Rhenium prices have jumped globally since the start of June (see charts) owing to increased demand for superalloys in turbine engine components and petroleum-reforming catalysts, but buyers are now showing resistance to higher offers and questioning the sustainability of the rally.

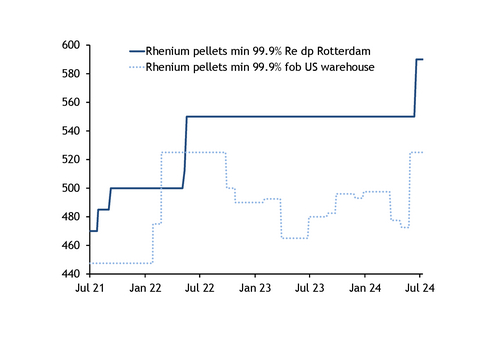

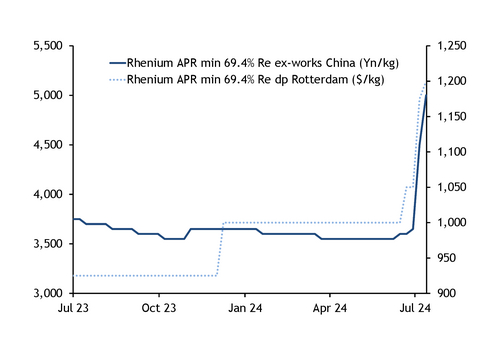

Prices in Europe for catalyst-grade ammonium perrhenate (APR) were last assessed on 16 July at $1,150-1,250/kg dp Rotterdam, up from $1,100-1,250/kg a week earlier, Argus data show. Prices for min 99.9pc rhenium pellets have so far held steady at $550-630/lb dp Rotterdam, but market participants note higher offers still pending.

A similar trend is noted in the US, where the monthly Argus assessment for rhenium pellets ended June at $550-550/lb fob warehouse, up from $455-490/lb at the end of May. The assessment for APR catalyst rose to $445-475/lb fob US warehouse from $400-430/lb over the same period.

Looking to China's domestic market, prices for 99pc-grade rhenium APR were assessed at 4,500-5,500 yuan/kg ($620-759/t) ex-works on 16 July. A trader was heard offering 99.99pc-grade APR at Yn8,200/kg with a longer-than-usual delivery time owing to tight supply, but no deals have been concluded at that level yet. Chinese producers may be aiming to align their offers with those in Europe, setting their target prices as high as Yn8,000-10,000/kg for 99.99pc-grade APR, according to market participants.

Underpinning this global jump in pricing is a rise in demand from the superalloy industry — particularly with regard to aerospace and catalyst applications — which is squeezing a supply base that cannot easily expand.

Rhenium producers in Chile — which account for more than half of global supply — confirmed to Argus that they have indeed experienced an uptick in orders, with one supplier sold out for at least two months. In the US, regional sellers have lately managed to achieve spot sales at higher prices because of consumers dipping into the spot market for extra units.

Rhenium is typically extracted as a by-product of copper and, in many cases, a by-product of molybdenum sulphide concentrates. It is not abundant and is both difficult and expensive to extract. Ramping up production in times of high demand is not always an option, and with most of the world's annual output — around 70t, including scrap and recycling — committed to long-term contracts, there is not much material left available for spot enquiries or last-minute top-ups.

Chinese stockpiling is also contributing to the overall rise in demand, market participants said. There is a lack of clarity about China's rhenium stockpiling but demand from the country has steadily increased over the past decade owing to the rapid growth of the aerospace and automotive industries. China is unable to meet its demand with its own supply, producing just 2t of rhenium in 2022, according to official data.

That said, there are mixed views in China as to whether underlying demand has truly risen and whether the recent price hikes are in line with market fundamentals. One source said the recent price hikes in China were prompted by one buyer booking a significant volume, which has then encouraged several producers to raise their offers in the expectation of further demand and tighter availability — but they said overall demand has not increased exponentially.

"There is no real change in fundamentals, so it is hard for buyers to accept this rapid price gain," a trader in China said.

For now, several buyers in China are taking a wait-and-see approach, and many are calculating replacement costs before taking any positions. Some producers in China are holding back from offering because they have little or no rhenium currently available, they told Argus.

Although several market participants think further price increases are likely in the near term, opinions diverge as to how long these higher levels will last and some sources attribute the extent of the rally to panic rather than a sustained increase in demand.