US rail regulators have approved Canadian Pacific's (CP) $31bn purchase of US carrier Kansas City Southern (KCS), creating a North America carrier with a network stretching from Canada to Mexico.

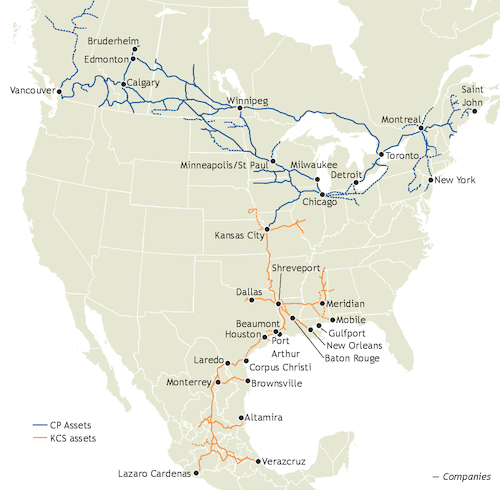

Today's approval by the US Surface Transportation Board (STB) means the railroads can begin combining into the new Canadian Pacific Kansas City (CPKC). The merger joins CP's operations in Canada, the US Midwest and the US northeast with KCS' operations in the south-central US and Mexico, including Kansas City Southern de Mexico. The Mexican government last year extended KCS's right to operate in Mexico until 2037.

Shippers have voiced concerns about the merger, fearing it will reduce competition and enable the combined carrier to increase rates.

The new CPKC will be under pressure to raise rates as it seeks to pay off the debt from the merger deal. Transportation patterns may also change, if CPKC determines some routes are more efficient for a combined railroad. That could affect transit times and shipper costs.

Past railroad mergers have led to performance problems that lasted for months. And shippers already have had to contend with extensive rail delays and congestion that plagued rail services across the US throughout 2022.

CP has said it expects it will take about three years to fully integrate the two railroads.

CP officially purchased all the shares of KCS on 14 December 2021. But CP and KCS have continued to operate independently, in case STB rejected the merger and required the deal to be unwound. Those shares have been held in a voting trust approved by STB.

STB's announcement comes nearly two years after the 21 March 2021 announcement that the two carriers would merge. The deal was temporarily derailed, when rival Canadian carrier Canadian National (CN) launched – and initially seemed to win - a bidding war for KCS, the smallest of the Class I railroads. But CN's effort faltered after its voting trust plan failed to pass STB muster. KCS canceled its deal with CN in September 2021 and returned to the arms of CP. But the fight meant CP ended up paying $2bn more for KCS than its initial $29bn offer.

Mexican regulators approved the merger in November 2021. The transaction does not need to be approved by the Canadian government.