Ongoing delays to the European Commission's decision on safeguard measures for manganese and silicon-based alloys and silicon are weighing on ferro-alloy prices.

Market participants now expect the announcement in September, a significant delay from an anticipated decision in April.

The commission announced the safeguard investigation into EU imports of silicon metal, ferro-manganese, ferro-silicon, ferro-silico-manganese, ferro-silico-magnesium and calcium silicon on 19 December.

The commission held a meeting last week on the safeguard investigation, multiple sources confirmed.

The safeguard plans will be disseminated to member states for voting in the coming weeks, a senior executive at a major European ferro-alloy producer told Argus at an industry event last week. He anticipates a decision could be announced as early as late July, but broader market consensus has settled on September.

Third-country imports have surged in recent years, with Indian exports in particular weighing on EU prices of certain ferro-alloys.

European producers currently supply less than 20pc of the market, and seek measures that will support a 40pc market share.

The continued delay to a decision has been widely attributed to the EU's need for flexibility to respond to US president Donald Trump's "Liberation Day" tariffs and on-going international trade negotiations.

The tariffs, which were announced on 2 April, disrupted the EU silicon and ferro-silicon markets. Both ferro-silicon and silicon metal of less than 99.9pc purity were included in the tariffs, which imposed major burdens on several major silicon and ferro-silicon-producing countries.

Manganese alloys were excluded from the tariffs.

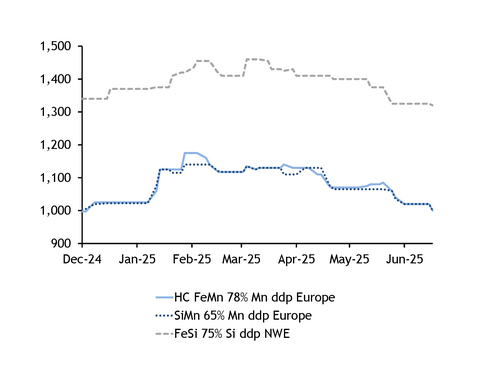

Mn alloy, FeSi prices fall on delayed announcement

After the EU safeguard investigation was announced in late December, traders rushed to move customs-cleared manganese alloys and ferro-silicon into Europe.

High-carbon ferro-manganese prices consequently rose by 15pc from the announcement on 19 December to €1,150-1,200/t ddp Europe works on 6 February, the highest price in 2025.

Many traders held on to their stocks of imported material in the first quarter of 2025 in anticipation of an April decision, anticipating a spike in prices after the implementation of safeguard measures. Ferro-manganese prices remained relatively steady at elevated levels from mid-February to mid-April, fluctuating within a €30/t range.

But as the wait for the decision has dragged on, high-carbon ferro-manganese prices have fallen as traders have offloaded material, with notable sharp decreases in the second half of April and the second half of May.

Argus assessed high-carbon ferro-manganese at €960-1,040/t on Thursday, down by 10pc from 17 April.

Many traders are unwilling to continue holding on to significant stocks as the wait for a decision is now stretching to the end of the summer.

One trader who had been holding out for the announcement to sell his stocks of Indian ferro-manganese has given up on waiting. He is now offering at levels even lower than prices were in December, before the investigation was announced.

A similar pattern has played out with silico-manganese prices. Argus assessed silico-manganese prices at parity with high-carbon ferro-manganese prices on Thursday, trading below pre-investigation levels.

Ferro-silicon 75pc Si prices also surged after the announcement and have since fallen. They rose by 6pc from 19 December to a 2025 high of €1,430-1,490/t ddp NWE on 11 March.

As seen in the high-carbon ferro-manganese and silico-manganese markets, prices began to decline as the decision was delayed. Argus assessed ferro-silicon at €1,290-1,350/t on 19 June, down by 10pc from 11 March.

Si market fragments on low demand, Chinese prices

Silicon metal prices have come under acute pressure from lower Chinese and third-country prices.

European producers cannot compete with China, Malaysia, Angola and other third-countries where production costs, particularly for energy, are lower. Icelandic silicon producer PCC BakkiSilicon temporarily shut down its production in Husavik last month because of challenging market conditions and disruptions from trade tensions.

Meanwhile, traders have warned that the imposition of a quota and associated tariffs while imported material is in transit to the EU could lead to significant losses once customs have cleared into the bloc. Many traders are unwilling to take positions on imported material before the commission announces preliminary measures.

Others have countered this by saying that slow and indecisive decision-making by the commission will mean any preliminary measures announced would not come into immediate effect, allowing importers time to clear any risky positions.

In either case, opportunities to sell in Europe are extremely limited regardless of material origin because secondary aluminium producers remain absent from the spot market and are relying on term contract deliveries to meet requirements.

Argus assessed 5-5-3-grade silicon metal prices down at €1,700-1,900/t ddp Europe works on Thursday, down by 17pc year-to-date with most of the downside concentrated in the second quarter.

The European market is potentially open to further losses as Chinese 5-5-3 export prices were assessed at their lowest level since 2007 at $1,180-1,220/t fob China on Thursday. This is equivalent to around €1,370/t cif Europe duty paid.