Seaborne iron ore lump premiums into China have fallen sharply over the past week following a shift towards lower-cost fines and domestic pellet as winter draws to an end.

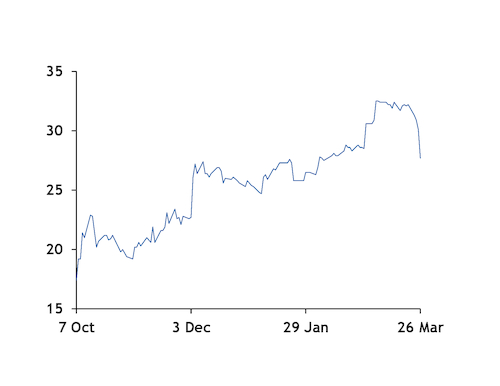

The daily Argus 62pc Fe seaborne iron ore lump premium fell to 27.7¢/dry metric tonne unit (dmtu) yesterday from 32.2¢/dmtu cfr Qingdao on 20 March. The premium is the additional cost per 1pc Fe for lump above the Argus ICX 62pc fines index.

The lump premium has been on an uptrend since after the lunar new year period, peaking at 32.5¢/dmtu on 4 March, supported by sintering restrictions during winter and a delayed resumption of domestic iron ore mines after the holiday.

"Increased output of domestic iron ore concentrate has made mills willing to pelletise by themselves to save costs. The sintering restriction has also been loosened with the weather warming up, which will reduce pellet and lump demand," a south China-based trader said.

Several steel mills have likely reduced the use of iron ore lump and increased the sintered ore ratio or added more domestic iron ore pellet in the furnace to control production costs.

It is normal for lump premium to fall as the previous level was high, caused by a short supply of domestic iron ore during coronavirus restrictions in China, market participants said. Meanwhile, shipments of iron ore pellet and lump cargoes to China increased because of production cuts at mills in other countries.

A Beijing-based trader predicted that the lump premium would fall further after the winter restrictions ended and domestic iron ore mines fully resumed operations.

Iron ore portside prices remained strong because of tight supply at Chinese ports. "The current iron ore lump premium for the portside market was calculated at around 36.8¢/dmtu, down slightly but still higher than the seaborne market. PB lumps stocks were at 650,000t in Tangshan and 800,000t in Shandong," a north China-based trader said.

Demand for lump resources in Shandong region remains high as domestic iron ore mines and mills are more scattered there compared with Hebei region, a Shanghai-based trader said.

The outright price for seaborne 62pc lump was at $102.25/dmt yesterday, based on the 27.7¢/dmtu lump premium and ICX fines index at $85.10/dmt.