European front-month gas prices have in recent days fallen to levels at which US LNG exports would no longer be profitable.

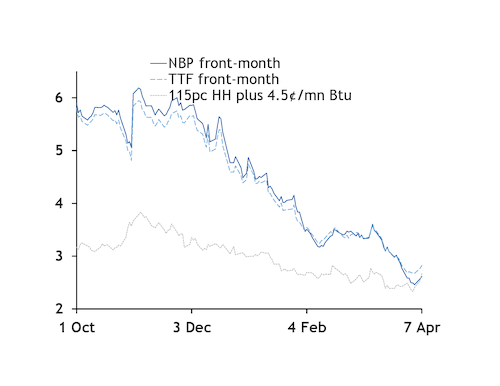

The NBP front-month market yesterday moved down to a premium to the US' Henry Hub that would no longer be wide enough to cover the variable costs of shipping US LNG cargoes to northwest Europe, even for firms that have sunk costs along the entire route. And TTF front-month prices have closed in on that support level.

Cheniere charges offtakers at its 25mn t/yr Sabine Pass and 10mn t/yr Corpus Christi facilities feedgas costs valued at 115pc of the final Nymex Henry Hub settlement for the month in which a cargo is loaded. Other variable costs could be as little as $0.04-0.05/mn Btu this summer for firms that own assets along the value chain and have long-term booked transport and regasification capacity that can be considered sunk costs, and would only have to factor in fuel costs.

The NBP front-month market held a tighter premium to the Henry Hub than these variable fees yesterday for the first time (see European gas prices vs Henry Hub graph). And the TTF front-month contract held just $0.15/mn Btu above this support level.

And firms without sunk shipping costs would have significantly higher variable fees. The NBP front-month market closed yesterday as much as $0.31/mn Btu below the level at which there would no longer be an incentive to ship a US cargo to the UK once factoring in the Argus Round Voyage freight costs between the US Gulf coast and Milford Haven.

The cost of feedgas may be lower for Cheniere, possibly ranging from 107-109pc of Henry Hub, market participants have said. NBP front-month prices were yesterday at a premium to Henry Hub that was slightly too wide to discourage US LNG from arriving after applying a 108pc formula and adding on $0.04-0.05/mn Btu in variable costs.

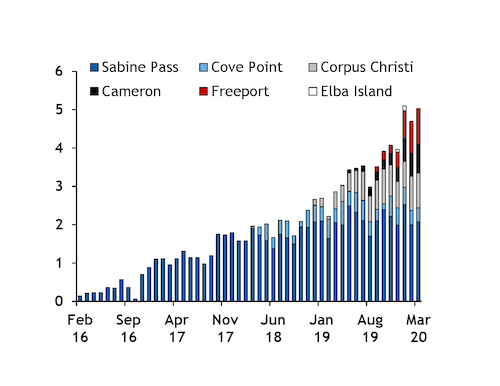

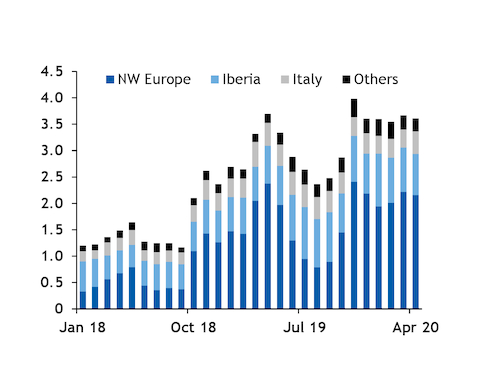

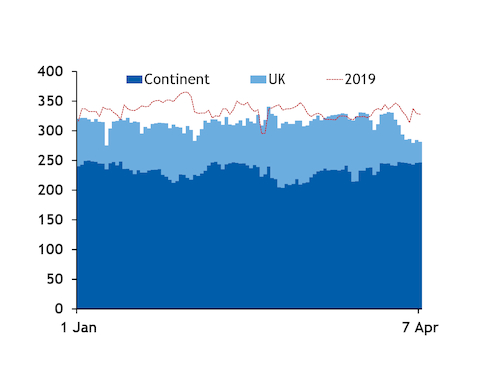

US LNG production could be shut in if there is little incentive for exports to Europe, which has soaked up the majority of US LNG cargoes in recent months and has mostly been a more profitable destination than northeast Asia (see European sendout graph).

