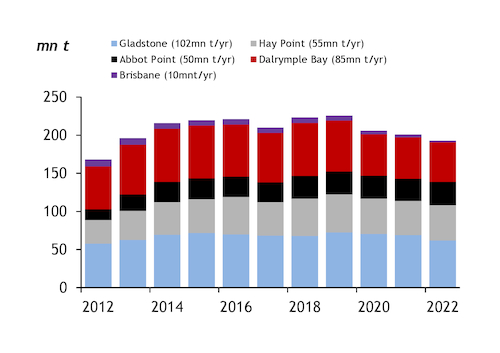

Shipments from the four key Queensland coal ports increased in December on drier weather but 2022 was still the weakest coal export year from the east Australia state since 2012.

The ports of Hay Point, Dalrymple Bay Coal Terminal (DBCT), Abbot Point and Gladstone shipped 17.12mn t in December, up from 16.35mn t in November and from 15.51mn t in December last year, according to port data. The ports shipped 190.94mn t in 2022, down from 197.28mn t in 2021 and from the peak of 219.24mn t in 2019.

December was drier than average, according to the Bureau of Meteorology (BoM), but the northern end of the Bowen basin and the associated ports of Abbot Point, Hay Point and DBCT experienced up to 800mm of rain in the first two weeks of January. These ports have longer than average ship queues, with 37 vessels waiting off the adjacent ports of Hay Point and DBCT, along with 11 off Abbot Point. There is a more average queue of 23 vessels at Gladstone, which sits outside the region that has experienced the heavy rain.

The BoM forecasts drier conditions for the coal-producing regions of Queensland during February-March, as the La Nina weather pattern, which drives the increased rainfall, eases. Drier weather, combined with an easing skills shortage and above average metallurgical and thermal coal prices, could drive a rebound in Queensland coal exports in 2023, particularly if the safety issues that disrupted production over the past four years are rectified.

Exports could also be increased by the return of the 4.8mn t/yr New Acland coal mine, which exports through the smaller port of Brisbane. The closure of New Acland cut Brisbane's coal exports to 1.92mn t in 2022 from 3.49mn t in 2021 and 6.36mn t in 2019.

Hay Point, which is operated by BHP Mitsubishi Alliance, and the multi-user DBCT had the strongest end to 2022, while Gladstone's exports were down the most compared with December 2021 and for the full year against 2021.

Abbot Point had a weak end to the year, with December shipments falling to 2.45mn t from 3.11mn t in November. Exports for the year were up by 1.3mn t on 2021 to 30.56mn t, including the contribution from the 10mn t/yr Carmichael coal mine that began shipping in January 2022.

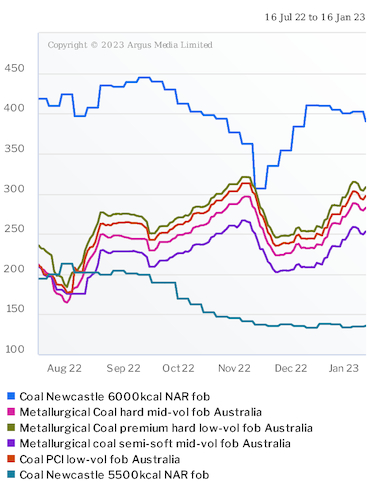

Argus last assessed high-grade 6,000 kcal/kg NAR thermal coal at $390.15/t fob Newcastle on 13 January, down from $410.17/t on 9 December and from a peak of $444.59/t fob on 9 September. It assessed the premium hard low-volatile metallurgical coal price at $308.20/t fob Australia on 13 January, up from $253.30/t on 9 December but down from $320.80/t on 4 November.

| Queensland coal shipments | (mn t) | ||||

| Hay Point | Abbot Point | DBCT | Gladstone | Total | |

| Dec '22 | 4.03 | 2.45 | 5.42 | 5.22 | 17.12 |

| Nov '22 | 3.36 | 3.11 | 4.57 | 5.31 | 16.35 |

| Dec '21 | 3.41 | 2.26 | 3.92 | 5.91 | 15.51 |

| 2022 | 46.27 | 30.56 | 52.10 | 62.01 | 190.94 |

| 2021 | 44.81 | 29.28 | 54.21 | 68.98 | 197.28 |

| 2020 | 46.46 | 29.85 | 54.58 | 70.52 | 201.41 |

| 2019 | 49.84 | 30.11 | 66.74 | 72.55 | 219.24 |

| Source: NQBP, GPCL | |||||