Australian iron ore lump supplies are to increase by around 33mn t/yr to feed growing demand, as steel producers try to minimise air pollution and carbon emissions by reducing the amount of sintering required.

Demand for lump is increasing across Asia, with premiums for 62pc Fe lump rising to new highs earlier this month, adding to already strong prices for fines.

The proportion of Australian iron ore exports that is lump has fallen from around 26pc in 2010 to around 23pc, albeit of a much larger total volume. This is about to change with UK-Australian mining firms Rio Tinto and BHP each looking to increase the proportion of lump that they sell through the start-up of new mines. Smaller mining firms, including Fortescue Metals, are focused on maximising their lump output to increase returns.

BHP's South Flank mine in the Pilbara region of Western Australia (WA) began producing last month and will increase the proportion of Australian lump that it exports to 30-33pc of its total from 25pc in the 2019-20 fiscal year to 30 June. BHP expects to come in at the top half of its 276mn-286mn t target for WA iron ore production on a 100pc basis for 2020-21 compared with 281mn t shipped in 2019-20.

Rio Tinto's 43mn t/yr Gudai-Darri, formerly known as Koodaideri, iron ore mine in the Pilbara is due to start operating in early 2022. It will increase the proportion of lump included in its Pilbara Blend exports to 38pc of the total from an average 35pc, according to the company. Only 33pc of the Pilbara Blend was lump in 2020.

Rio Tinto expects to ship 325mn-340mn t of iron ore from WA in 2021 compared with 330.6mn t in 2020. Around 27pc of its total iron ore shipments were lump in 2020.

Based on 2020 total shipments, the increased proportion of lump could add up to 33mn t/yr to the export market, with an additional 11mn t/yr from Rio Tinto and 22mn t/yr from BHP.

But this rise in lump exports could be higher, with BHP aiming for a medium-term target of 290mn t/yr and Rio Tinto 360mn t/yr from WA, with other smaller producers also looking to increase lump output. Magnetite concentrate and pellet exports are also set to increase through Fortescue's 22mn t/yr Iron Bridge project and productivity increases at Citic's 24mn t/yr Sino Iron pellet facility, adding to the supplies of higher grade Australian iron ore products.

