The molybdenum market has been "saved" by voracious buying from China in 2020, a trend that is likely to continue in 2021 even as demand in the western world re-emerges.

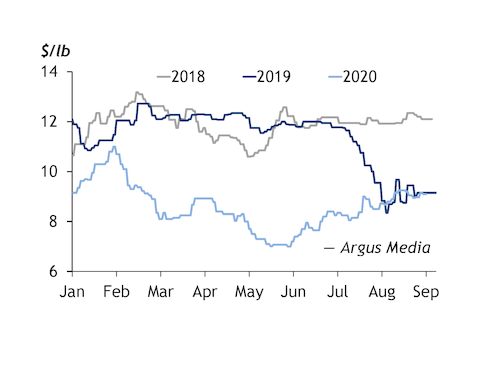

Argus-assessed prices for 57pc oxide powder in Europe slumped to a 2020 low of $7/lb duty unpaid in warehouse Rotterdam on 30 July, but prices rallied to reach $9.10/lb du Rotterdam on 14 December, which is an increase of around 30pc over four-and-a-half months.

The dominant price driver is the month-on-month escalation of oxide imports into China along with an improving macroeconomic climate in the west, despite it struggling to contain the spread of Covid-19.

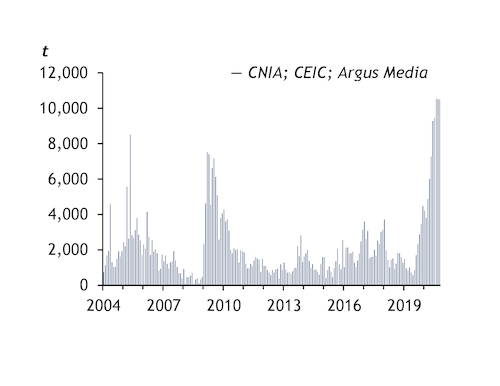

China's imports of molybdenum ores and concentrates have increased by a factor of almost five over 2020 and are 42pc higher than the previous crisis' peak monthly imports in 2009, data from China's Nonferrous Metals Industry Association show. In January-October this year, China imported 76,403t of molybdenum, while just 13,296t were imported in 2019. The last time China made such a foray into the import market was during the financial crisis in 2008-09. In the first 10 months of 2009, imports reached 53,937t.

Furthermore, prices for European 65-70pc grade ferro-molybdenum — which have followed an identical growth path since 30 July, rising by 32.3pc to $23.15/kg dp Rotterdam as of 14 December — shows that there continues to be end-use demand to support prices throughout the molybdenum supply chain.

China demand up

Improving market dynamics are likely to be carried into 2021. Prices in the new year should benefit from resurgent demand from the global automotive sector, strengthened monetary measures in China and improving procurement patterns in Europe.

A shift towards more modern, environmentally friendly cars will increase the use-case of molybdenum in vehicles next year. Annual global light duty vehicle sales are expected to grow by 1.7pc annually and the share of newer, battery-powered vehicles sold is expected to rise to 6.1pc of the 91.8mn vehicles, data from LMC Automotive show.

Molybdenum is crucial in making high-strength steels, and conventional high-strength, low-alloy steels are widely used. Increased molybdenum usage could lead to cars that are almost 20pc lighter than older vehicles, which can improve fuel efficiency, decrease emissions and increase their recyclability.

Some of the automotive steels use up to 0.3pc molybdenum according to the International Molybdenum Association (IMOA). For example, the dual-phase advanced high-strength steel type used in body-reinforcement applications uses 0.1-0.3pc molybdenum, and a shift towards more modern, environmentally friendly cars will increase the use-case of molybdenum in vehicles next year.

Meanwhile, China's monetary environment is strengthening, and the US dollar has depreciated by around 7pc against the Chinese yuan so that the dollar only buys 6.55 yuan, when last year it bought close to 7. This is expected to continue, which will make molybdenum more affordable for Chinese buyers.

Europe demand re-emergence adds upside

Should improved activity in Europe add to this increased demand, prices could be set to rise above cost-curve levels to induce new supply in either greenfield or brownfield.

Production is already strong given China's voracious demand for copper, with molybdenum also mined as a by-product. According to the IMOA, global production of molybdenum rose by 3pc to 148.2mn lb in the second quarter of 2020 compared with both the first quarter and the same quarter of 2019.

And there are already signs of recovery. European purchasing managers' indices have been in expansionary territory (above 50) since July, and momentum is likely to gather as vaccines for Covid-19 improve confidence. Market participants expect buying behaviour to firm into 2021, which is likely to see increased demand from Europe and the US, and higher western prices for both oxide and the alloy.