Falling passenger car sales led total US automotive sales down by 2pc in the first half of 2019 from a year earlier, pressuring steel suppliers more than their aluminum counterparts.

Automotive producers sold 8.3mn units of passenger cars, trucks and sports utility vehicles (SUVs) in the first six months of 2019, down from 8.5mn units in the prior year period, according to monthly and quarterly figures released by automotive manufacturers.

The list of producers covers the 17 largest companies but excludes Land Rover, which had yet to release year-to-date June figures. On an annualized basis, sales fell to levels not seen since 2013 at 16.6mn units.

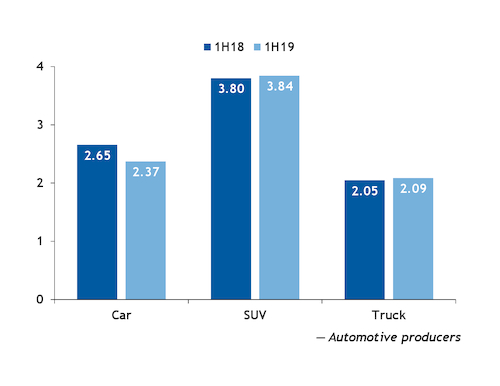

Passenger car sales declined by 11pc to 2.37mn units from 2.65mn units in the 2018 period. Decreasing sales from Ford and General Motors (GM) contributed the most to the slide, with GM sliding by 24pc to 231,529 units and Ford declining by 22.5pc to 208,460 units.

Lower passenger car demand was not relegated to the two largest US suppliers. Car sales were down for 14 of the 17 producers in the first half, with double-digit declines in more than 60pc of those companies.

GM's Cruze model sales roughly halved to 39,477 units, while Toyota's Prius and Nissan's Altima and Maxima model sales also contributed to lower levels.

In recent earnings some steelmakers discussed declining automotive demand amid lower prices for steel sheet. Nucor expected in its first quarter earnings that demand from automotive original equipment manufacturers (OEMs) and suppliers would decline for 2019. ArcelorMittal highlighted low automotive demand over the same period in particular for European consumers. Lower demand from automotive consumers also weighed on demand forecasts for steel producer SSAB.

US hot-rolled coil midwest prices fell by 39pc to $539.50/st on 9 July since Argus began assessing it in August 2018.

Light-weighting efforts by OEMs have lifted aluminum's share in heavier SUVs and trucks, which additionally fared better in terms of sales. As a result aluminum producers were spared some of the worst outcomes by the downturn in total automotive sales.

In its first quarter earnings, Arconic expected that unless there was an "absolute collapse" in volumes, the growing share of aluminum and better demand for light truck, pickup trucks, and SUVs would support shipments. Rolling mill Constellium raised its automotive shipments by 18pc, while its automotive and packaging shipments rose by 9pc to 281,000 metric tons (t). Automotive shipments for producer Aleris rose by 7pc in the first quarter on demand for autobody sheet from its Lewisport, Kentucky, facility.

The US SUV market, the largest by vehicle sales, edged up to 3.84mn units in the first six months from 3.8mn a year earlier.

Greater sales of GM's Blazer, Equinox and XT4, combined with higher sales from Subaru, outweighed a drop from Fiat Chrysler. Fiat's Jeep brand of vehicles sold 456,281 units, down from 495,022 units, driving most of the slide. In addition sales of Toyota's RAV4, of which new models use aluminum body sheet from Novelis, were up by 1pc to 200,610 units.

US sales of trucks similarly moved up by 2pc to 2.09mn units in the first half of 2019 from the prior year. Although sales of Ford's aluminum-bearing F-series trucks fell to 448,398 units from 451,138 units, sales of the mid-sized model truck Ranger totaled 30,301 units compared to none a year earlier.

Ford opted to switch its F-150 truck from a steel to an aluminum alloy body in 2014 in order to cut 700 lbs from the vehicle's weight. The frame remained high-strength steel. The vehicles are assembled at its Dearborn, Michigan, and Kansas City, Missouri, plants. The company restarted assembly at its Wayne, Michigan, plant of its mid-sized Ranger pickup for 2019 after an eight-year hiatus.

Truck sales were also boosted by a 28pc jump in Fiat's Ram pickups to 299,480 units. The Ram pickup has aluminum tailgates and hoods.

Despite comparatively strong automotive demand, prices for aluminum scrap declined from a year earlier reflecting oversupply of industrial scrap. Aluminum scrap 5052 clips, which automotive sheet manufacturers consume, declined by 19pc to 80¢-83¢/lb on 9 July from a year earlier. Scrap 5052 clips discounts fell to 18¢/lb under the Argus midwest transaction price, down from 16¢/lb under a year earlier. Discounts for EC wire, which automotive sheet manufactures also consume, moved down to 20¢/lb under the transaction price from 12¢/lb a year earlier.