The Australian Rail Track (ARTC) is planning nine Hunter Valley network maintenance closures this year that will impact thermal and semi-soft coal deliveries into the key New South Wales (NSW) port of Newcastle.

ARTC is preparing for the first major maintenance shutdown that will start on 6 February and run until 10 February, with the last major shutdown to be conducted in late November.

The port of Newcastle plans its maintenance work to coincide with the closure of the railway that services it, although it does have the capacity to hold up to 3mn t of coal in stockpiles at the port, which it can load during a rail outage. The number of maintenance shutdowns remains the same this year as in 2022, although the planned June 2022 maintenance shut was moved to September after parts of the network were flooded in June.

The Bureau of Meteorology expects that the La Nina weather pattern that has brought above-average rainfall to NSW over the past three years should continue to ease, making 2023 a drier season for the state's coal industry.

ARTC has two types of rail closures, with the major ones being an entire network closure that can last for four days, and the minor ones being on the section of the track between Newcastle and Maitland that can last just two days. The minor shuts still impact deliveries because of the closure of the main line that leads into the port at Newcastle from the lower Hunter Valley region at Maitland. Most of the coal mines sit further inland than Maitland, in the Hunter Valley, Gloucester region and Gunnedah basin.

Newcastle shipped 136mn t of thermal and semi-soft coal in 2022, down by 13pc from the 156.33mn t in 2021, and down by 18pc from the 165.14mn t in 2019. Shipments are likely to rise in 2023 if drier weather persists, and if China continues to ease its informal ban on Australian coal imports that was imposed in late 2019. Exports could be reduced by ongoing labor shortages in Australia and rising costs, particularly if thermal coal prices return to more average levels.

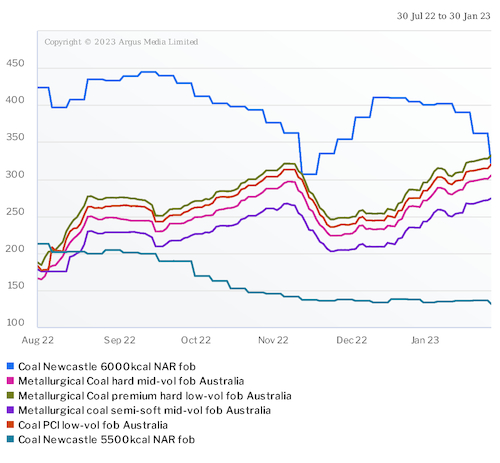

Argus last assessed high-grade 6,000 kcal/kg NAR thermal coal at $319.23/t fob Newcastle on 27 January, down from $410.17/t on 9 December 2022 and from a peak of $444.59/t fob on 9 September 2022. It assessed low-grade 5,500 kcal/kg NAR thermal coal at $131.49/t fob Newcastle on 27 January, down from $133.39/t on 9 December and from $199.12/t fob on 9 September.

The heat-adjusted premium for higher grade thermal coal on a NAR 6,000 basis dropped to $175.79/t on January 27 from a record $255.06/t on 6 January, on hopes for the wider reopening of the Chinese market for low-grade coal.

Shipments of semi-soft coking coal accounted for around 10pc of Newcastle's shipments, although some producers have reduced sales because of the higher relative price of high-grade thermal coal. Argus last assessed semi-soft coking coal prices at $287.30/t fob Australia on 1 February, up from $242.85/t on 3 January and $204.25/t on 30 November.

| Hunter Valley 2023 rail maintenance programme | ||

| Dates | Region | Scope of work |

| 6-10 February | Network wide | Major |

| 18-19 March | Newcastle to Maitland | Minor |

| 4-6 April | Network wide | Major |

| 23-25 May | Network wide | Major |

| 10-12 June | Newcastle to Maitland | Minor |

| 5-8 August | Network wide | Major |

| 4-6 October | Network wide | Major |

| 28-29 October | Newcastle to Maitland | Minor |

| 20-24 November | Network wide | Major |

| Source: ARTC | ||