Higher freight rates have driven a sharp rise in European manganese flake prices, but planned production cuts in China mean the challenges facing European consumers are mounting.

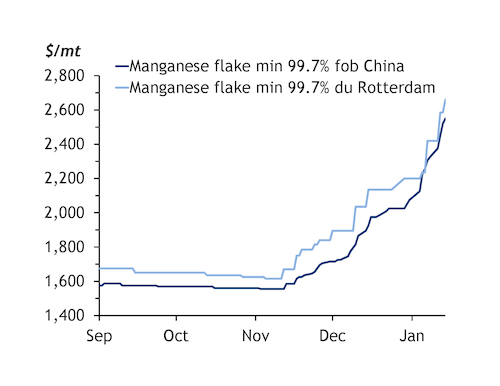

Duty unpaid flake prices in Rotterdam were assessed at $2,620-2,700/t yesterday, up by 10pc on the week. This marks a 64pc rise from 5 November, when prices had been slipping since mid-September, and the uptrend is expected to continue until at least the start of China's lunar new year holiday.

Prices rose through much of December as sellers hiked offers to absorb surging freight rates as a shortage of containers from Asia to Europe hindered exports. Rates are usually around $40/t, or roughly $1,000 per container. But the container shortage has seen traders quoting rates from Asia at $220/t, and the Drewry Asia-Europe container index put prices at $5,220 per container this week.

But even excluding freight, manganese flake prices are still up significantly — $2,460/t in Rotterdam, against $1,580/t in November. This calls into question expectations that prices will soften ahead of China's lunar new year holiday, based on the assumption that reduced industrial activity frees up containers, leading to lower freight rates.

Opinion is divided as to price direction for the coming weeks. Some participants say prices will soon cross the $3,000/t threshold, but then fall. Buyers are increasingly sceptical about the basis for further price hikes, with many traders warning that end-users will turn away if prices rise further without a corresponding increase in stainless steel production. European end-user demand was sluggish in the fourth quarter of 2020 and has remained so in the past fortnight, underpinned by limited purchasing activity for key products made with stainless steel.

"A lot of people are reluctant to buy larger volumes — we can't be too far away from a ceiling," a trader said. Another participant said it is only selling flake if it can replace it immediately in Rotterdam, describing buying from China as "impossible" at current rates. "Demand is actually weaker than people think. But China just isn't an option," it said.

Production cuts add to strain

Earlier this week, major Chinese flake producers — including the world's largest producer, Ningxia Tingyuan — agreed to cut output for 60 days to support prices. Overall run rates for China's manganese sector could fall to around 50pc from 70pc if Ningxia Tingyuan goes ahead with the cut.

Producers including Ningxia Tingyuan and Baosteel have already raised their domestic tender prices for January in light of the planned cuts, fuelling expectations that export prices will also rise. Fob China flake prices stood at $2,050-2,100/t on 31 December, but hit $2,500-2,600/t fob yesterday — a 23pc increase. European traders have recently been quoted $2,800/t cfr for Chinese material.

End-user demand still weak

Flake demand from European end-users remains low amid sluggish consumer activity further downstream. Germany's economy contracted by 5pc last year, as Covid-19 lockdowns hit industrial output and consumption. And 2021 seems to be on a similar trajectory, with lockdown measures still in place in Germany and other parts of Europe, although steelmaking can continue this time round.

As a result, European flake traders are struggling to find end-user buyers. "To buy now at a super high price with no buyer is risky," a trader said. "People will lose money if they replace from China [at current prices]," they added.

Ferro-manganese substitution unavailable

When flake prices are high, some steel mills usually consider switching from manganese metal to medium or low-carbon ferro-manganese, but availability of the alloy is tight because of reduced output in Europe and South Africa. Major producers are not currently offering alloy on the spot market, having cut run rates last year because of low demand.

South African ferro-manganese plants are also facing a shortage of oxygen supply as more is directed to hospitals battling Covid-19.

Prices in Europe have risen accordingly, with Argus' 14 January assessment at €1,440-1,500/t delivered duty paid (ddp) Europe, up from €1,290-1,350/t ddp just before Christmas.