Shipments of iron ore from major Australian mining companies rebounded in August following maintenance outages in July, easing supply concerns that had sent prices to five-year highs.

Total exports from Australia-based producers Rio Tinto, BHP, Roy Hill, Atlas and Fortescue rose by 8.8pc to 80mn t in August from 73.5mn t in July, according to port and vessel tracking data.

BHP accounted for the largest month-on-month increase of 2.5mn t to 26.5mn t from July. BHP conducted shiploader maintenance that halted shipments from its Finucane Island A and B berths in early July.

Rio Tinto, Australia's largest iron ore producer, increased shipments by 2mn t to 32.3mn t. Roy Hill shipped 5.6mn t in August, up by 1.7mn t. Fortescue shipments rose by 295,995t to 14.1mn t.

A rebound in Brazilian iron ore shipments has also eased supply concerns, aided by Vale mine restarts after regulators and courts forced the shutdown of more than 90mn t/yr of capacity early in the year. Brazil will release August shipment data later this week.

The Argus ICX 62pc fines price fell by 27pc to $86.25/dry metric tonne (dmt) cfr Qingdao on 30 August from $118.25/dmt on 31 July. Prices hit a five-year high of $125.20/dmt on 3 July. A January dam collapse in Brazil and March cyclone in Australia's Pilbara region shed more than 100mn t from mining firms' shipment guidance.

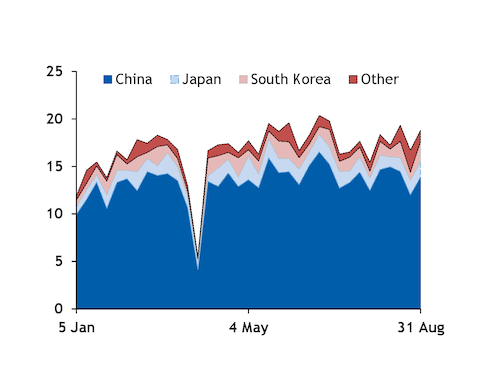

The Australian producers shipped 18.78mn t in the week ended 31 August, up by 12.5pc from the previous week. This was the third-highest week in August, raising the shipments' four-week average to above the 18mn t level for the first time since mid-July.

Shipments to China rose by 15.4pc to 13.89mn t in the week to 31 August. It was the second-lowest week for China-bound cargoes in August, indicating that other countries took a larger share in late August.

Iron ore prices have rebounded this week to above the $90/dmt cfr Qingdao level on higher demand for October deliveries, especially for high-grade cargoes that mills will use to maximise productivity when steel demand returns after China's 70th anniversary celebrations on 1-7 October.

| Monthly Australian iron ore shipments | t | ||

| Company | Destination | Aug-19 | Jul-19 |

| Dampier | |||

| Rio Tinto | China | 11,625,177.0 | 10,729,467.0 |

| Japan | 754,467.0 | 413,820.0 | |

| Malaysia | 0.0 | 182,060.0 | |

| South Korea | 250,005.0 | ||

| Taiwan | 180,159.0 | 208,500.0 | |

| Other | 175,580.0 | ||

| Port Hedland | |||

| BHP | China | 20,747,485.0 | 19,403,928.0 |

| Indonesia | 207,600.0 | 180,000.0 | |

| Japan | 1,979,731.0 | 1,979,104.0 | |

| South Korea | 2,532,977.0 | 1,829,444.0 | |

| Taiwan | 620,457.0 | 590,368.0 | |

| Other | 361,287.0 | 0.0 | |

| Fortescue | All destinations | 13,265,544.0 | 13,151,131.0 |

| Atlas Iron | All destinations | 1,538,307.0 | 1,498,474.0 |

| Roy Hill | All destinations | 5,614,174.0 | 3,914,973.0 |

| Port Walcott | |||

| Rio Tinto | China | 11,899,665.0 | 12,080,025.0 |

| Japan | 3,097,517.0 | 3,734,587.0 | |

| South Korea | 1,208,991.0 | 1,315,529.0 | |

| Taiwan | 943,739.0 | 769,434.0 | |

| Vietnam | 545,250.0 | 363,019.0 | |

| Other | 1,634,092.0 | 523,665.0 | |

| Source: port data, vessel tracking data | |||