Ethanol producers selling fuel in California may emerge as a beneficiary of a technology often associated with the coal industry.

The California Air Resources Board (ARB) has proposed changes to the state's Low-Carbon Fuel Standard (LCFS) meant to spur projects that capture CO2 and inject it into underground geologic formations.

Advocates say industrialized countries that burn fossil fuels must develop carbon capture and sequestration (CCS) if they want to have any hope of meeting global climate goals. But high costs and engineering challenges have limited the deployment of the technology in coal plants, as well as the oil and gas sector.

Stanford researchers argue in a study published on 23 April that ethanol biorefineries could take advantage of favorable economics to build CCS projects.

"This is an opportunity not only for biofuel producers to make profits, but also for CCS technology to be more widely piloted and developed," said Daniel Sanchez, a postdoctoral scholar with the Carnegie Institution for Science and lead author. "This is an essential first step if we are going to deploy carbon removal at levels necessary to keep dangerous climate change in check."

The team found that ethanol facilities in the US could use CCS to cut carbon emissions by 38mn metric tonnes — 84pc of the industry's total — with a carbon abatement credit of $90/t.

Argus assessed LCFS credits, accessible to ethanol producers who sell fuel in California, at $155/t yesterday.

Ethanol has a natural advantage over other sources when it comes to CCS because production of the fuel produces CO2 of a higher purity that can be captured and compressed for injection more cheaply.

Ethanol producers see an opportunity with CCS to further drive down the carbon intensity of its product.

"The industry has long been working on trying to find ways to improve its carbon scoring, for purposes of getting it to markets like California, but also export markets as well," said Edward Hubbard, general counsel for the Renewable Fuels Association, the US ethanol industry's trade association.

The study arrives as the ARB board prepares to review a package of LCFS amendments on 27 April that would add additional sources of credits to the program, including ones generated by CCS projects.

State regulators have called CCS "an important technology for reducing CO2 emissions from large stationary sources," and major refiners like BP have largely supported the move by the agency.

Ethanol refiners are not left out.

The CCS protocol "can be used for both biofuel pathways and petroleum projects," ARB chief of transportation fuels Sam Wade said last month.

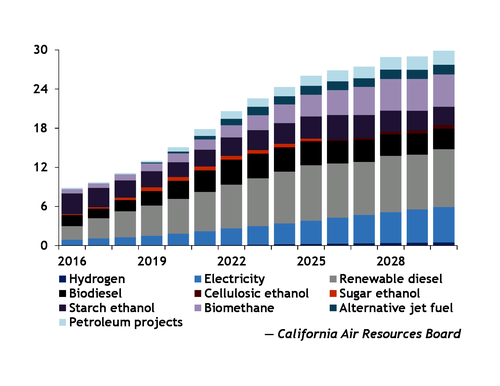

The agency has estimated that CCS and other refinery investments could generate roughly 500,000t/yr of LCFS credits by 2030, the deadline to achieve a proposed 20pc cut in the carbon intensity of the state's transportation fuels. That number could increase significantly if ethanol producers adopt CCS at a large scale.

Regulators will likely need to resolve some issues with refiners, including a provision that CCS sites must be monitored for a minimum of 100 years, before the ethanol industry gets the green light.

"We are deeply concerned that such a requirement would severely limit, if not wholly preclude, the use of CCS in the state," Latham & Watkins attorney Robert Wyman said on behalf of the Western States Petroleum Association, a client of the firm.

But if the ARB sends the right signals to biorefineries, the momentum for CCS could quickly build, according to the Stanford researchers.

Canada is the largest importer of US ethanol. A national clean fuel standard under development might offer additional opportunities for the technology if policymakers there take a page from California's book and include CCS provisions.