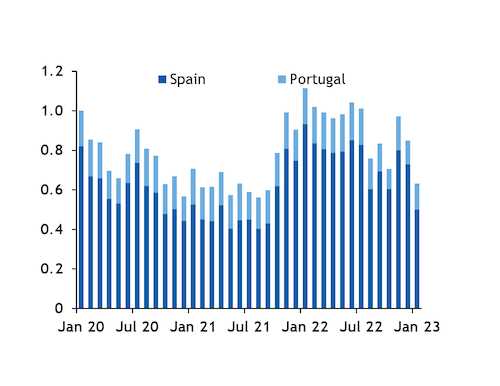

Spanish LNG receipts are on track to fall to their lowest for any month since September 2021, while Portuguese receipts could slip to their lowest since July 2021, as weak consumption and lower prices limit the incentive for firms to utilise Iberian import terminals.

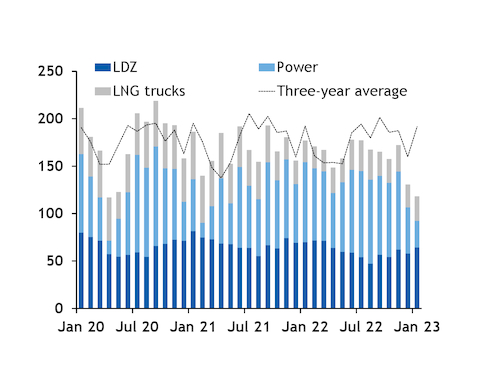

Spanish LNG deliveries of 2.6mn m³ on 1-24 January average out at 108,000 m³/d, which is lower than any full-month pace since September 2021. This left the country's LNG stocks at 2.3mn m³ this morning, the lowest for any date since 22 December. And four more vessels carrying as much as 670,300m³ — judging by vessel size — have declared for Spanish terminals on 25-31 January. Assuming the vessels deliver full cargoes, this could take January deliveries to 3.3mn m³ — still the lowest since September 2021. Sendout has also fallen sharply, at just 500 GWh/d on 1-24 January — also on track to be the lowest since September 2021 (see sendout graph).

And the pace of Portuguese deliveries has fallen sharply this month. Unloadings of around 422,000m³ averaged around 17,600 m³/d on 1-24 January, lower than any full-month average since July 2021. But no more laden carriers were declaring for Portugal's 6.9mn t/yr Sines facility for this month, according to ship-tracking firm Vortexa. Assuming no more vessels deliver at the facility, Portugal's January LNG unloadings could be at their lowest since August 2018.

Weaker consumption, lower prices

Weak Iberian consumption has limited demand for LNG in the peninsula, while Spanish PVB prompt prices have fallen to the lowest in a year and a half in recent days.

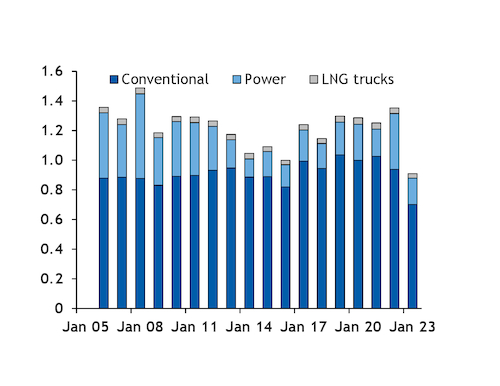

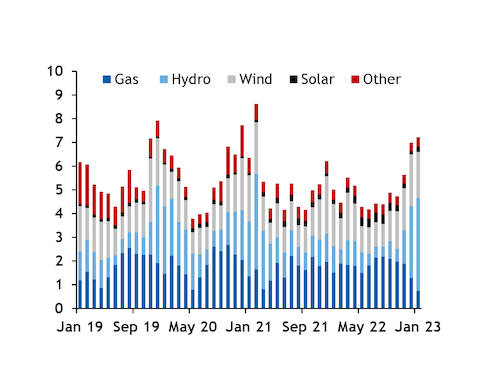

Gas consumption in Spain averaged 909 GWh/d on 1-24 January, putting demand this month on track to be the weakest for the month since at least 2006, driven by exceptionally low demand from industry, households and small businesses, and the power sector (see Spanish graph). Portuguese consumption of 119 GWh/d is on track to be the lowest for any month since April 2020 (see Portuguese graph). Power sector demand of just 28 GWh/d in Portugal would be the lowest for any full month since February 2021. Gas-fired generation has collapsed as Portuguese wind and hydro generation have soared since December, prompting net power exports towards Spain — Portugal had been a net importer from its neighbour every month since March 2021 (see generation graph).

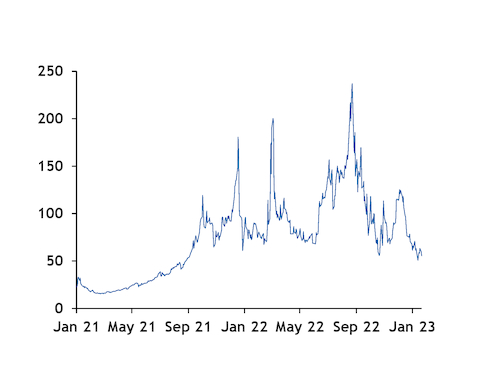

The fall in consumption has also weighed heavily on PVB prompt prices. The PVB front-month price fell to €50.75/MWh on 16 January, the lowest for any date since 27 August 2021 (see price graph).