US voters could shape global LPG flows by sticking with Trump's aggressive unilateralism or opting for Biden's more conciliatory, green agenda, writes Amy Strahan

The outcome of the US presidential election on 3 November could affect global LPG trade by determining future relations with countries such as Iran and China, which have fallen prey to punitive measures under Donald Trump's administration.

Democratic rival Joe Biden may look to end sanctions on Iran, which have restricted the gas-rich country's ability to produce and export LPG, should he win as the polls predict next month. A second term for Trump meanwhile could heighten uncertainty over relations with China and the future of the two countries' phase-one trade agreement to remove import tariffs on some products including LPG. The incumbent president continues to blame China for Covid-19, saying it will "pay a big price" for its role in the pandemic.

The contentious election has focused largely on racial injustice, the Trump administration's handling of Covid-19, and how to improve the country's unemployment rate, which stood at 7.9pc in September. Both candidates have fallen along party lines on environmental issues. But a shift in US trade policy is likely to impact LPG and petrochemical exports. Trump has touted the 25pc tariffs on $250bn of products from China as a major accomplishment of his administration.

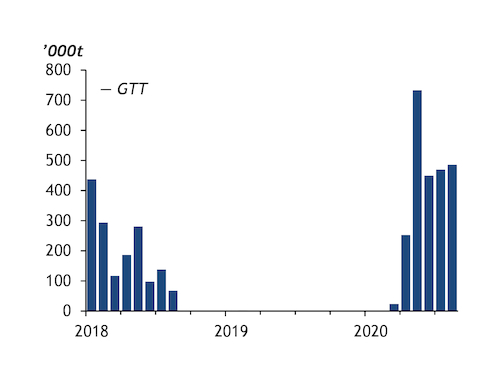

China waived 25pc tariffs for some importers of US LPG earlier this year as part of its trade agreement with Washington, under which it pledged to buy an extra $18.5bn of US energy imports compared with pre-tariff levels in 2017. This augured a return of trade to China after a near two-year hiatus — China imported 485,000t of LPG from the US in August and a record-high 733,000t in May, customs data show. But the potential of Trump renewing the trade war with China could split the market for imports again in Asia-Pacific between US and non-US origin cargoes.

Biden has described Trump's bellicose unilateralist use of trade tariffs as "damaging", "reckless" and "disastrous". His ascendency is likely to pave the way to the eventual removal of at least some of these measures. Yet he faces pressure to continue taking a tough stance on China from all sides of the political spectrum.

Greener grass

A Biden victory would raise uncertainty for the oil and gas and petrochemical sectors as he vows to take a strong environmental tack. His "Green New Deal" pledges to move the country away from petroleum fuels, introduce tougher caps on methane emissions for oil and gas operators, and rejoin the 2015 Paris climate accord. But this is just a "rallying cry" — "anybody who is serious about energy policy knows this is not terribly realistic", US propane association the NPGA's vice-president, Jeff Petrash, says. The gridlock in Washington in recent years has led to US states setting their own energy policies, he says.

Should Trump be re-elected and the Senate maintain its Republican majority, with the House remaining in Democratic hands, the current US policy of "energy dominance" that supports upstream output and exports is likely to continue, Petrash says. A second Trump term with the Democrats gaining both houses of Congress could on the other hand lead to a push for legislation backing renewables, and efforts to combat climate change and potentially block petroleum pipeline projects, slowed by the inability of both parties to compromise, he says.

Should Biden win and Democrats gain control of the House and Senate, Petrash expects major new legislation focused on climate change. "We probably will see a move back to renewables like solar and wind, and increased energy efficiency, because that is the least expensive form of sustainability," he says. "If the Democrats control all three, 2021 could be very busy on the energy front in Washington."

Biden has said he staunchly opposes "fossil fuels", a position the Trump campaign says threatens the US oil and gas industry, but neither has opposed fracking — the engine that drove the US shale boom in Texas and Pennsylvania and the surge in natural gas liquids (NGL) output.

Trump administration officials have given speeches at the site of Shell's Monaca ethylene plant project in Pennsylvania — which will use ethane from the Marcellus shale as feedstock — to demonstrate the sector's ability to fuel economic growth. But Biden says he would support fracking in Pennsylvania. "No I would not shut down this industry, I know our Republication friends say I would." But Trump says Biden "has repeatedly pledged to abolish fracking — he is a liar, OK? He is a liar."