Increased transportation disruptions, including intermodal container delays, helped more than double US railroads' demurrage collections in the third quarter compared with the year-earlier period.

The supply chain became congested last year when the Covid-19 pandemic shut ports and manufacturing facilities. As the supply chain reopened, a surge in e-commerce drove an increase in intermodal transportation and caused freight congestion across the globe. The US supply chain became even more congested this year as a shortage of labor, equipment and warehouse space sparked railroad and trucking delays.

Railroads blame congestion partly on shippers who have been slow to pick up containers and return them to rail years. Those late container pickups have increased demurrage charges.

Carriers use demurrage and accessorial fee charges to incentivize customers to handle equipment more efficiently, which they expect will help ease supply chain congestion.

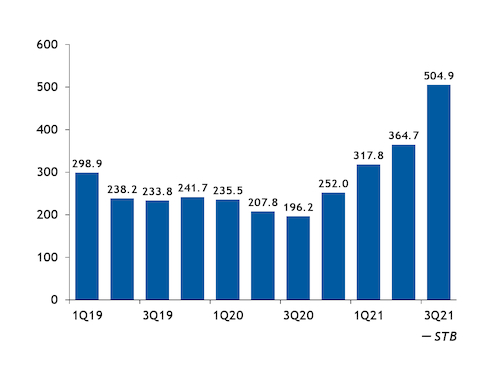

The seven Class I railroads, which handle most of US freight rail traffic, charged demurrage fees totaling $504.9mn in the third quarter, more than double the $196.2mn in the third quarter 2020, US Surface Transportation Board (STB) data show.

Carriers assess demurrage fees when shippers hold on to carrier-owned cars for too long or fail to remove their own cars from railroad-owned property.

Shippers have been frustrated for a number of years by rising demurrage charges, initially related to the implementation of the precision scheduled railroading operating model. Earlier this year, a number of shipper groups sought to turn the tables on carriers, petitioning STB to let them bill railroads when carriers delay returning railcars.

Based on comments by railroads, the third quarter's jump in demurrage revenue seems related to delays in shipping containers and other railcars.

The largest increase in demurrage fees occurred at eastern railroad CSX. The railroad's demurrage revenue rose to $159mn in the third quarter 2021, up from $38.6mn during the same period in 2020 and $45mn in 2019.

"Strong demand combined with increased use of CSX yards and terminals for mid- and long-term storage have contributed to the increase in reported demurrage amounts," CSX told Argus. Shippers and freight handlers have, since the second quarter of 2020, pushed CSX to provide more intermodal container storage and railroad assets amid surging rail volume and rising congestion.

CSX expects that "as supply chain congestion begins to ease, the reported demurrage figures will also decrease."

Demurrage collection by western railroad Union Pacific (UP) almost tripled. The railroad's demurrage revenue rose to $94.1mn in third quarter 2021, up from $31.7mn in third quarter 2020 and $40mn during the same time in 2019.

UP's demurrage charges are mostly related to intermodal shipments. The railroad said demurrage and accessorial fee charges, including storage and per diem, "used to encourage shippers to retrieve their containers in a timely manner by imposing fees on containers stored for lengthy periods" at its terminals. UP said dwell time for containers at its terminals had increased by about 40pc this year.

"Containers that are not picked up in a reasonable time frame make it difficult for incoming trains to unload containers and for freight to be trucked into the facility for transport," UP said.

UP customers this year are taking about 20pc longer to return equipment, "which is impacting other customers and their ability to get needed capacity," the railroad said.

Demurrage has not increased significantly at every Class I railroad. In fact, Kansas City Southern's (KCS) demurrage charges dropped by 3pc, or about $330,000, compared with third quarter 2020. Demurrage revenue also fell by 1pc, or about $120,000, compared with the same period in 2020.

BNSF demurrage revenue rose by 29pc compared with third quarter 2020 but fell by 1pc from the same period in 2019.

But the BNSF's accessorial fee revenue jumped in the third quarter to $108mn, up from $19.8mn during the same time in 2020 and from $17.2mn in third quarter 2019.

BNSF's intermodal storage charges are reflected in the accessorial revenue increase.

"The sharp increase in intermodal storage charges is a result of supply chain congestion and freight exceeding the allotted timeframe after notification of arrival," BNSF said.

The railroad has "relatively few options to maintain the fluidity of our intermodal terminals if containers are not picked up by customers on a timely basis," BNSF said.

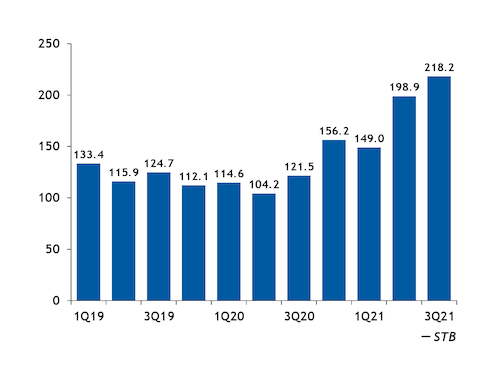

Overall, Class I railroad accessorial fee collections rose by 80pc to $218.2mn compared with $121.5mn in third quarter 2020. Charges also rose by 75pc compared with third quarter 2019. Accessorial charges are fees for items beyond normal handling, such as diverting a train in transit, ordering a car but returning it empty, weighing a railcar, or providing incomplete or incorrect shipping instructions.