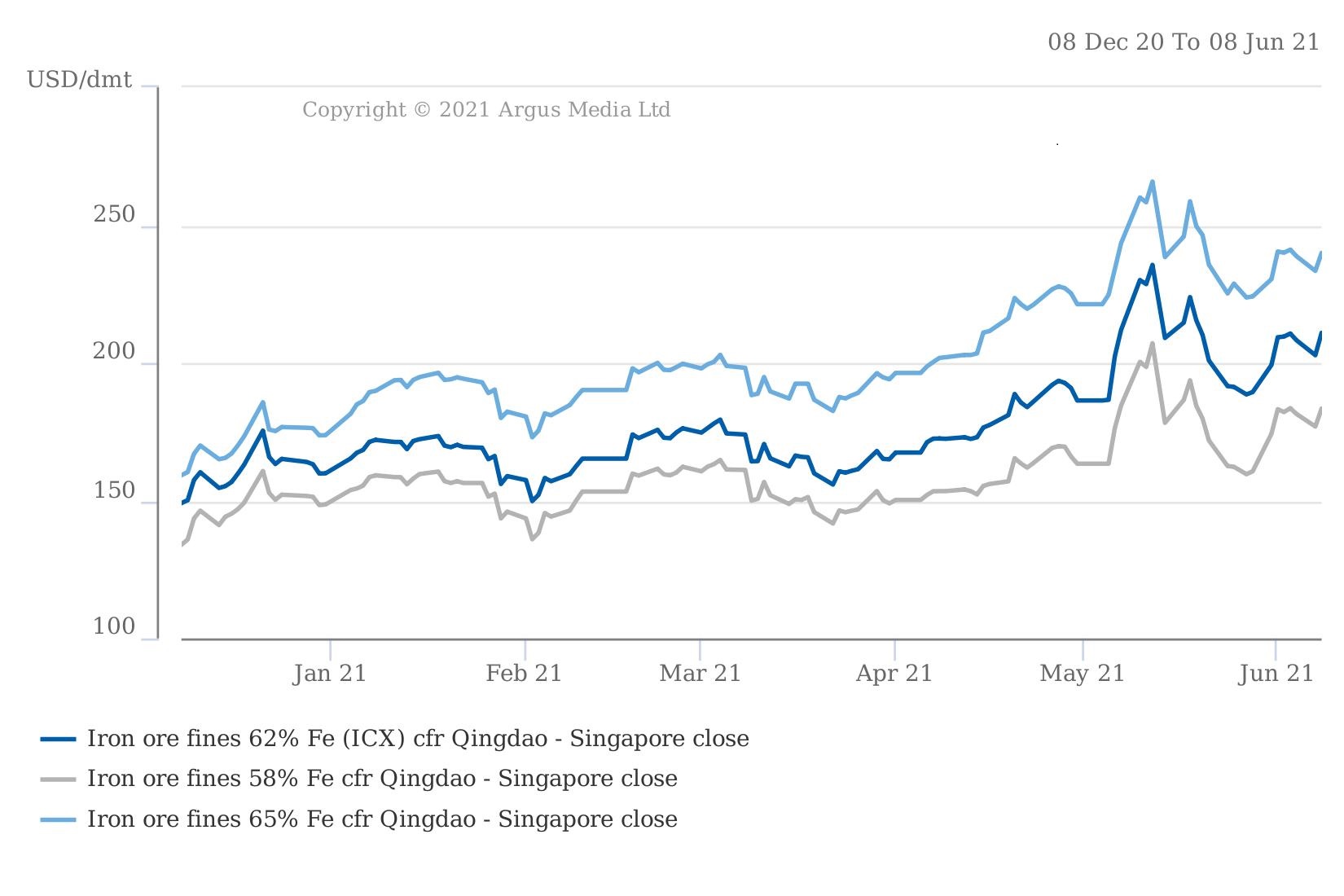

Argus assessed the ICX iron ore price at $210.90/dmt cfr Qingdao on a 62pc Fe basis yesterday, up from $209.30/dmt on 1 June but down from a high of $235.55/dmt on 12 May. This was up from $167.45/t on 1 April and $159.90/t on 31 December.

