Growing interest from the battery sector is expected to bolster demand for vanadium in high pressure forms this year, potentially lending support to a tightly-balanced market with producers sold out until early February and global steel production remaining robust.

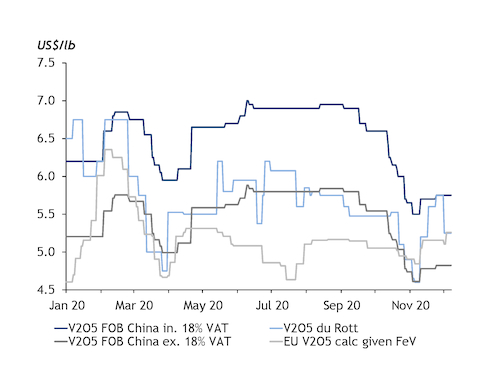

Prices spent much of last year under pressure, in part owing to low Chinese spot buying activity. European ferro-vanadium prices hit a 2020 low of $22.10/kg dp Rotterdam on 10 September after a steady decline from $30.50/kg on 10 December 2019. Vanadium pentoxide has declined more sharply, slumping to $4.60/lb dp Rotterdam on 5 November compared with $7/lb on 14 April.

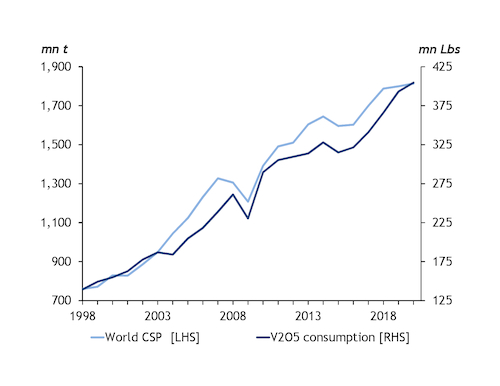

But real underlying demand has remained robust, according to market participants, and this encouraged prices to tick upwards as 2021 was approaching, with steelmakers hoping for higher demand for long steel products by the construction sector. Global crude steel production totalled 1.84bn t in 2019 and is on track to dip just slightly in 2020 to 1.81bn t, according to annualised data from the World Steel Association (WSA). Demand for finished steel was down by 6.4pc last year but the WSA expects it to rise by 3.8pc in 2021 to 1.72bn t.

Steel production accounts for around 90pc of vanadium consumption, meaning robust steel outlooks bode well for vanadium demand. Of the remainder, 9pc is split evenly between aerospace alloys and chemical catalysts, and 1pc goes into vanadium redox flow batteries (VRFBs).

Production of VRFBs is expected to grow significantly in the near-term, encouraging some key pentoxide producers to move firmly into the arena. Largo Resources has founded a subsidiary called Largo Clean Energy, which will provide VRFB systems, and has acquired VRFB technology from VionX Energy at a price of $3.9mn in stock options.

VRFB technology allows varied oxidation states of dissolved vanadium in electrolytes to store or deliver electricity. Electrolytes are continuously fed from a tank system into the reaction cell. The battery can either store or discharge energy — depending on demand — which makes it highly attractive for static energy solutions, often coupled with renewable forms of energy generation. For example, a VRFB can charge itself from sunlight captured by photovoltaic cells during the day and then discharge overnight to supplement the base load of energy supply.

Because the electrolyte flow direction does not have to change when loading and unloading, the VRFB has a very fast response time (less than 20 milliseconds), according to producer Schmid. Market participants estimate that around 9.89t of pentoxide is used per MWh of storage and that the world could see around 4GWh of globally installed capacity brought on line by 2030.

A ramp-up in this sector would equate to around 20,000t of new vanadium demand — or V units — or around 36,000t of pentoxide demand at a standard 56pc grade. Clearly the sector has a long way to go in order to achieve this type of growth but progress is already being made and, at pentoxide prices below $10/lb, the economics are looking ever more attractive when compared with lithium-ion battery solutions.