German industrial production in April fell to its lowest in recent years because of the Covid-19 outbreak and measures taken to contain it, but the economy has started its recovery, the country's economy ministry said.

Manufacturing output had already dropped in March as Germany introduced social distancing measures and industrial users turned down production. But the full effects of these measures were not felt until April, the ministry said.

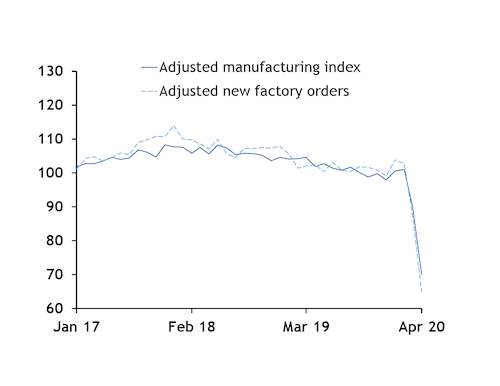

April's seasonally and working-day adjusted industrial output fell by a further 22.1pc from March and was equivalent to only about 70pc of that in April 2015. The month-on-month decrease was far steeper than March's 11pc decrease from February.

The drop in industrial production was led by lower output from the motor vehicles industry, the economy ministry said. Production from the sector largely ceased in April, the ministry said (see manufacturing demand graph).

Capital goods output collapse continues

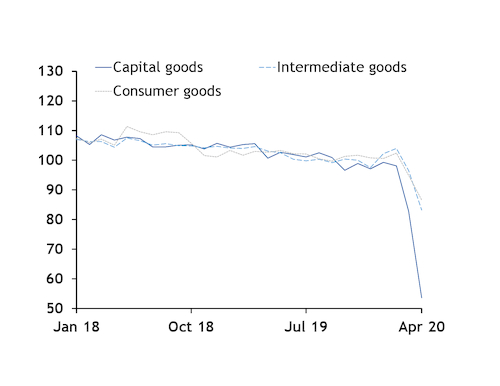

A sharp drop in the output of capital goods led the decrease in April, similar to March, as consumer and intermediate goods production also continued their fall.

Output of capital goods plunged by 35.3pc on the month, outpacing sharp drops in production of consumer and intermediate goods of 13.8pc and 8.7pc, respectively. Capital goods output had already fallen by 15.6pc on the month in March and was just above half of the April 2015 production in the segment (see decline by sector graph).

Seasonally and working-day adjusted new factory orders also nose-dived, falling by 25.8pc on the month. Orders from domestic and foreign markets were down for all sectors.

But the slump was particularly steep for capital and intermediate goods, at 30.6pc and 22.7pc, respectively. The decline in orders for capital goods was driven by a sharp drop in demand from eurozone markets other than Germany, but orders from domestic and non-eurozone foreign markets also tumbled.

The drop in new orders for consumer goods was more modest, at 11.4pc, but accelerated from a month-on-month decrease of just 1.8pc in March.

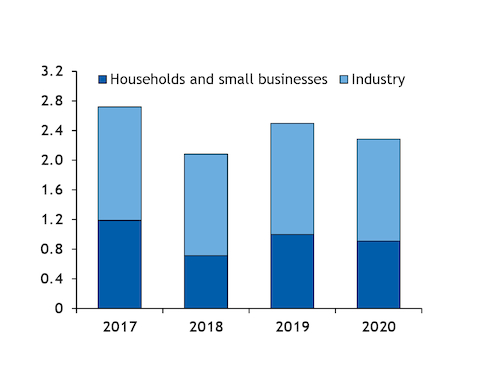

German gas and power demand slid as the country introduced social distancing measures and industrial users turned down production. Temperature-adjusted gas deliveries directly to industry, which includes the power sector, and to local distribution networks, which mainly connect households and small businesses, fell sharply from mid-March.

Industrial demand slipped to 1.38 TWh/d in April from 1.47 TWh/d in the past three years. And gas sent to local networks fell to 908 GWh/d from 966 GWh/d (see April demand graph). Gas use fell even as the weather was cooler. Overnight temperatures in Hamburg, Berlin, Munich and Cologne slipped to an average of 3.3°C from 4.4°C over the month in the past three years.

Recovery begins

The low point of Germany's industrial recession has likely passed, the ministry said.

Pandemic restrictions that had remained in effect from the second half of March and through April have been gradually loosened, the ministry said. Retail shops of all sizes have been allowed to reopen and schools have restarted.

And the resumption of production from the automotive sector is likely to support Germany's economic recovery, the ministry said. German vehicle manufacturers, including Volkswagen and Daimler and Man Truck and Bus, restarted production in late April and have ramped up activity since then.

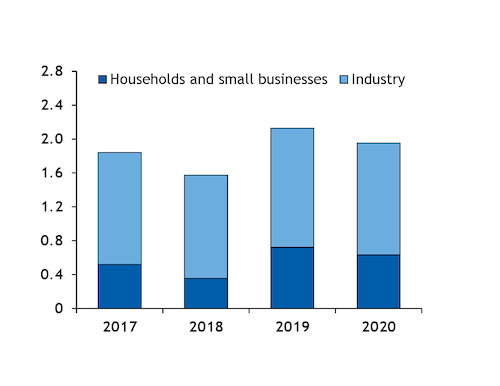

Overall temperature-adjusted demand has climbed in recent weeks relative to most recent years, boosting outright consumption. And the decline in industrial demand has been offset largely by strong gas burn from Germany's power sector in recent weeks.

Industrial demand edged up above 1.32 TWh/d on 1 May-6 June from just under 1.32 TWh/d in the past three years. And gas deliveries to local networks rose to 632 GWh/d from 531 GWh/d (see May-June demand graph).

The increase was likely driven by stronger heating demand, as overnight temperatures in the same four German cities fell to an average of 6.3°C from almost 9°C.

Still, a sustained, if slow, economic recovery could continue to lift temperature-adjusted demand in the coming months.

The federal government passed a €130bn stimulus plan earlier this month that introduces a number of measures designed to boost economic activity — including a temporary reduction in value-added tax (VAT), a cap on consumer electricity costs, financial relief for municipalities and a national hydrogen strategy — that will take effect from 1 July.

Berlin will also lift its travel warning for EU and other European countries by 15 June.