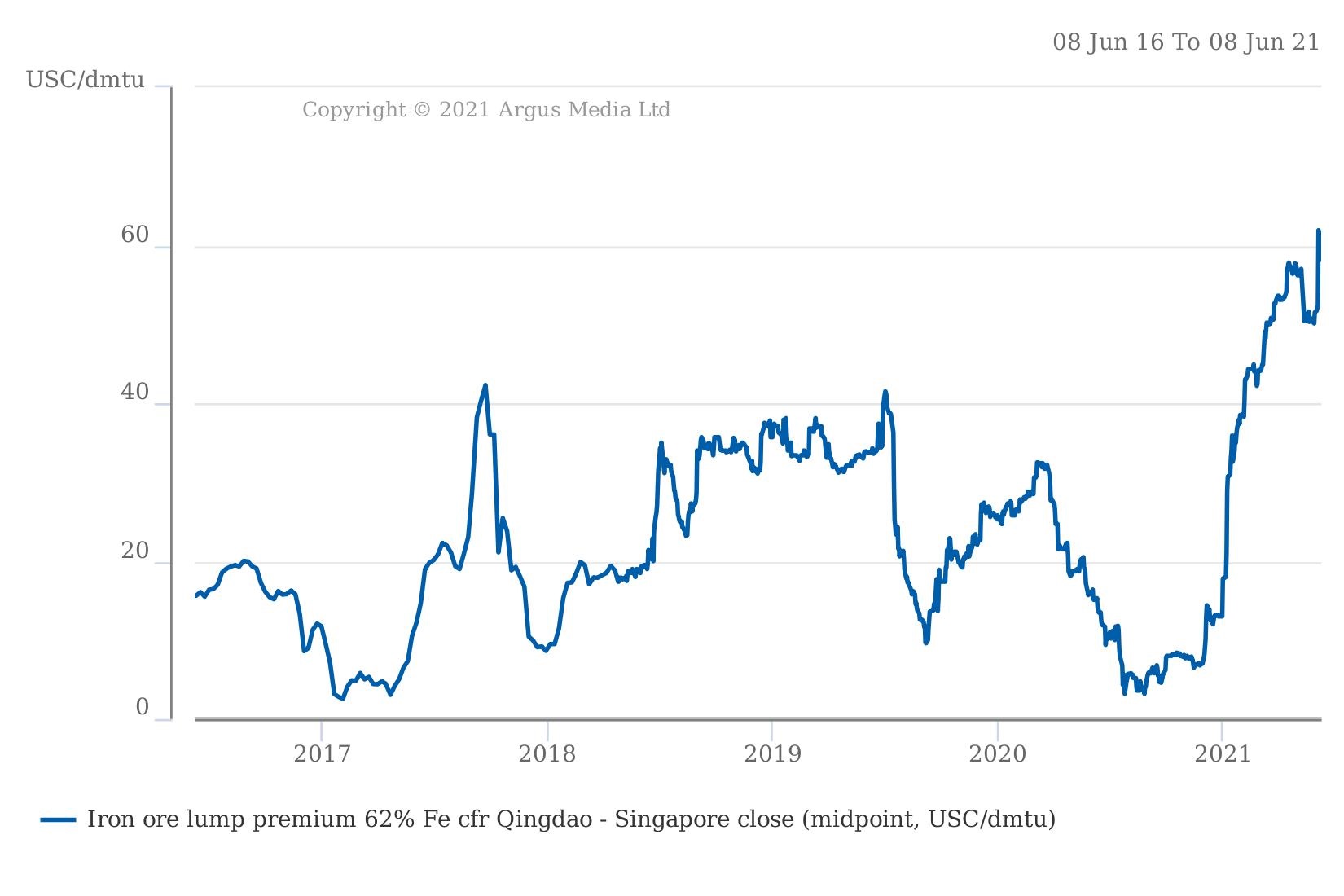

The lump premium to 62pc Fe peaked at a record high of 61.9¢/dmt unit cfr Qingdao on 3 June and has since eased to 58.7¢/dmt unit (dmtu). But is almost five times the 12¢/dmtu in mid-December, according to Argus assessments.

| Australia iron ore exports | (mn t) | |||||||

| Year | Total | China | Japan | South Korea | ||||

| volume | % lump | volume | % lump | volume | % lump | volume | % lump | |

| Jan-Apr 2021 | 275.23 | 23.3 | 204.83 | 21.7 | 19.18 | 40.3 | 19.33 | 25.9 |

| Jan-Apr 2020 | 270.61 | 23.4 | 224.78 | 21.4 | 17.98 | 35.3 | 16.73 | 24.6 |

| 2020 | 870.29 | 23.5 | 701.26 | 22.2 | 52.31 | 36.9 | 53.49 | 22.8 |

| 2019 | 839.14 | 23.1 | 692.77 | 21.1 | 61.70 | 39.9 | 53.44 | 21.7 |

| 2018 | 835.46 | 23.1 | 678.89 | 21.3 | 65.41 | 40.5 | 51.80 | 19.8 |

| 2015 | 768.32 | 20.9 | 628.09 | 18.6 | 70.47 | 36.7 | 50.40 | 17.2 |

| 2010 | 401.85 | 26.1 | 273.78 | 22.0 | 75.59 | 37.0 | 38.56 | 29.2 |

| Source: ABS, GTT | ||||||||

| Total includes all destinations, not just those listed. Volume includes lump and fines | ||||||||

| Rio Tinto iron ore sales | (mn t) | |||

| Ore type | Jan-Mar '21 | Oct-Dec '20 | Jan-Mar '20 | Full year 2020 |

| Pilbara Blend Lump | 15.74 | 20.15 | 17.51 | 77.12 |

| Pilbara Blend Fines | 35.78 | 42.73 | 33.20 | 155.53 |

| Robe Valley Lump | 1.93 | 2.35 | 2.14 | 8.69 |

| Robe Valley Fines | 4.53 | 5.78 | 5.07 | 21.65 |

| Yandicoogina Fines (HIY) | 14.22 | 15.05 | 12.91 | 57.75 |

| SP10 Lump | 2.66 | 1.04 | 1.01 | 3.88 |

| SP10 Fines | 2.92 | 1.77 | 1.09 | 5.95 |

| Total shipments | 77.79 | 88.87 | 72.92 | 330.57 |

| Source: Rio Tinto | ||||