A rebound in gasoline demand sparked by an easing of Covid-19 lockdown orders has pushed prices higher for the fuel additive MTBE across the world.

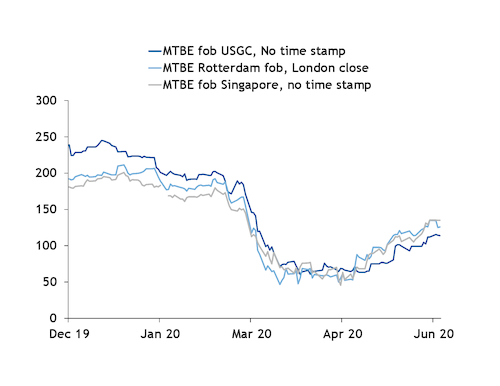

Spot MTBE prices in Asia, Europe and US have roughly doubled over the last few weeks, with trade activity in every region reawakening after the height of the Covid-19 pandemic in March and April brought activity to a halt.

Asia MTBE prices climbed to a three-month high on 5 June, following gains in the gasoline market. Argus assessed MTBE prices in that region at $481/metric tonne (t) on 5 June, the highest since 6 March.

Gasoline sentiment has improved with rising driving activities in the region.

MTBE buying interest also has started to emerge as blend margins strengthened. MTBE is added to gasoline to lift the octane content and allow for a more complete burn at the tailpipe. The 95-92R blend margin was at $3.10/bl on 3 June, the highest since December. The breakeven level for blend margin is usually at around $2.60/bl.

With the higher blend margin, buyers started to appear last week seeking June- or July-loading cargoes, lifting MTBE fob Singapore prices to $433/t on 2 June. The discussions were the first to emerge in trading sessions that had been inactive for seven consecutive weeks.

Local MTBE prices in China also rose following gains in crude prices and stronger gasoline demand. Unplanned shutdowns at a handful of units in the country lent further support to MTBE prices. Ex-tank prices in east China rose on 5 June to Yn3,700/t ($524/t), the highest since 13 March.

In Europe, MTBE consumption is steadily increasing and prices have held firm over recent weeks. A spot barge deal was concluded yesterday at $448/t fob Amsterdam-Rotterdam, up from April when spot MTBE barges traded below $200/t.

Overall, European gasoline demand is still comparatively low compared to previous years, as travel restrictions, isolation requirements and working from home has eroded demand. But the demand recovery has begun, and many commuters prefer cars over public transport during the pandemic.

Gasoline prices also remain relatively low at the pump, which could help sustain the recovery in driving demand. There is growing interest in gasoline exports from Europe to West Africa, which also would be supportive for MTBE blending.

The higher MTBE prices seen in Europe and Asia opened the arbitrage on paper for additional US MTBE shipments to those regions, pushing US MTBE producers to ramp up production.

TPC Group in May restarted production of MTBE on the Houston Ship Channel and is at full capacity of 450,000 t/y, according to market sources. Total US MTBE operating capacity is estimated to be at 60-65pc,up from 50pc in May, according to Argus Consulting, a division of Argus Media.

US MTBE spot prices rose to 114¢/USG fob US Gulf coast on 10 June, more than double a nearly 20-year low of around 61¢/USG on 7 April. The low stemmed from weak demand from Mexico, the primary outlet for US-produced MTBE, brought on by the Covid-19 pandemic. Prices have since rebounded as rising gasoline demand in Asia and Europe opened the arbitrage to those regions.

Despite the recovery in spot prices, US producers remain cautious about increasing ratesuntil demand from Mexico returns.

US MTBE could get another boost as demand from Mexico's fuel sector begins to gradually return. Mexico started phase two of its reopening process earlier this month.