The Class 1 nickel price is expected to hover within the $15,000-18,000/t range in 2025, supported by firm nickel ore prices, but limited by growing smelting capacity.

Nickel prices have shown signs of bottoming out after they hit a low range in the $16,000s/t in July, with prices expected to stay rangebound in the face of weak fundamentals. Possible changes to Indonesia's government and policy could also cause some price fluctuations within the band.

Ore prices to support nickel prices

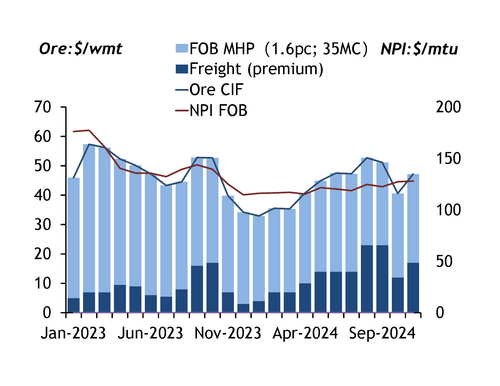

The traded level of nickel ore so far this year has been higher than the benchmark price (HPM) published by Indonesia's ministry of energy and mineral resources (ESDM), largely driven up by constrained ore supply. Nickel ore is typically traded on a cif basis, which is the sum of HPM and freight charges from the mine to the processing facility. The HPM is a formula based on London Metal Exchange (LME) nickel prices, while the freight charge is also known as a premium in the market.

The cif prices hit a record high at $57.29/wmt in February 2023 on the back of elevated LME nickel prices at an average of $26,938/t. The cif prices remained elevated at around $50/wmt for several months, supported by higher premium charges resulting from tightening ore supply caused by a delay in RKAB approvals.

The ESDM has approved a combined nickel mining quota of 249mn wet metric tonne (wmt) as of August this year, but supply has been constrained by mining capacity, transportation capacity and weather conditions.It is possible that the Indonesian government could approve more quotas, also known as RKAB work plans, according to market participants,to support expanding capacities that use the hydrometallurgy process, on the back of a growing electric vehicle (EV) market.

But the amount of RKAB to be allocated to the hydrometallurgy sector is unknown. The hydrometallurgy process, which produces mixed hydroxide precipitate (MHP), typically uses lower nickel content ores of around 1.2pc, while ores of higher nickel content at around 1.6-1.8pc are fed to the pyrometallurgy process to produce nickel pig iron (NPI) and matte.

Nickel ore output from Indonesia over January-September rose by 14pc on the year to 148mn t in nickel metal equivalent, according to data from intergovernmental organisation the International Nickel Study Group (INSG). One market participant noted that "the tight ore supply situation had a limited impact on Indonesia's NPI production."

NPI prices to limit lower end of nickel price range

NPI remains the main nickel product in Indonesia, with the sum of NPI's production cost and the processing fee to produce nickel metal, to form the lower end of the range of class 1 nickel prices. The processing fee is typically indicated around $4,500-5,000/t.

Producers in Indonesia aim to increase NPI profitability, which has been dampened by nickel ore and energy prices that are projected to rise. Chinese NPI producers based in Indonesia have lifted their offers to 1,050 yuan/metric tonne unit ($146/mtu) in October from Yn980/mtu in September. This means that fob prices have increased to $12,800/t from $11,900/t over the same period.

Australian firm Nickel Industries' Ranger Nickel project in Indonesia is typically used to estimate the production cost of NPI producers in Central Sulawesi province, and its cash cost in the third quarter of 2024 was $11,794/t, up by 4.3pc on quarter, according to the latest quarterly activities report from Nickel Industries.

"We were contending with losses from July to September due to firm ore prices, but NPI prices have been weak over the same period, dampened by the lukewarm downstream stainless steel demand," an Indonesia-based NPI producer told Argus.

NPI output is expected to rise by 3.5pc from a year earlier to 1.48mn t/yr in nickel metal equivalent in 2024, according to data compiled by Argus. This reflects a significant slowdown in growth rate compared to output in 2023 rising by 24pc from 2022.

Indonesia to steer market direction

Global nickel supply and consumption is expected to continue growing in the near term, but at a slower pace, with surplus this year expected to be similar to 2023's surplus of 167,000t, according to the INSG.

Indonesia — as the world's main nickel miner and producer — continues to play a key role in the nickel supply chain despite a global supply glut of nickel products. Market participants closely monitor developments in Indonesia as any news on RKAB, tax or environmental policy could possibly influence global nickel demand, supply and prices.

Nickel consumption remains on an uptrend, with demand from the downstream stainless steel market expected to rise by 3pc in 2025, supported by Chinese and Indonesian appetite. But the demand outlook for the nickel-cobalt-manganese (NCM) battery sector is not as optimistic given the rapid development of the more cost-effective lithium-iron-phosphate (LFP) battery sector.

China this year introduced 200,000 t/yr of new nickel capacitythat heavily relies on Indonesian-produced MHP or matte as feedstock. These new nickel capacities will likely also become one of the key drivers of market conditions because the newly added output would affect producers' profit margins, the balance of class 1 and 2 output and the longevity of high nickel prices. But some producers could continue with operations despite losses as they are applying to be registered with the LME, which requires six months of continuous production. Upon registration, products can be delivered to LME warehouses, which allows for more sales opportunities, and increases liquidity.