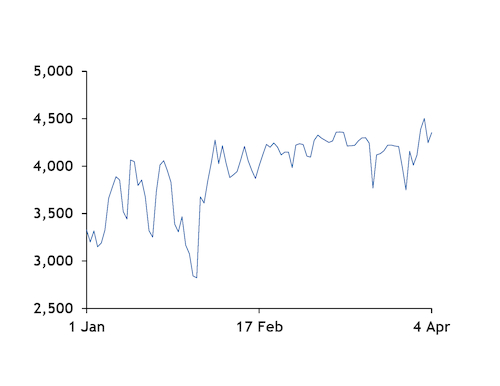

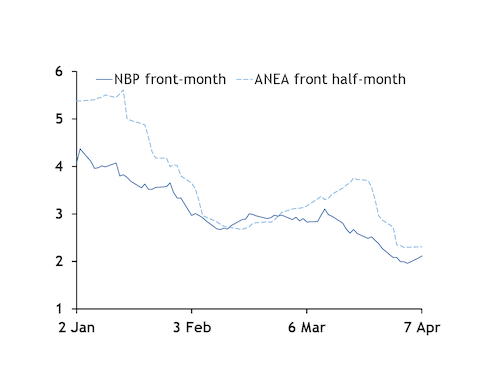

Northeast Asian delivered LNG markets and European hub prices have chased each other lower in recent weeks, with demand in both regions having been hit heavily by measures aimed at curbing the spread of Covid-19 (see NBP vs ANEA graph).

ANEA near-curve prices had slid enough in late March-early April to discourage US cargoes from heading to the Pacific basin, following the start of a 21-day national lockdown in India from 25 March.

But European gas prices have since fallen faster than ANEA markets, with gas-intensive industrial output down especially sharply in southern Europe. Emerging demand from Asian buyers for June deliveries has also lent support to ANEA June prices in recent days. The ANEA June price yesterday held just enough of a premium to northwest European LNG prices for delivery in the first half of May to attract US cargoes.

Various firms had foreseen Henry Hub plus variable costs acting as a floor for European gas prices in the coming years.

Gas delivered to Europe in the coming years will be priced according to the Henry Hub rather than oil-indexed with the option of halting some US LNG output if there is little incentive for exports, BP's Russia and CIS economics chief, Vladimir Drebentsov, said in 2017. The convergence of NBP, Henry Hub and Asian spot LNG prices will continue in the coming years as US liquefaction capacity grows, Drebentsov had said.

But global gas prices may have to hold below the Henry Hub for a prolonged period to provide an incentive for some production capacity to be mothballed for commercial reasons, partly because of logistical problems of turning off US liquefaction capacity.

Cheniere said in February that customers cancelled two April loadings because of low global LNG prices, with both cargoes cancelled by Spain's Endesa.

But US LNG exports did not slow in March despite the sharp drop in global prices, suggesting that significant volumes were not cancelled for this month (see US LNG exports graph). Offtakers would have lost more money by cancelling cargoes than potentially selling them at a loss.

US LNG exports could still slow this month, with one of Sabine Pass's five liquefaction trains likely to be off line for maintenance judging by a drop in feedgas since 3 April.

Europe needs significant supply-side responses

Europe will struggle to absorb all its supply this summer without firms using their available flexibility to reduce supply, with most of the scope to make demand-side reductions used up last summer.

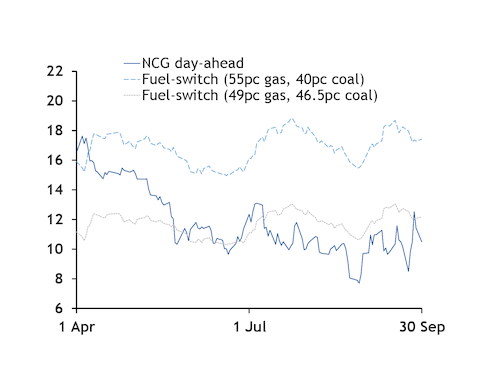

Even before the slide in weather-adjusted consumption following the coronavirus outbreak, Europe was set to enter the summer with even weaker injection demand than a year earlier. And the region had already exhausted almost all its demand-side flexibility last summer by burning more gas in the power sector and lifting storage inventories to or even above nameplate capacity in some regions (see fuel-switching graph).

The full displacement of base-load coal and lignite-fired generation could create some extra demand this summer, especially as some coal-fired plants have been mothballed, including German units operated by RWE and Steag. But long-term power hedges locking in coal-fired generation may limit the switch to gas from coal and lignite.

And Ukraine could provide an extra outlet for Europe's spare supply given ample unused storage capacity.

But this will have to be accompanied by a significant turndown in Europe's LNG and pipeline imports from a year earlier.

Norwegian pipeline flows to the UK have already dropped early this month close to their contractual minimum, with NBP prompt prices partly disconnecting from continental hubs and holding well below the summer 2021 contract (see Norwegian flows graph). State-controlled Equinor has likely turned down output from its flexible Troll and Oseberg fields.

But Russian state-controlled Gazprom's pipeline deliveries to Europe, excluding the Baltic states, and Turkey have risen early this month (see Russian flows graph).