Shipowners have been largely uninterested in using LNG to meet looming 2020 fuel oil sulphur rules, despite its low-sulphur properties and wide price discount to marine gasoil.

But LNG is likely to become a bigger player in the bunkering market within the next five years due to three factors: new greenhouse gas emissions limits; the expansion of global LNG infrastructure; and the higher costs of MGO for shipowners that opted against scrubbers and are not confident in the compatibility of 0.5pc sulphur blends.

In the shorter term, shipowners appear content to ride out high prices for HS380 fuel oil by using scrubbers to clean non-compliant fuel to the International Maritime Organization's (IMO) 0.5pc sulphur standard, expecting that the fuel price will fall.

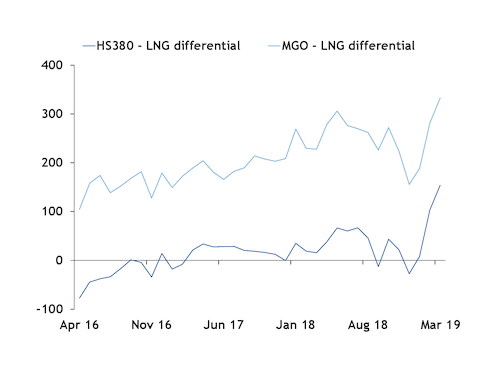

The Rotterdam HS380 fuel oil and northwest Europe LNG small-scale delivered via truck premium reached $154/t in March, the widest monthly average premium since Argus first began assessing small-scale LNG in northwest Europe in April 2016.

The premium widened as residual fuel oil supplies tightened due to US sanctions against Venezuela and Iran, as well as the mothballing of the Trinidad & Tobago refinery in December. But the favorable residual fuel oil crack spreads are expected to be short-lived, with prices falling in 2020.

Most analysts expect residual fuel oil prices to find their footing as some utilities embrace resid for power generation and as refineries cut back on fuel oil output or turn to burning sweeter crude.

As such, LNG for bunkering's prospects are not dead in the water.

The two major bunkering hubs, Singapore and Rotterdam, have been promoting LNG for use as a fuel for ships.

In Rotterdam, Shell's LNG bunker vessel, the 6,500m³ Cardissa, was delivered in mid-2017. Titan LNG and Anthony Veder also supply LNG for bunkering in Rotterdam. The port authority expects to have ten LNG bunker suppliers by 2025. There are two LNG-for-bunkering suppliers in Singapore: Pavilion Energy and FueLNG. They each expect to receive a delivery of a newbuild LNG bunkering barge. Pavilion Energy will receive a 12,000m3 barge in early 2021 and FueLNG will receive a 7,500m3 barge by the end of 2020 to operate in Singapore.

At its next meeting in May 2019, the International Maritime Organization (IMO) will consider a strategy to cut global shipping sector emissions by at least 50pc by 2050 compared with 2008 levels. If the IMO does not deliver by 2021, the EU has said it will include shipping emissions in its emissions trading scheme (ETS) from 2023.

Under the European Union (EU)'s Emission Trading System (ETS), companies receive or buy emission allowances, which they can trade with one another. A March snapshot of ETS GHG emissions prices shows that if ETS was applied, the marine fuel bill for shipowners would increase by about $80/t regardless if they burn MGO, HS380 or 0.5pc sulphur fuel.