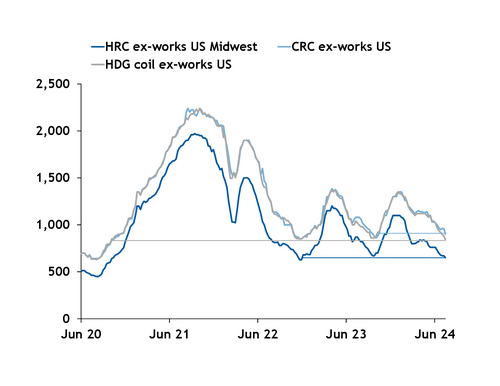

Oversupply in the US hot-rolled coil (HRC) and hot-dipped galvanized (HDG) coil markets has pressured prices to the lowest in years.

The Argus US HRC Midwest and southern assessments fell on Tuesday to $650/short ton (st), the lowest since 29 November 2022.

The Argus US HDG assessment fell on Tuesday to $840/st, the lowest since 29 September 2020.

The US flat steel market, particularly in HRC, has reported persistent oversupply for more than a year. New flat steel production cut HRC prices to $670/st in September 2023, down by 44pc from a high of $1,200/st in April 2023. While 1mn st of maintenance outages that concluded in the fourth quarter briefly boosted prices to a 2024 peak of $1,100/st in January, HRC prices have since dropped by 41pc.

Some service centers report that demand from some customers is down by double-digit percentages for the remainder of the year, as high lending rates hit downstream businesses like construction and agricultural equipment. Many service centers have said the only way to boost prices amid tepid demand is by cutting production, which no steelmaker has said they plan to do.

To reduce US inflation, the Federal Reserve has held the federal funds target rate steady at 5.25-5.5pc — the highest since February 2001 — since the end of July 2023 after increasing its target rate from near-zero starting in March 2022.

Higher interest rates have increased borrowing costs for consumers and businesses, delaying home purchases and investments in construction projects.

US HDG supplies have been bolstered by additional galvanized supply from new coating lines at Steel Dynamics' Sinton, Texas, mill and US Steel's Big River Steel mill in northeast Arkansas.

A spike in US imports has exacerbated the flat steel oversupply.

This year through May, HDG imports have jumped to 1.18mn metric tonnes (t) (1.3mn st), up by 336,100t from the same period prior year, according to data from the US Department of Commerce.

Import volumes of all other metallic coating flat products have more jumped in the same period by 231,500t o 563,400t.

For HRC products, imports are at 872,300t through May, up by 188,000t from the same period last year.