed to continue this level until 2025. But while financing increased to $83.3bn in 2020 from $58.5bn in 2016, it was still well below the $100bn mark, latest OECD data show, and unlikely to be met before 2023 even under its best-case scenario.

The foundations of the goal may in part be hampering its achievement. For instance, the convention setting out the goal contains no means of monitoring, reporting or acting on whether it is being achieved, co-chair of the UN Framework Convention on Climate Change Standing Committee on Finance (SCF), Zaheer Fakir, highlighted at June's UN climate change conference in Bonn, marking the midway point between the annual Cops. The SCF will produce a report on progress towards the goal for consideration at Cop 27 in Sharm el-Sheikh in November.

A lack of common accounting methodology could cause further problems, Fakir warned, with potential disagreements over how much money has been "mobilised" or "provided". The concept of mobilising finance itself amounts to "diminished responsibility" for the developed country parties providing the finance on the one hand, and increased responsibility on the developing country parties on the other to leverage the finance, Fakir added.

With no common definition of climate finance, "it will always be contested" whether a precise finance flow should be counted as climate finance or not, head of WWF Poland's climate team Marcin Kowalczyk said at the Bonn conference. Kowalczyk pointed to several other potential pitfalls in the set-up of the target, such as the risk of double counting information originating from different sources, and the issue of exchange rates — $100bn means different things in different currencies, and this will shift over the period up to 2025.

The $100bn question

Even the elusive $100bn could be far off what is required to prevent the worst effects of climate change. "The 100bn was never based on any needs, it was based on a collective group of individuals who sat around in a room and thought 100bn is a very sexy figure," said Fakir, according to whom the true amount needed to address the objectives of the convention and meet the goals of the Paris climate agreement stands somewhere between $5 trillion and $11 trillion.

"Even if we multiplied the $100bn by 10, it would not even cover half of the funding gaps for developing economies to address climate change," the UN Climate Change high-level champion for Egypt Mahmoud Mohieldin told Argus last month, highlighting that the topic of finance and mitigation at Cop 27 should not just be limited to talking about the $100bn. Egyptian Cop 27 president Sameh Shoukry and UK Cop 26 president Alok Sharma have emphasised that finance will be a priority at this year's event.

And with similar issues as those dogging the $100bn goal threatening to recur in negotiations on the new collective quantified goal on climate finance post-2025, which will be finalised in 2024, concrete progress on discussions for both targets will be considered key to a successful conference. But "nobody's talking about what an ambitious, quantified goal would be", Fakir warned in Bonn of the discussions.